This is another chapter in The Money System That Never Fails and finishes one of the most important parts of the book, your wealth generation plan. This section covers how to make it your own.

Remember, this is YOUR Wealth Generation Plan. Make it your own. While I provide my template and how I do it, change it up as you see fit. As long as you’re positively working on each of the four areas, to a lesser or bigger degree, then you will move in the direction you want to go.

The point of this plan is that you’re paying attention and working to optimize each area. Depending on where you are currently with your money, you have stronger and weaker areas. You also have areas where more can be done, and areas where you have less.

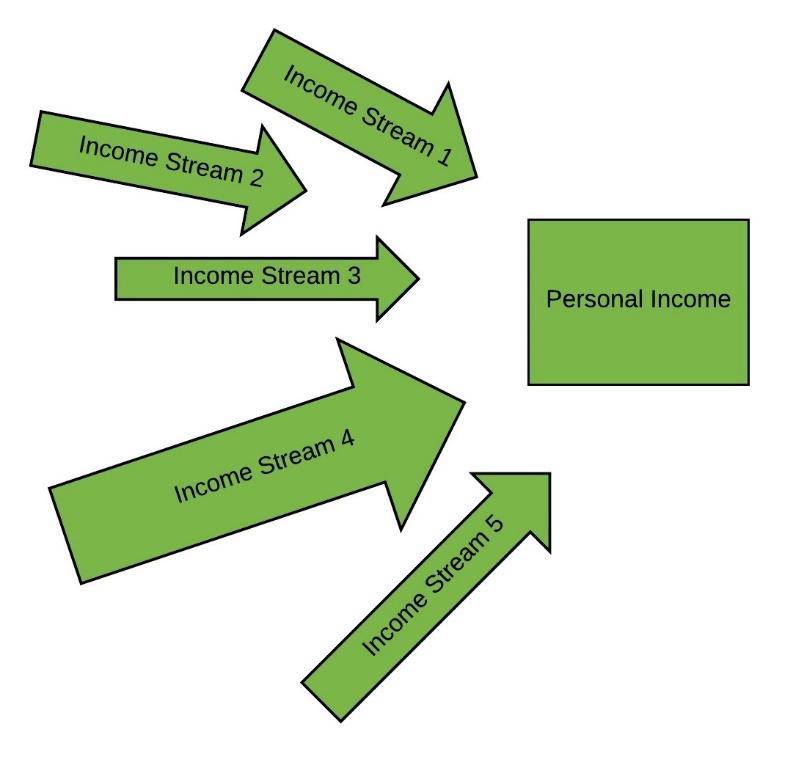

If you don’t make much income, and your expenses are high, then investing is not the most important thing for you to focus on now. Instead, it will be income and expenses. If you have a good income, and expenses are fine, then how you work with your savings and investing becomes much more important. Put your attention, action steps and goals there.

In a way, there is kind of a progression through this:

- Expenses

- Savings

- Investing

Note that I do not include Income on this progression. That’s because it is the accelerator, regardless of everything else. Some people make tons of money and spend all of it and more. That’s the star athlete that lives big because of the million-dollar contract, but doesn’t have any money management skills.

Thus, the first step is to make sure that your expenses do not outstrip your income. This typically means cutting your expenses, as that is easier to do than earning more money (at least in most cases).

Once your expenses are under control, you start focusing on savings. Build up your savings. The best thing to do when you get a raise, or start making more income from anything else, is to not spend more, which is the natural human reaction. Instead, start saving more. Bump up your percentages or automatic investing.

After you’ve saved for some time, and start to have some real money, then you can start learning more about and participating in investing. There really isn’t any point in focusing on investing until you have thousands of dollars to do so.

With me personally, my expenses are managed well enough. I’m always tweaking the savings amount, working to move them higher and higher. Now that I achieved my big goal of buying a house, in addition to paying that off, I will work even more on the investing area, while still seeking optimization in all

others.

As such, this also means that all books about money tend to cover one or more of these areas. Besides what you’re reading now, I haven’t found many that talk about all of them, at least not with this same kind of clarity.

Where you are at will determine what you should additionally study. In consumer debt? Something like Dave Ramsey, where he talks about cutting out the lattes might be appropriate. Looking to grow your investing? That same book is likely not going to be so useful.

Wealth Generation Plan Review

I like to do this monthly. Other people, who aren’t quite as hands on with their finances, might be fine to just do it once a quarter. At some point, I’ll probably switch to that, but currently, I like to review it monthly, even if I don’t make any changes.

Reviewing your wealth plan means reading through it and doing the following:

- Updating your strategies as needed

- Crossing off To-Do’s and adding more, or changing as necessary

- Crossing off Goals and adding more, or changing as necessary

- Updating savings percentages and automatic saving/investing amounts

- Updating any other details that need updated

If you do this, it means you’re constantly updating what you’re doing. Hopefully, you’re learning along the way, including from any financial mistakes, and thus you’ll get better over time. This plan is not a set-in- stone document, but something to evolve along with you. Over time it will be what gets you to wealth, hence the name.

In NLP, one of the maxims is that “There is no failure, only feedback.”

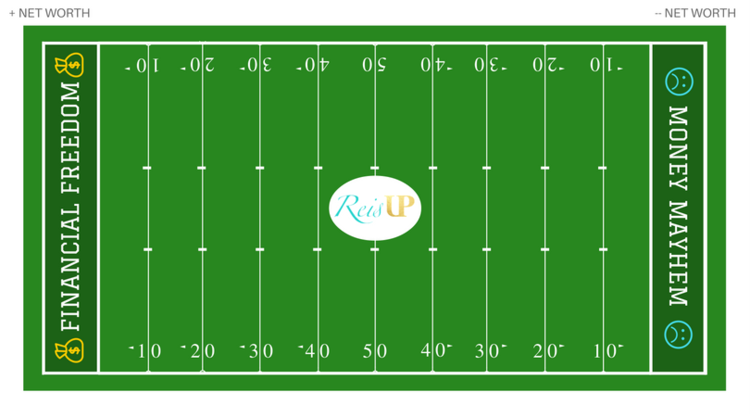

That’s why I call this The Money System that Never Fails. It’s not that you won’t make mistakes along the way. Or that you won’t learn new better things that can make this work better. It’s just that you follow the plan, and adapt the plan along the way.

Ultimately, it is this framework for a plan, covering the four major areas of money, that is why it is a

system that won’t fail. The only way for it to fail to work, is for you to fail to work with it.

For more The Money System That Never Fails is now available in paperback and Kindle at Amazon.

If you missed the first chapters you can view them here:

- Introduction

- Money Offense and Money Defense

- Most Important Part of the Money System

- Mental Accounting and Different Perceptions of Money

- Essential Accounts

- Optional Accounts

- How to Maximize Your Savings

- Automatic vs. Manual Savings

- Your Wealth Generation Plan

- Offense – Income and Investments

- Defense – Savings and Expenses