Why am I bullish on crypto?

It comes down to three main things. I’ve touched on these before but want to cover them a bit more today.

Number one is that it’s a hedge against the dollar and all the shenanigans of the central bankers.

We are in inflation. No doubt about it even to the normies, just a question of how much and how long.

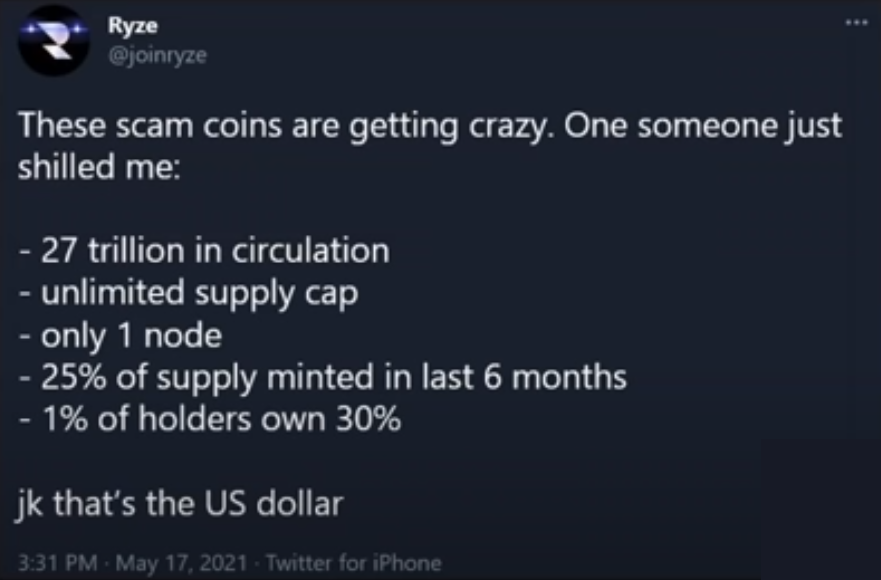

In the crypto space some tokens are literally scams. There’s no denying that.

Which brings us to this…

When you compare our monetary system to what’s possible with Bitcoin or other cryptos, well you can see which one is left wanting.

The Fed has license to print as much money as they want. They’re doing it, buying up corporate debt and the like.

With BlackRock (more on them later) it is the total fusion of the public and private sectors.

There are no guarantees that Bitcoin continues to far outperform most assets.

But there is a very good chance.

If you want to hedge yourself, it’s a solid bet.

And that’s just point number one.

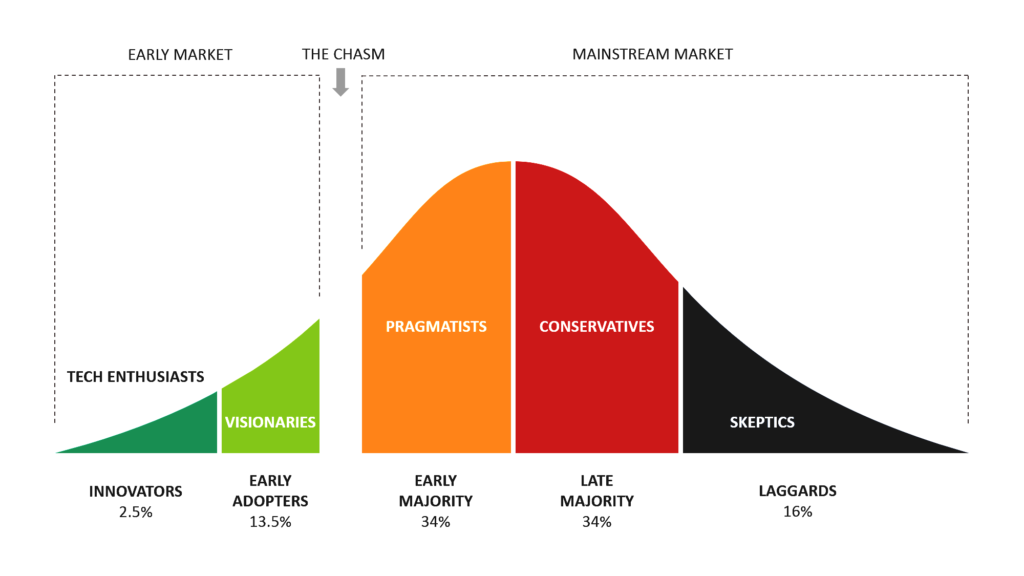

Point number two is adoption.

Total users have doubled from 106 million in February to 221 million in June.

There’s a good chance there are half a billion people using crypto by the time 2021 ends.

It’s not just people.

With El Salvador it’s even a sovereign country. (When will the next one join in?)

And also hedge funds, banks, companies and more.

We’re crossing that chasm.

If you understand anything about “network effects” you’ll recognize how all these people and institutions piling in will drive prices up.

The FOMO that sets in with the next leg up will likely be legendary. Tulips got nothing on Bitcoin 😉

And the third point is the technology.

I know, I know, it’s tough to wrap your mind around how all this works. Are you an engineer? Are you into cryptography? If not, it might be tough to understand these things.

Wait, your wallet doesn’t actually hold the coins? Wait there are no actual coins just a public ledger?

I’m still struggling with it as I stretch my knowledge base!

What makes proof-of-stake different from proof-of-work? How will impermanent loss affect your liquidity pools…and thus the money you make or lose? What is seigniorage have to do with algorithmic stablecoins?

As I’ve said it gets complicated quickly!

But the possible benefits of this technology also stretch the mind.

In the DeFi space (decentralized finance, aka no bankers involved) there are things such as self-paying loans.

These can’t possibly work in the world of centralized finance. But they can work in the world of smart contracts.

It’s basically a new entity like a corporation or LLC…except that instead of owners it’s “an open-source blockchain protocol governed by a set of rules, created by its elected members, that automatically execute certain actions without the need for intermediaries.”

There’s a crypto token I’m looking at right now that offers a 7.33% yield. That’s a pretty good number to make on your money. Except it’s not an annual yield. That’s in just five days.

Sounds like a ponzi scheme, right? Except that there is a ground floor price on the token.

I could go on and on.

But here’s my point. Any one of these things (inflation hedge, adoption, and technology) would be a good reason to get some crypto.

All three of them together? Well, that’s why I’ve devoted so much of my time to the topic this year. It’s powerful.

My new Crypto Crash Course will take you through everything you need to know to get up and running.

I’m working on more of the Advanced Track videos where I walk you by the hand in how to interact on DeFi later today.

And right now you can get the Beginner Track for free, if you just want to dip your toe in.

I figure once your Bitcoin goes up, you can come back and pay for the rest of the course 😉