We continue in The Money System That Never Fails with Mental Accounting and Different Perceptions of Money

If you missed the first few of parts you can view them here:

One of my favorite books on money is Inside-Out Wealth, by L. Michael Hall. Hall is one of the best writers and teachers of NLP (Neuro linguistic programming). In this book, he details his journey to making millions and applying the methods of NLP modelling to look at it. It is a detailed and complex book, but worth spending time with.

Money and wealth are both abstract words. While a hundred-dollar bill is something you can carry, “money” itself isn’t. Even more so in this day and age, our money is simply digits on a screen. There isn’t “your cash” sitting inside of a bank vault somewhere. (For every dollar in the bank, in the USA, they’re only required by law to keep 10 cents there.)

Thus, when two people speak about “wealth” they can have very different numbers in their head of what that looks like. Ultimately, there are different images, sounds and feelings that go along with that wealthy lifestyle too.

When we say money, what kind of money are we referring too? We already covered four different types: income, expenses, savings and investments. When you hear or read those words, you may picture those quite differently than if I say “money”.

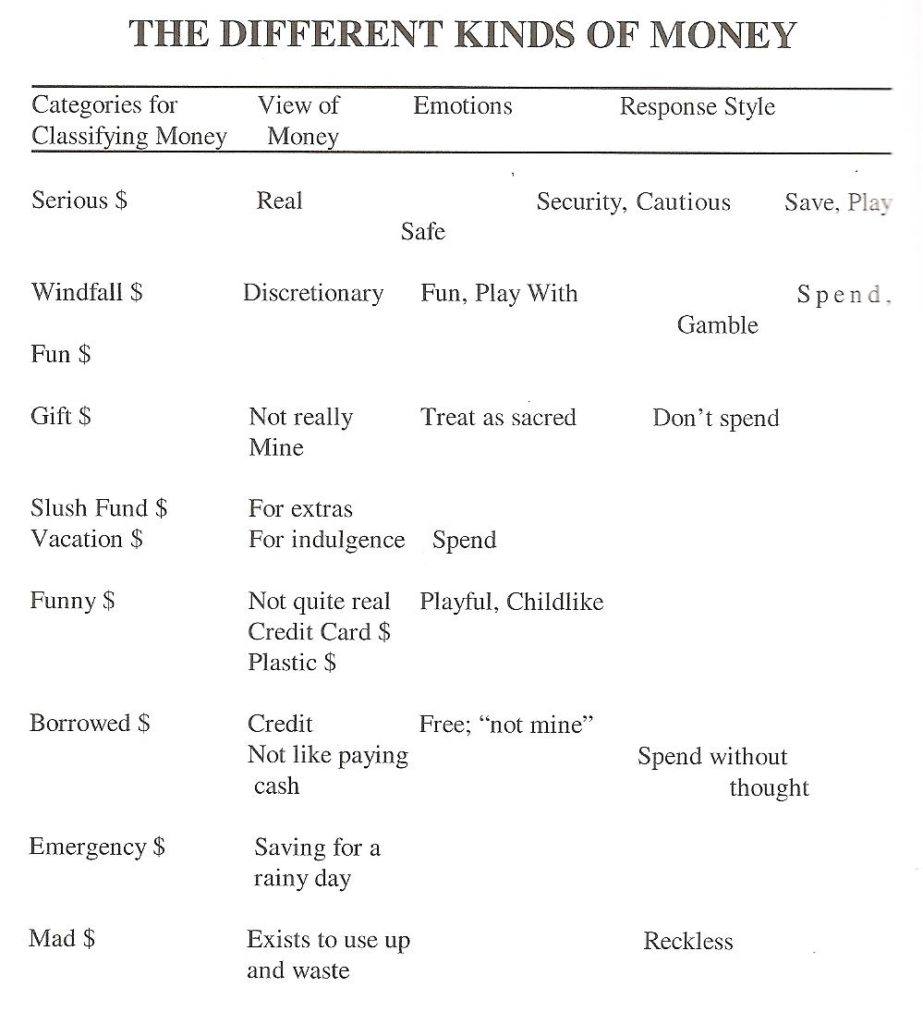

This is why it is important to get to concrete numbers in your planning. Further, with money we can attach all sorts of other meanings. The chart on the following page comes from Hall’s book, showcasing different frames of money we humans tend to think in.

Have you ever got a bonus or tax refund and felt you deserved something special? Contrast this to your normal income and you can see we easily think about money differently.

How much easier is it to put something on a credit card than to pay with actual cash?

That we treat different types of money differently shouldn’t surprise us. But most people miss this critical distinction. In the end, you shouldn’t fight this. Instead, harness and use it in a systematic way.

Since we put money into different mental accounts, it’s just a part of human nature and how we think, why don’t we just extend this to physical accounts too? Almost every writer or speaker on the topic of wealth discusses this. Why? Because it works. Find the right model, the right amount and purposes of accounts to suit you.

For the reasons just discussed, it is important to match the real world to your thoughts. We do this by actually setting up different bank accounts for different purposes.

Money that gets commingled gets spent in commingled ways. If both serious and fun money are in the same account, you’ll have no idea which is which. Separate accounts allow you to easily and without effort separate out what that money is for. It gives the money an explicit purpose as is defined by what the account is for.

Ease of use and transferring is important. While we’ll address the specific cases in which you might want money to be hard to access, in general, you want it to be easy.

First, we’ll cover the essential accounts. Then, we’ll move onto the optional accounts. Later on, in the book, we’ll address business accounts. (Even if you don’t own a business, this still might interest you for someday, or just to see the same principles working in something bigger.)

The Money System That Never Fails is now available in paperback and Kindle at Amazon.