We continue in The Money System That Never Fails with how to maximize your savings, one of the most crucial elements of the overall system.

The Money System That Never Fails is now available in paperback and Kindle at Amazon.

If you missed the first chapters you can view them here:

- Introduction

- Money Offense and Money Defense

- Most Important Part of the Money System

- Mental Accounting and Different Perceptions of Money

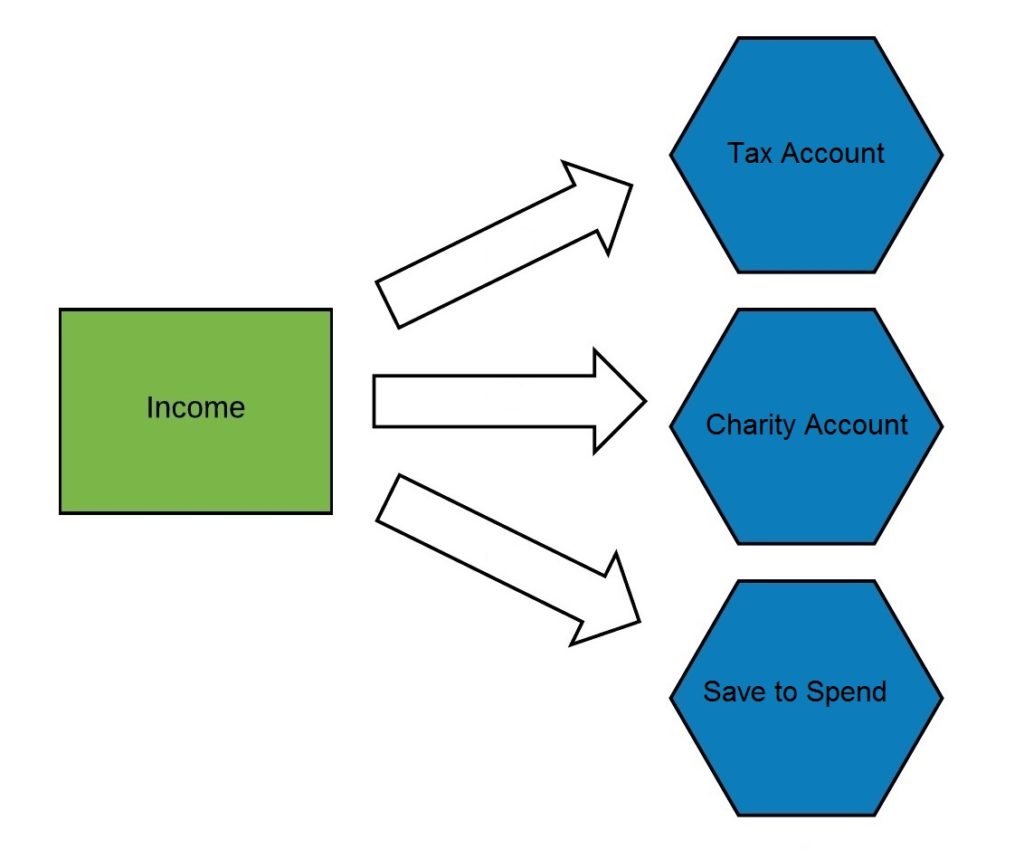

- Essential Accounts

- Optional Accounts

I just covered three necessary savings accounts, and six optional ones. First off, you may be thinking that that is a lot of accounts! And it is compared to an average person. But the question to ask yourself, is do you want average results? If we look at wealthy people, we’ll typically see money spread out in many different places…and this is before we even look at investing or business accounts!

Remember that most of those were optional. It is better to start on the easier side, and go with just those three essential accounts. Once you’re used to the system, and saving, then you can add more later.

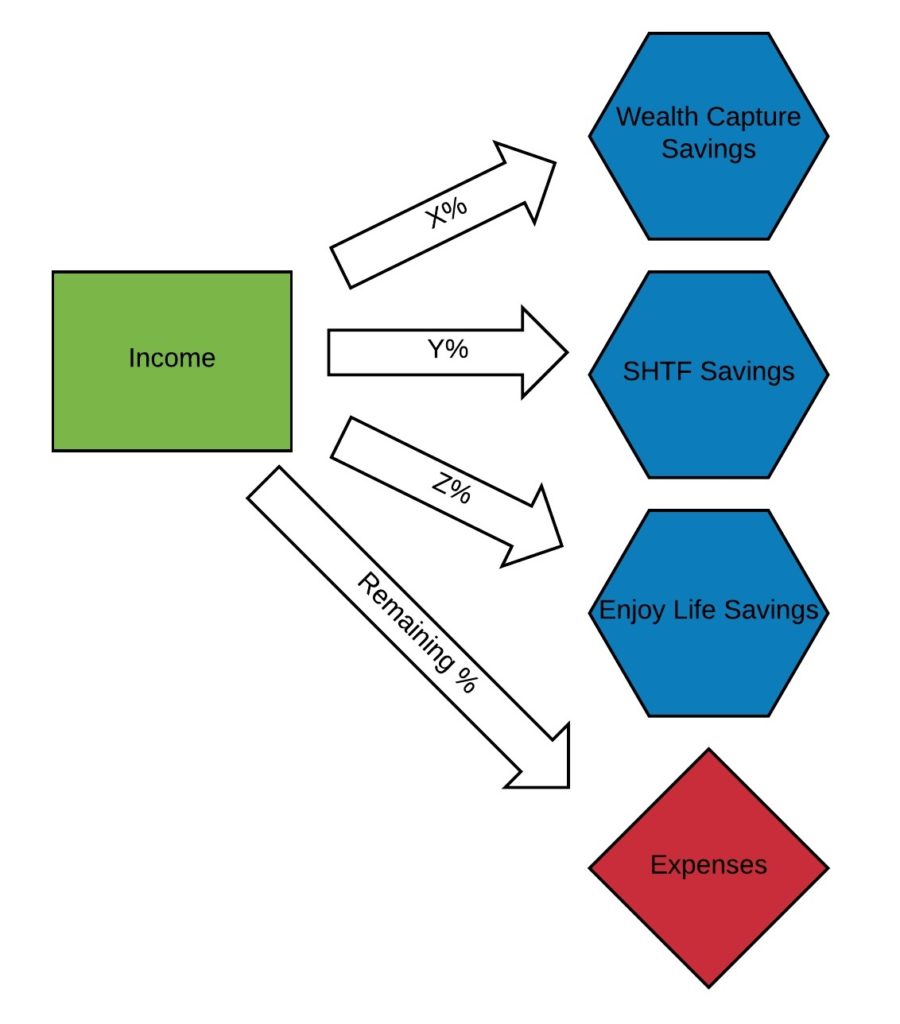

The main question to ask is, “What percentages go into these savings accounts?” Along with that, you may be thinking: If you have all these different accounts and you’re saving to each one of them, how is there anything left to live on?

The answer is by starting small. There is a systematic flow to all of this. The flow is like this:

Remember, the savings must come off the top for this system to work. That is part of what makes it never fail.

If you’re currently living paycheck to paycheck like most Americans, or even worse, living off 110% or more of your income by using credit, this can be a tough pill to swallow. In these cases, you need to start real small. But you will still start saving.

When it comes to the Wealth Capture account, the standard number used is 10%. So, 10% of your income goes into savings. If you are not currently saving that may be a big chunk. And you may feel the difference when you start doing.

The most important thing (in the beginning) is not the amount, but the habit of doing it. If 10% is too much you can do 5%, 1%, even a fraction of a percent. If you’re up to your eyeballs in debt, just do ½%. This amount isn’t going to make a difference to you, nor the creditors, but the act of doing it can begin to turn things around, because of how it changes your habits, your mindset and your relationship to money.

The fact is, when you’re starting out, it is best NOT to feel the pain of savings. If it is a noticeable difference, you’re more likely to tap into it, or abandon the system. If you have to struggle to save, you’ll likely quit at some point. But if you can do it effortlessly, it is more likely to stick.

Then over time it builds. You increase your savings by a percentage point here and there. Once the amount starts to grow it is hard to not get excited by it and want to do even more. And once you really get going, 10% is too small. If you’re doing well, you can go with 15 or 20%. With these larger amounts, aggressively saving, you can watch your wealth soar.

But the Wealth Capture account is just one of several accounts. What about the others? They don’t all need to be 10%, nor the same amount. Some of them, like the SHTF fund or the Health Savings Account, also have a cap on how much you need or can put into them. You have to look at several factors.

As an example, currently I am putting 20% into my Wealth Capture account, 3% into my Vacation account, and 3% into the SHTF fund/Save to Spend combo I previously mentioned.

When you’re starting out, if you can only put ½% into each of these three accounts, that’s what you’ll do. Just know that it will grow over time.

Right now, making these transfers is one of the first things I do every Saturday morning, for the income that came in the previous week. If I happen to be traveling, or otherwise unavailable on that day, I’ll do it as soon as I can.

I use a spreadsheet to total up the income I made both personally and in my businesses. Using formulas to calculate the percentages, these then get totaled and I know how much to move into each account. You can find a copy of the Weekly Savings Template here.

Note that you’ll find a simple version in the first tab of that, and a more complex version complete for businesses in the second tab. We’ll revisit the details of that later.

My big aim is to save 50% of my money. I was doing this for a little while earlier, but my expenses have since changed. Now, this wasn’t all permanent savings. Some of the savings are earmarked for later expenses, but still it is fun to see how quickly your wealth adds up when you aggressively save like this.

I think 50% savings is a good goal for anyone to aim towards. But please, do not jump into doing this. Let the snowball roll until it grows and begins an avalanche.

Remember you need multiple accounts, one for each specific purpose. You can use your own bank. You can use multiple banks. Personally, I have most of my accounts at https://www.marcus.com (and this is where I’ve been setting up the latest ones).

It is easy to set up. The online portal is easy to use. And, at the time of writing this, they give 1.4% interest rate (actually it looks like they just raised it to 1.5%). While this isn’t great, it is far better than most banks offer. By all means, if you have a local credit union, or something else that offers something better go for it. But at the time of writing, this is my current recommendation.