I’m working on a book that shares about money and finances. It shares my system that took me from a mountain of debt to being very comfortable and on projection for riches to come. The working title is “The Money System Than Never Fails” because it is just that. It is a systematic approach to money that anyone can adopt. Of course, I would highly recommend doing so.

None of these things are unique to me. Most of it I picked up from many sources. However, I started working on this system because I never saw anyone cover finances in a holistic manner like this.

Below is the introduction to this book. I might even be sharing the entire thing, over time, here on the blog. On that note, I’d love to hear your comments, if you want to see more of this…

“Wealth is not the man that has it, but the man who lives it.”

– Benjamin Franklin

When I was growing up, I saw how my parents handled money. We weren’t poor by any stretch, but I thought of us as in the lower middle class, while some friends’ parents of mine were in the upper middle class. I have no idea if that is financially accurate, I’m not sure if there are official positions for those spots, it’s just the way it seemed to me at the time.

While my friends’ parents owned nice houses, we rented, and were forced to move a couple times because changes in ownership. While my friends’ parents seemed to spend more just on little things here and there, such as family outings, I saw my mother and father fight about money.

In high school, I started to get interested in money. On a friend’s encouragement I read Rich Dad, Poor Dad by Robert Kiyosaki. This is turn led me to reading Napoleon Hill’s Think and Grow Rich. I decided then that I would have a million dollars by the time I was 25. Seemed doable at the time.

I started putting some money into stocks. I felt like I was on top of my personal finances. I made money and I saved a lot of it. But this was just because I didn’t have many expenses. I didn’t even have a car until I was 20.

Fast forward a couple of years, and I start my business as a personal trainer, while still being employed.

Specifically, it was in going into business that I would begin my financial descent. While I did well personally, I knew nothing about business nor the changes in finances in there. Being a solopreneur, I rode the roller coaster of unstable income, and constantly reinvesting money back into my business, mostly in the form of more education. While this was good, I was doing it in an irresponsible way.

My debt started to grow. At its highest point, I was around $25,000 in credit card debt. Throughout this time, as you might imagine, I developed a strained relationship around money.

One of the first major turning points around money for me (of which I’ve identified three occasions) was pointed out by one of my coaches. He told me to say the phrase, “I Appreciate Money.” As soon as I said it, I could feel the sinking feeling in my chest, and I knew that it wasn’t true.

Once you know a few tools that can help to transform beliefs, then it is the finding of them that is the hard part. We did some work to clear that up. The following transformation in my financial life was nothing short of extraordinary.

Within a couple of months, I made more money than I ever had before in my business. I was able to pay off my debt completely. And I noticed that I always had cash in my wallet. I was never without money.

My relationship to money became far better than it was previously.

But like all things, that was just one turning point. An even bigger change was coming up on the horizon…

Although I got out of debt and started to develop some savings, I would find that I would run up the bill on my credit cards a bit. Then, in a fit of frustration, I would borrow from my savings (with the intention to pay that money back, since I wasn’t supposed to touch it) to get back to zero.

This probably happened four or five times over the next few years.

Although I “appreciated” money, I still seemed to struggle with it. I couldn’t get ahead. Finally, I got fed up with this pattern and resolved to break it once and for good.

Here, I took massive action. Over the course of a few weeks I read at least 30 books on the topic of money and finances, looking for whatever missing keys to money I was lacking. I can’t say there was any one book that solved the problem for me. But all together they did.

While there were certainly some changes in beliefs during that time, the biggest change was in how I saw different forms of money, and how they all fit together systematically.

It was during this period that I largely developed the system that you’re about to read about. It was then that I developed my Wealth Generation Plan. This included new shifts in mindset and establishing habits, that would get me out of that repetitive cycle I was in.

From that day forward, getting ahead with money was never an issue. Every week, every month my net worth grew.

And still I was not done learning. …

With that plan in place my financial foundation was now in place as well. Over the next years I continued to grow financially…at least personally.

What happened was that one of my businesses, Lost Empire Herbs, grew to the point over the next few years, where the finances were a bit beyond my current skillset. While I had always done the Legendary Strength financial books myself (my other business), because they were simple to do, here we handed them out to a bookkeeper.

I lost track of what was happening. What money was coming in. What money was going out. But armed with my plan, I realized this problem sooner rather than later. I had to upgrade my financial skills even more. I had to learn how to read a Profit and Loss Statement, as well as a Balance Sheet. I had to figure out cash flow, in an inventory heavy business. I had to understand good debt, and how it can be used to fuel growth.

In addition to these new things, what I realized is that I needed the same type of foundation that I had personally, going on in the business. While the numbers were bigger, and many more transactions took place, it really wasn’t all that different from what I did personally.

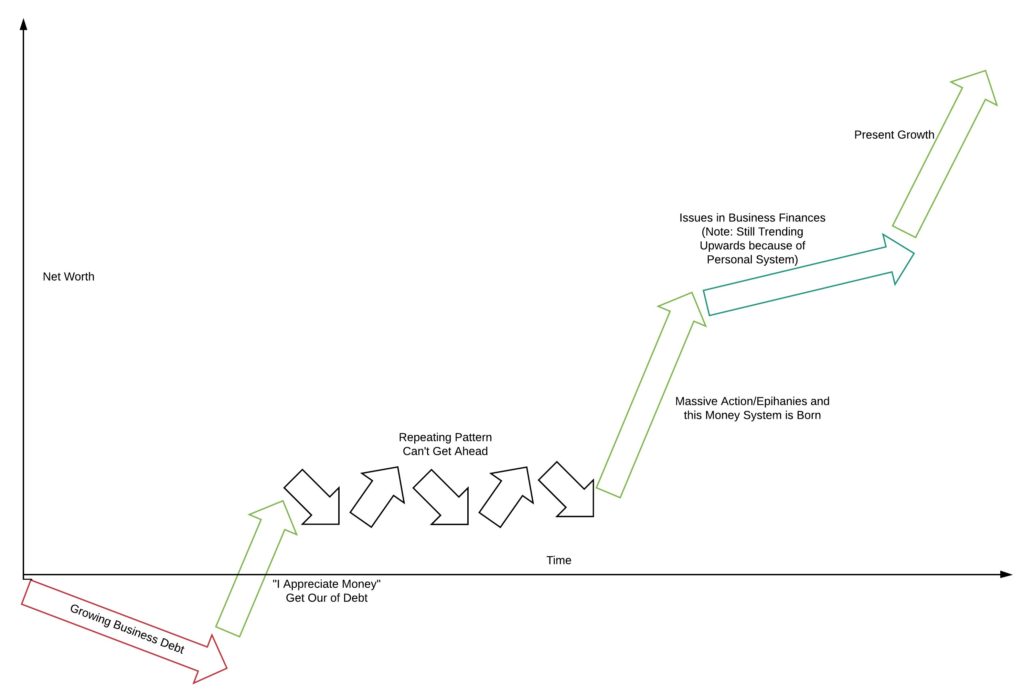

Looking back on my life I can see these three pivotal moments and the periods in between. It’s a series of plateaus’ and jumps or exponential growth points. Because of the system though, ever since that took place, the plateaus are not flat, but are trending upwards. You can see a graphical representation of this here. While simplified, this is overall quite accurate to my financial life.

I’m sure there will be a couple more jumps in my future. There are always new things to learn. However, I don’t expect these to be quite as impactful as these few moments in time. That’s because the system is the rock on which it all stands. It will get better over time, but that foundation is now firmly set.

The Money System That Never Fails is now available in paperback and Kindle at Amazon.