Is cryptocurrency a result of systemic collapse?

Did Bitcoin arise organically from Satoshi Nakamoto as a result of the 2008 financial shenanigans?

We don’t know who Nakamoto was. The answer is shrouded in darkness, so you better believe that there are conspiracy theories on this topic! Was it an NSA/CIA project from the beginning to usher in the transformed and controlled economy we’re stepping into?

Yet that’s hard to matchup with the libertarian ethic of the vast majority of people in the crypto space, especially early on.

Understand this is a system, designed how it is to be decentralized and trustless, that could free us from the centralized system of financial tyranny and control we live under. Or at least that’s on the surface.

However, I don’t want to underestimate their ability to co-opt movements or utilize multi-layered deception, including roping in numerous patsies in a long-range plan.

Even if Bitcoin was something built to help free people from the beginning, in what ways can the narrative be steered?

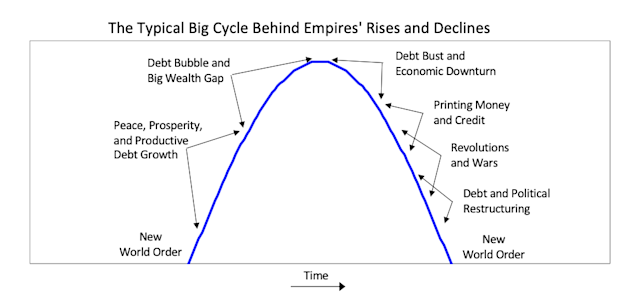

There is no doubt in my mind that cryptocurrency is the basis of our future economy (unless we destroy ourselves back to the stone age or a solar flare wipes out all electronics). This complete transformation will take place over the next decade or two. The question is whether it is economic collapse or economic controlled demolition as I’ve been talking about? Or, most likely in my opinion, some combination of the two, a steering of collapse in a certain direction to “build back better” how it is desired.

The conclusion that crypto is the future of money, in one form or another, is one thing.

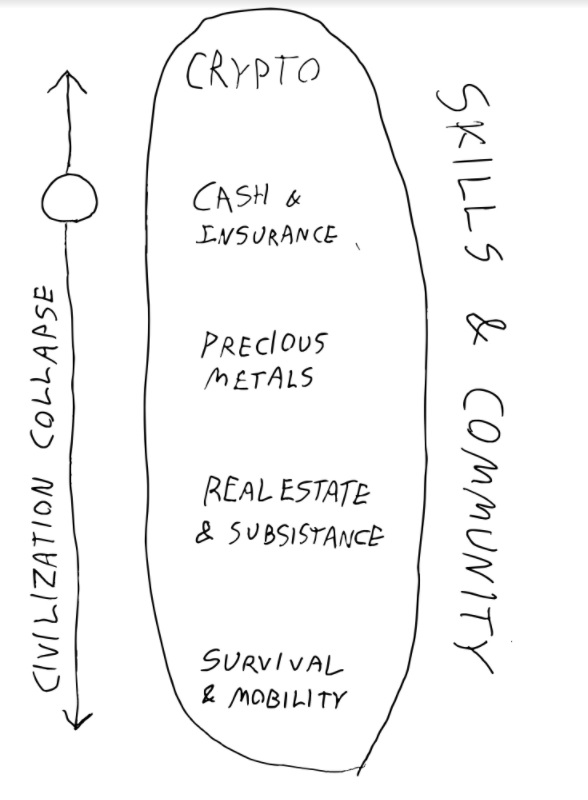

But HOW exactly it plays out, for better or worse, is what I’m really interested in. If you and I can get this right, it will be easier to navigate future events, including making “civilization collapse stack” investments along the way.

This article focuses on Bitcoin almost exclusively. The next part will look into other cryptocurrencies, most notably the field of stablecoins and CBDC’s (Central Banker Digital Currencies).

Bitcoin’s Origin Story

Bitcoin as a Technology to Free Us from Banker Control

The 2008 financial crisis had kicked off with Lehman Brothers collapsing in September. Satoshi Nakamoto put out a whitepaper on October 31st that year, titled Bitcoin: A Peer-to-Peer Electronic Cash System.

As a result, Bitcoin began with its genesis block on January 3rd, 2009, when the first 50 BTC were mined into existence.

Contained in this genesis block was a hidden message, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” which was the headline of The Times newspaper that day.

And so it was that Bitcoin was initiated as a solution to the systems caused by bankers. Meanwhile, via their captured government partners, the bank that were “too big to fail” were rewarded for bad choices to “preserve the system”.

This reminds me of the Buckminster Fuller quote that I often think about…

Here was something that didn’t aim to fight the system, but instead to overcome it by building something better.

And so most of the people involved in the early days were crypto-anarchists and libertarians.

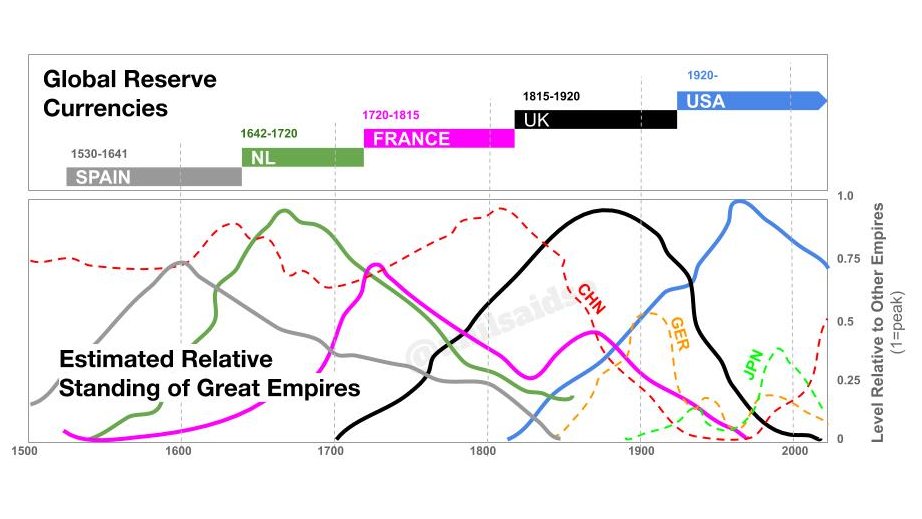

Fast forward about 13 years, and Bitcoin has become the third or forth largest currency near its peak price, give or take, only behind US dollars, Euros, and likely Chinese yuan.

We don’t know who Satoshi Nakamoto is. Was he just a smart but otherwise average person interested in cryptography that kicked off a revolution?

Way back in 1517, Martin Luther posted his “Ninety-five Theses” in the church door, condemning the corrupt world power of the time, the Roman Catholic Church. This event kicked off the Protestant Revolution, which over the coming centuries would alter the course of Western civilization and thus the world.

Is it a coincidence that Martin Luther posted the Thesis on October 31st, the same day as Nakamoto’s whitepaper? Or was this another “encoded” message?

Regardless, it is worth considering that the Bitcoin Whitepaper started a similar trend in action. That we are in the midst of a revolution just beginning to take shape.

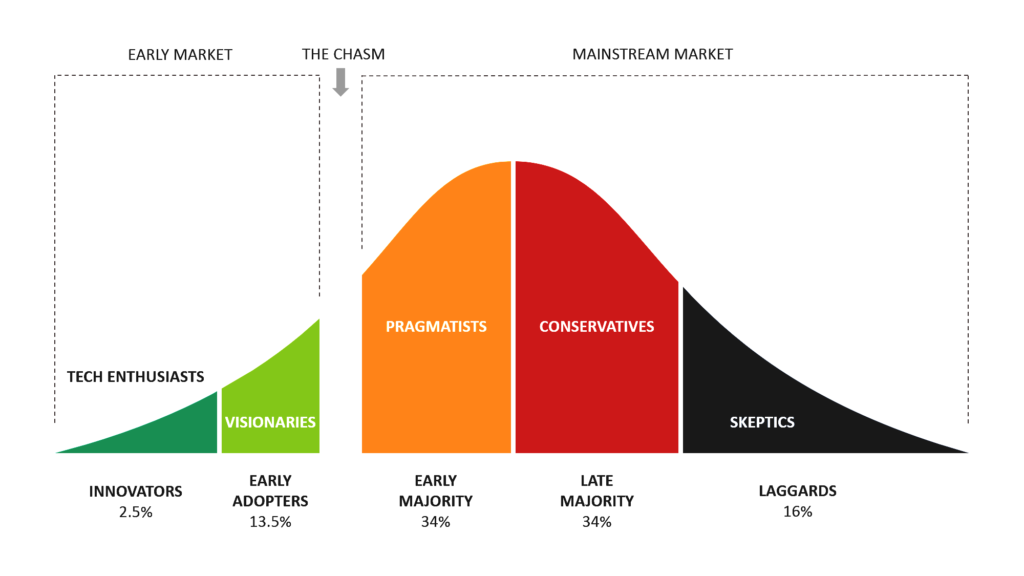

Make no mistake, there were previous attempts at cryptocurrency, like Bit Gold and Hashcash. But Bitcoin was the first one to become successful and reach a dominating network effect.

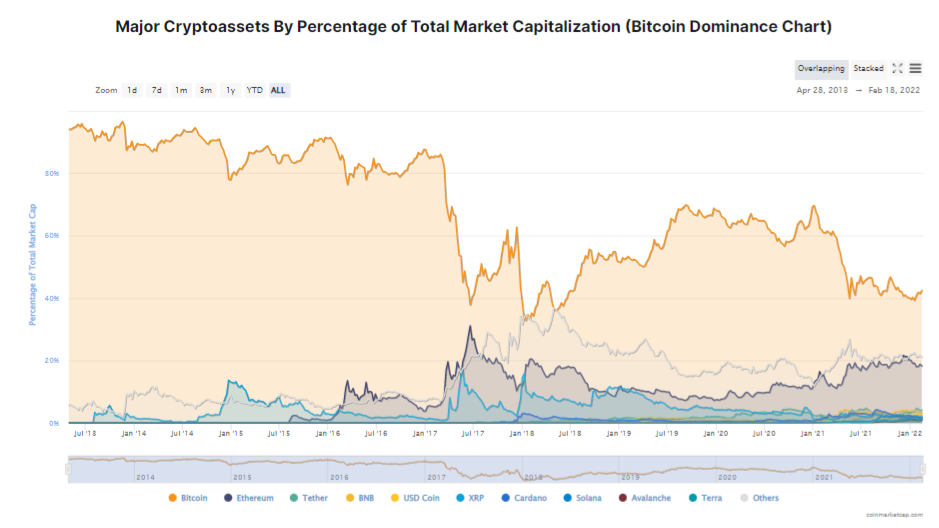

Bitcoin is currently over 40% of all crypto by value and that is near it’s lowest ever mark. The next player, Ethereum, isn’t even half that.

Still, this story is only one narrative and is not the only option…

Bitcoin as a Controller Plot from the Beginning

It’s tough, without knowing much of anything really about Satoshi Nakamoto, to judge where this came from.

There are conspiracy hypotheses that Bitcoin was a CIA plot from the very beginning. Or NSA, or bankers, or whatever other powerful entity you might think of.

What if the controllers of the world saw that the fiat system was unsustainable, especially with the grift-machine involved, and wanted to start up a new system that would give them even more control?

Satoshi Nakamoto, whomever that is, is sitting on a stash of 1.1 million BTC. That’s worth about $40 billion USD in today’s prices. If it was one person, that person would be roughly the 15th richest person on earth (publicly anyway) from this alone.

What happens if this money ever actually moves?

Could a new system have been designed from the ground up?

Oh, how devious would it be to enroll libertarians into your new system, only to enslave all people even more so later on.

To me, this seems a bit of a stretch. I concede it is possible because no one really knows how the world works. But that doesn’t mean it seems likely.

After all, there isn’t really anything I’ve seen in the way of proof to back this up. Nothing solid I’ve seen anyway. (If you have data, please do let me know.)

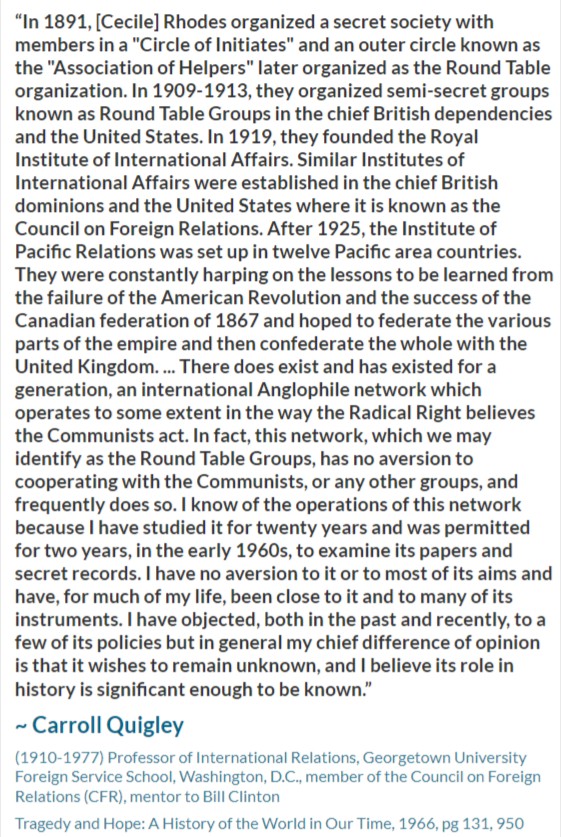

This is a conspiracy theory that exists only off of conjecture. That doesn’t make it wrong, but certainly very opaque. Based on other evidence they do seem capable of pulling of massive, devious and long-range planes.

Secondly, the fixed and therefore sound money supply, plus the decentralization involved do seem quite contrary to the ideas of centralized control.

Related to this is the idea that Bitcoin was a prototype, but was never meant to be the final solution. Which brings us to the next narrative. Even if Bitcoin had noble intentions from the beginning, doesn’t mean that would always be the case…

Bitcoin Co-Opted?

Do NOT underestimate the ability to co-opt and steer legitimate movements. We see CIA infiltration of the feminist movement, FBI infiltration of anti-Vietnam movements with COINTELPRO and so much more. We see powers that be literally involved in terrorist acts, murdering innocent people with Operation Gladio to steer the narrative as desired. There are so many examples of this.

So what if Bitcoin was a legitimate revolution as it may well have been?

Do you think the powers that be would simply roll over and allow a new financial system to take away all their power? Of course not!

Infiltrating the movement and influencing its direction would be expected. It’s not a question of if…but how. What does that look like exactly?

Here’s one possibility. The following comes from an exchange years ago I had with my friend who gave me permission to share this. (Some slight edits involved for readability.)

I’ll distill it down for you as best as possible. It’s like this:

Original Bitcoin = First big threat to banks in many centuries. Original bitcoin is called bitcoin core.

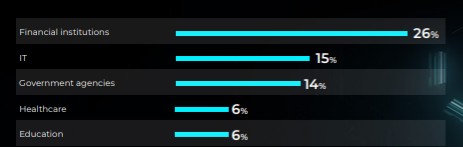

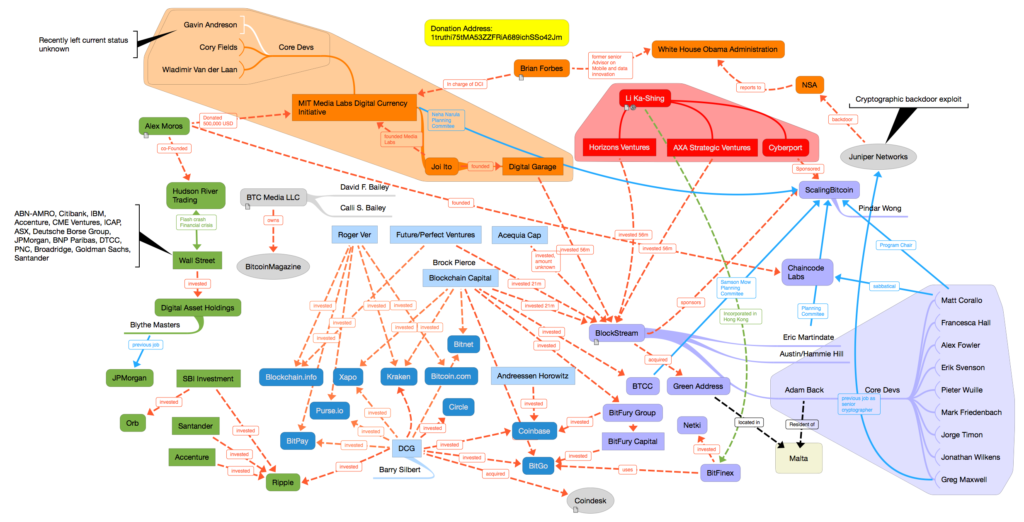

Banks form fund through AXA Investors (well over trillion in assets) – many ties to Bilderberg group, institutional investors, etc (ref: AXA is the second most powerful transnational corporation in terms of ownership and thus corporate control over global financial stability and market competition)

AXA Investors does (documented, likely much more) 75m investment into a company called Blockstream.

Blockstream goes on hiring spree of some of the best blockchain programmers at high pay and begins to do 4 things:

- Inject proprietary patentable code (with NSA back door) into bitcoin core’s code.

- Break the functionality of bitcoin core so it is NOT usuable as peer to peer electronic cash, resulting in centralized nodes of control (lightening network), like banks have with high fees so they can control it better. This was what the big block/small block debate was. Blockstream limited blocksize to destroy the functionality of bitcoin (slow to no confirmations) and charge high fees from a tollbooth position.

- Turn it into a financial instrument, like a security so they could drive up the price and crash it to make money and shake the publics confidence and control it.

- Hired a massive social media trolling army to change the narrative to “store of value” and “digital gold” (i,e., not a medium of exchange for normal people) and viciously attack other crypto’s namely, Bitcoin Cash which forked away from Core and is actually the original bitcoin.

The first post in this thread lays out what AXA actually is and what it’s doing nicely.

Here’s an infographic but it’s only a fragment of what’s going on and out of date by several years.

FYI this is the only uncensored Bitcoin forum on Reddit. The rest are controlled by the troll army and heavily censored as is twitter, etc – owner of twitter is actually paid Blockstream shill, no shit.

ETH was actually created because Vitalik was blocked by Blockstream from using his ideas in Bitcoin.

Do you know about that Tether scam? In a nutshell, Tether acts as a large central bank for Bitcoin core. Every time the price of core goes down they will mint millions of tether and buy Bitcoin core to prop the price up. An academic paper was even written about this that proved the link, mostly through Bitfinex.

I don’t want to be anywhere around core when that pops. It will bring down the whole system for awhile, but especially core.

To wrap it up, Bitcoin Cash is the original bitcoin. It’s super fast, super low fee and used grassroots world-wide. It is the original Bitcoin. Bitcoin Core is no longer bitcoin, that ceased with the fork. Roger Ver is a libertarian who is the largest proponent of BCH or bitcoin cash, he gets DESTROYED in social media by the Core Troll Army. Here is his site which is pretty much the only non-propaganda news you can get in the crypto world (i.e., it’s not controlled by blockstream).

I paid my brother $200 in BCH (bitcoin cash) last night, payment went through in 2 seconds. I use it online all the time. The utility is there.

Crazy story!

***

I personally have not dug deeply into all this to vet it out, but share it here to share the possibility and have the links for digging deeper to start your research if you want.

This has the ring of accuracy to me. It absolutely is true that BCH is faster and cheaper to use than BTC for transactions.

And I have dug into the shadiness of Tether (USDT).

If the bankers that essentially control the world economic system saw a threat in Bitcoin, why wouldn’t they do something about it? If you couldn’t outright destroy it due to its decentralized nature, the least you could do is get your tentacles into it, just like they’ve done with pretty much every single big institution in our world. In that way this seems to follow the playbook.

And of course there’s even more rabbit holes to go down…

There is Craig Wright, who claims to be Satoshi Nakamoto (most people don’t believe him as his proof is dubious at best). But Bitcoin Cash (BCH) was forked to become Bitcoin Satoshi’s Vision (BSV). If BCH is the true Bitcoin, was this another co-opting, done to further muddy the waters and make BCH seem less useful by confusing people?

One of the best ways to keep people from finding the truth is to layer in more deception. When there’s too many rabbit holes to go down, there will be massive confusion. And a confused mind is easier to control.

Block Size and Decentralization

However, I list that as a possibility. I do understand something of the contrary argument. To increase Bitcoin’s block size would increase its centralization. Bitcoin (BTC) blocks are 1MB in size. With that its entire history is about 380GB in size.

Meanwhile, Bitcoin Cash (BCH) blocks are up to 32MB in size.

It’s entire blockchain size is only 176 GB. Why is it smaller, if it has a larger block size? Less transactions in total. BTC is much more popular and thus has many more transactions.

For those of you who have no idea what this means, let me explain it simply. These bigger block sizes mean that transactions are cheaper and faster as more transactions are contained in each block. However, this does come at a cost of decentralization. The miners (or validators in other blockchains) need storage space and capacity to hold the blockchain so they can secure and verify transactions. The bigger the chain is, the less individual people can do it on home computers and the more big dedicated companies need to be involved. If people alone can’t do it, only big companies can, then this is more centralized. More details on BTC vs BCH in this article.

And just to throw it in there, BSV has a 2GB block size! The chain is 2334 GB and growing fast.

(Compare also to one of the hot blockchains right now, Solana (SOL), which has a 1GB block size every second, producing 4 petabytes of data per year. While they split validators and archivers, this doesn’t seem like a sustainable model. In any case it is highly centralized and subsidized.)

This website gives you a visual of the traffic on a few of the different blockchains, with each transaction represented by a person, and each block represented by a bus, smaller or bigger depending on blocksize.

Understand that decentralization is key to keeping it uncontrollable by ANY entity. This is what the bitcoin maximalists are shouting about.

So that covers some of the theories about the past. Now we’re going to switch gears and look at some ongoing narratives about Bitcoin.

Current Bitcoin Narratives

Bitcoin is Bad for the Environment

This is probably the most prevalent of the narratives. Here’s a video from Coin Bureau that goes over the facts.

Bitcoin can be mined with polluting forms of energy, absolutely. But it also can and does use sustainable forms of energy for mining, with this being an ever growing amount. It can also use wasted energy production such as the flare off of natural gas at oil mining sites to also mine bitcoin, further improving economics.

In short, “bitcoin is bad for the environment” is easily falsifiable in a couple of ways.

- The traditional finance system that Bitcoin aims to replace takes far more energy than bitcoin does.

- Compare the energy used for let’s say the US military. The left doesn’t really talk about reducing that, even though they use to be anti-war, instead they focus on favorite enemies like bitcoin instead.

And maybe part of the narrative is that Bitcoin isn’t good for the environment, so another system such as any of the proof-of-stake cryptos which are much more energy efficient (and typically much more centralized) should take its place.

Still this narrative is constantly reiterated. We see headlines such as “Iran Orders Crypto-Mining Ban to Save Power During Winter Crunch.” As it appears that there are energy troubles on the horizon (like in Germany due to the intermittent production of renewable energy sources), this will continually be used to attack Bitcoin. (On the flip side people are talking about how bitcoin mining can actually be used to heat people’s homes!)

Rest assured, with the ongoing climate change narrative, this narrative regarding bitcoin and cryptocurrency is not going away anytime soon.

Bitcoin is Used By Criminals

In a WSJ interview, Bill Gates was asked what technological advancement the world could do without. Gates replied, “The way cryptocurrency works today allows for certain criminal activities. It’d be good to get rid of that,” he quickly added: “I probably should have said bio weapons. That’s a really bad thing.”

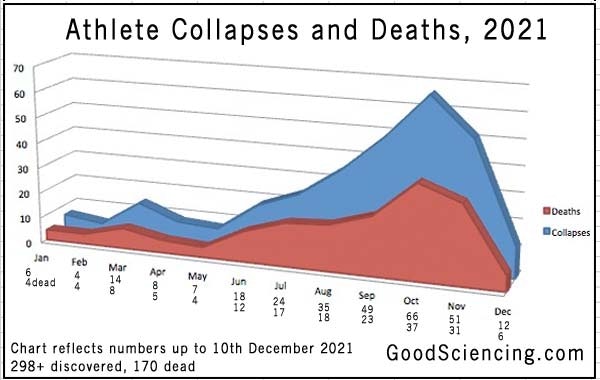

This is darkly hilarious to me in many different ways. The thing is I think Gates likes bioweapons…

Early on, bitcoin was used to fund WikiLeaks when they were blocked by a financial blockade which included Bank of America, Visa, MasterCard, Paypal and Western Union in 2010.

One of Satoshi’s last few posts read, “The project needs to grow gradually so the software can be strengthened along the way. I make this appeal to WikiLeaks not to try to use Bitcoin. Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change, and the heat you would bring would likely destroy us at this stage…It would have been nice to get this attention in any other context. WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us.”

Satoshi’s warning was not heeded. WikiLeaks started taking Bitcoin payments in June of 2011.

Was it this event that got the financial powers to start targeting and co-opting Bitcoin?

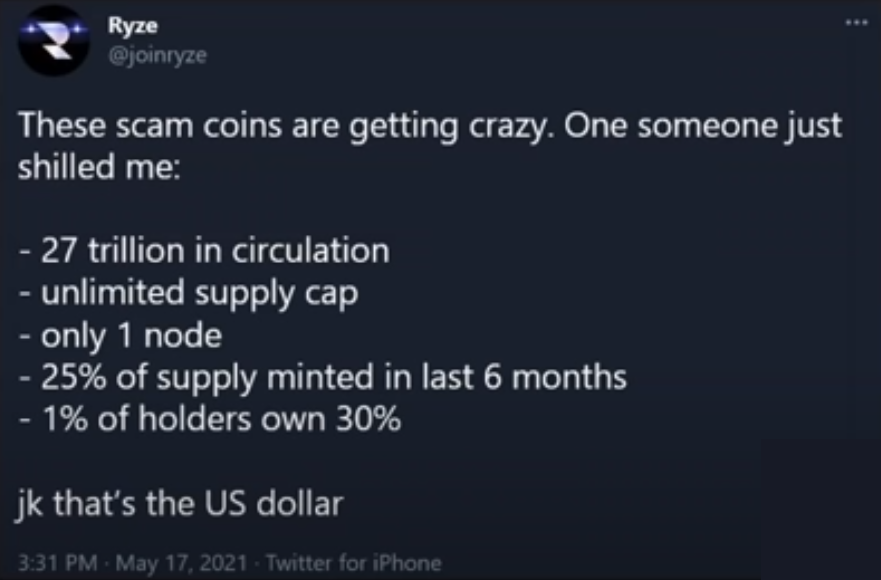

Yes, Bitcoin was used by people to buy drugs, including online. But so is cash. And the stats show that more financial crime is done with the US dollar over anything else. In that way this narrative is quickly falsifiable. The US dollar or other fiat currencies aren’t targeted by the narrative because of their use by criminals. (After all the biggest criminals, the bankers, use their fiat currencies of choice.)

Of course they never let the facts get in the way of a narrative. Senator Elizabeth Warren echoes these: “Cryptocurrencies have created opportunities to scam investors, assist criminals, and worsen the climate crisis.” A triple whammy!

It happened with WikiLeaks. It’s happening now…

Bitcoin Funds Terrorists!!!

While this has been an ongoing narrative for some time, there’s a present event that is being talked about in these regards.

The Freedom Convoy in Canada. Here’s a couple videos for those not familiar with this (what with the mainstream media blackout primarily, and smear campaigns secondarily).

Or as the narrative basically talks about it “Attack of the Transphobic Putin-Nazi Truckers!” (<–CJ Hopkins gives his humorous take on it in this article.)

Funding was raised initially through GoFundMe. They, being a Silicon Valley company, stopped the funding. (For many people this was the first time they heard of GoFundMe doing such, but they’ve been delisting anti-narrative things for well over a year now.)

The crowdraising platform GiveSendGo became the next place to be used with almost $10 million raised so far. As a result they were:

- Hit by denial-of-service attacks to disrupt the website.

- Hacked and their donor list doxxed.

- Ordered by a Canadian court order to cease transferring funds to which they said basically you can’t tell us what to do.

Now, funding is being frozen at the bank level, as part of the Emergency Act that Trudeau’s WEF’s penetrated government has unleashed.

Back to our main story, in addition to GiveSendGo, TallyCoin is being used to fund the convoy movement with bitcoin.

Bitcoin is great in that it can’t be censored. That’s what people have been talking about for a long time, ever since WikiLeaks. However, if they’re freezing bank accounts (not to mention crypto exchange accounts) you can’t necessarily transform BTC into fiat currency. This is okay if others will take your BTC, but not if you need to go from one economic system to another.

BREAKING: Canadian Federal Police call for FINTRAC to block over 30+ #Bitcoin wallets from transacting with major financial institutions.

— Dennis Porter (@Dennis_Porter_) February 16, 2022

This story is continuing to unfold by the day.

As the terrorism narrative is largely being turned internally with domestic terrorism (including those spreaders of false or misleading narratives and conspiracy theories), continue to look for this to target bitcoin and other cryptos.

Bitcoin May Play a Role in the Cyber Pandemic

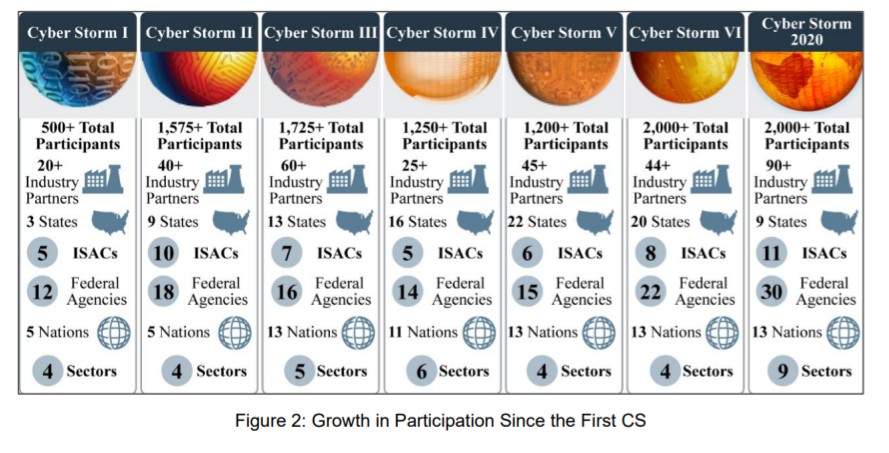

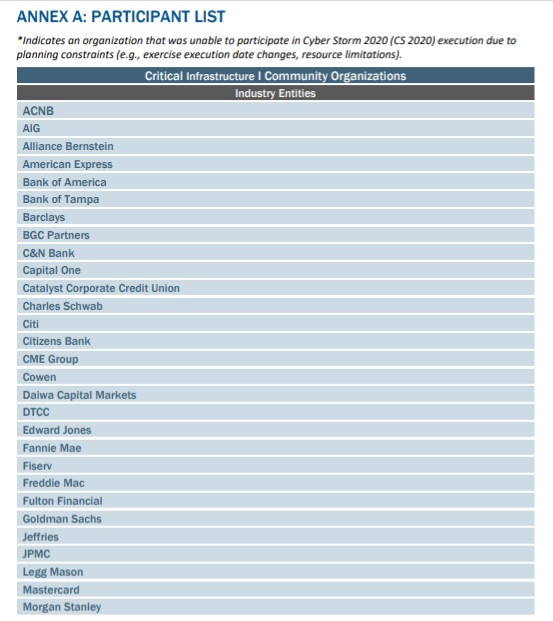

I covered the coming cyber pandemic possibilities at extensive length here. Long read, but well worth it to better understand the major possibilities of the next COVID-sized world-shaping narrative.

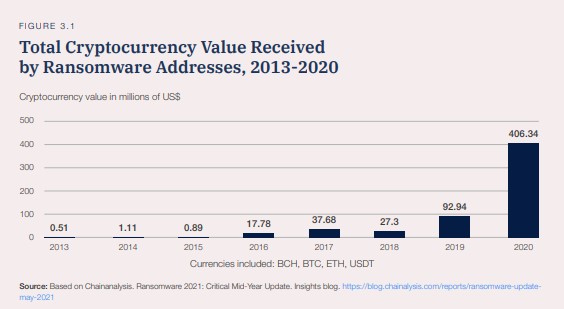

In short, Bitcoin being used as the crypto of choice for hackers doing ransomware of other cyber attacks. (Actually Monero and other privacy coins are far better than Bitcoin as it is relatively easy to track Bitcoin on the blockchain.)

I finally found the video that I couldn’t find for that post! Matthew Kratter discusses how such an event could specifically target Bitcoin. The scenario he lays out starting at 5:55 is:

- Global internet outage

- Shadowy super-coder hackers demand Bitcoin ransom

- Global outcry against Bitcoin

- Coordinated global crackdown on Bitcoin

- This then leads to a global war on cyber terrorism that leads to required internet registration, “internet passports,” CBDC’s and the like to further control…

Definitely seems like a good way to go with the plan. Squeeze out bitcoin while CBDC’s and your digital ID, the trusted solution, come in its place.

Bitcoin Will Be Banned or Regulated Out of Existence

All of these other narratives lead to the idea that bitcoin will be banned.

Its tough because as long as enough people use it bitcoin will continue on the trajectory it’s been on since its inception, which is towards mass adoption.

But if one or multiple of these narratives are successfully used, I can’t fully discount this possibility. Even if it never happens, that certainly won’t stop the headlines. For example, Bank of India to totally ban crypto or ‘Snow Job’: The Plot to Hand the Crypto Industry to the Big Banks.

Bitcoin has been claimed dead some 444 times in the media now! But then some people just make bad projections…

I’ve said it before and I’ll say it again, I don’t want to underestimate my enemy’s ability to co-opt movements and steer the narrative. The aforementioned narratives ramped up far and hard enough could ultimately lead to this place of crushing bitcoin.

The following is a long video but a good discussion with Catherine Austin Fitts, author of the Solari Report, some of the best intel for the people in my opinion, and Aleks Svetski, found of Amber a Bitcoin app and editor of The Bitcoin Times, hosted by Dr. Mercola:

Can Bitcoin Circumvent Economic Tyranny

Fitts viewpoint is that basically some of the narratives mentioned here will crush bitcoin. That it was a prototype of the controllers from the beginning. And that digital money cannot help us thrive if other steps aren’t taken to stop the digital control grid.

On the other side…Svetski’s thesis is related to the next point, and switches gears to a more positive narrative for Bitcoin…

The Bitcoin Standard

Bitcoin is designed to be inflationary but at a set amount that cannot be changed. Furthermore, it is a decreasing amount, unlike the inflation we’re facing now and is fiat’s destiny. This makes bitcoin scarce.

And as Michael Saylor has argued, it is the first currency that was ever engineered to be so. In other words, it is the first technological improvement in money as a whole in a long time.

The further innovation is that it was designed to be trustless, or perhaps in a better put way, the trust is so flatly distributed (through the miners) that there is no central controller. No central controller means a fair and independently sovereign money.

That these factors could lead to Bitcoin becoming the standard by which the global money supply is used. It could be the bitcoin standard like it used to be the gold standard. And in fact, bitcoin is superior to gold in several ways not the least of which is its ease and cost in being moved.

(One possible scenario that came to mind is what if we get to a Bitcoin standard…only to later have that removed decades later through one means or another? Again, co-opting and steering narratives is always done.)

So even if it was crippled to become “digital gold” instead of “digital cash” the benefits of this being the settlement layer for the world could very well be vast.

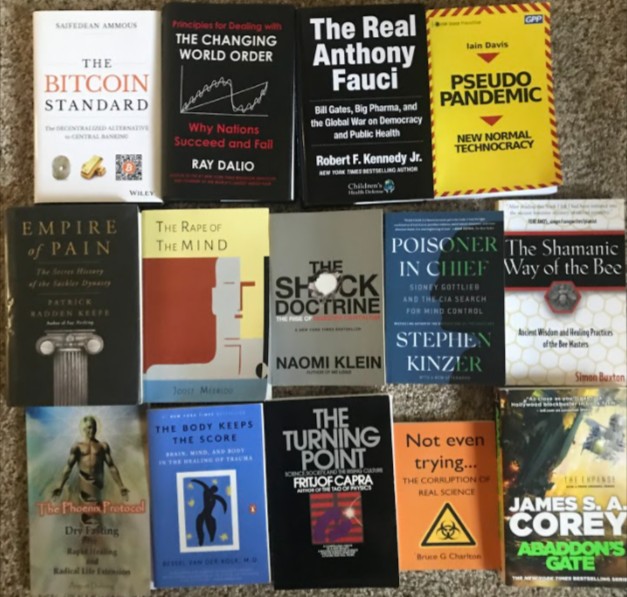

I highly recommend the book, The Bitcoin Standard by Saifedean Ammous for more details on this scenario, and the viewpoint of why humanity should adopt it.

This is what all the bitcoin maximalists are pushing for. The fact that there is an actual possibility of it occurring, makes bitcoin worth investing in at some level, in my opinion.

Does this solve all our problems? Of course not! But we absolutely need steps in the right direction.

Even just to have bitcoin as one of many possible currencies does give big utility for savers and censorship resistance. Where I disagree with Fitts on this subject is that bitcoin is a helpful step in the right direction. It can be used now to help us, but certainly is just one tool in a kit we need to assemble.

Bitcoin as Legal Tender & Sovereign Money

Related to this we see the adoption of bitcoin as money, not just by people and institutions but by countries.

El Salvador made the news last year when they adopted it as legal tender, in addition to the US dollar.

My prediction, as well as the prediction of many others, is that this year we’ll see more countries follow suit.

Basically, it’s going to go one of two ways. Will there be contagion, other countries doing the same? Or it will be crushed in some form?

If Bitcoin does indeed fight the powers-that-be, El Salvador is very likely in for a rough ride ahead. This includes regime change being on the table. (Libya’s leader Gadaffi wanted an African union and currency outside the petro dollar for example.) Still, if such attacks can be weathered, and if it is played smartly El Salvador could become much more successful.

If Bitcoin is part of wicked a plan of centralization through deception, then El Salvador may do well indeed, but slowly move towards greater control and less freedom.

There are some concerns towards the later being the case with the Lightning wallet. Bukele ‘Has Not Responded’ to Claims of Bitcoin Vanishing From Citizens’ Wallets: Report. If that indeed is happening, that is certainly anything but sovereign money!

And this stuff looks straight out of the WEF’s future desires. (Is Bukele’s cabinet penetrated too?)

I am very curious to see how this plays out. Exactly how things go for El Salvador gives us very strong hints as to whether Bitcoin is really for freedom or has been controlled/co-opted.

Should You Invest in Bitcoin?

In summation, I don’t know where it came from! I don’t know where it’s going!

This article probably gives you more questions than answers. But at the very least I hope this has given a good overview of the different possible past and future scenarios and various ways they could play out.

As for your own personal investing, understand this. At worst Bitcoin can go to zero. The chances of this happening are far less than that of other cryptocurrencies, but it is still possible. Besides that it may get controlled in such as way that it becomes less usable (the platforms that allow convertibility to fiat).

On the positive side, bitcoin is censorship resistant and in its short history, has been not just a store of value but ever increasing in value when looked at in the span of years. That this could continue means the sky is the limit on where bitcoin could go.

For it to back the world’s financial system or even just a portion of it would mean a six and eventually seven figure bitcoin.

Even (especially?) if it is controlled/co-opted it may still have a role for the powers that be. And that would almost certainly mean its value will go up.

I remember someone mentioned that they can’t kill bitcoin because it would kill trust in digital money which would be bad for CBDC’s. I’ll tag on that they can’t kill it YET, but that time may indeed come.

Playing the odds, it is my opinion that you ought to have some bitcoin. Worst case is it goes to zero. Best case is sky is the limit. How much is up to you.

Here’s my free crypto crash course that will help you buy your first bitcoin and here’s the complete crash course to go much deeper (including how to earn interest on Bitcoin and far more).

The next article will continue talking about economic collapse and demolition but with a wider net of other cryptocurrencies, most notably stablecoins and CBDC’s.