“This is a planned, organized partial shutdown of the U.S. economy in the second quarter. The overall goal is to keep everyone, households and businesses, whole… It is a huge shock and we are trying to cope with it and keep it under control.” – Federal Reserve Bank of St. Louis, James Bullard https://www.marketwatch.com/story/unemployment-could-reach-30-in-the-us-says-st-louis-feds-bullard-2020-03-22

Planned shutdown of the economy. (How far in advanced was it planned? Will they be able to “keep it under control”?)

What about a planned shutdown of the dollar itself?

As we entered into 2020, I was intrigued to see a number of people make predictions for the decade ahead. Today, I am going to make one such prediction.

The US dollar will not be relevant as a worldwide currency anymore. It might even be fully gone, except as a collector’s item by 2030. It might just happen much faster than that too.

It’s may seem a bold prediction but there are reasons for it which we’ll cover today. Once again, I make the disclaimer that I am far from an economist. This stuff can be quite complicated, even purposefully made so. But I share what I’m seeing as clear as I can state it.

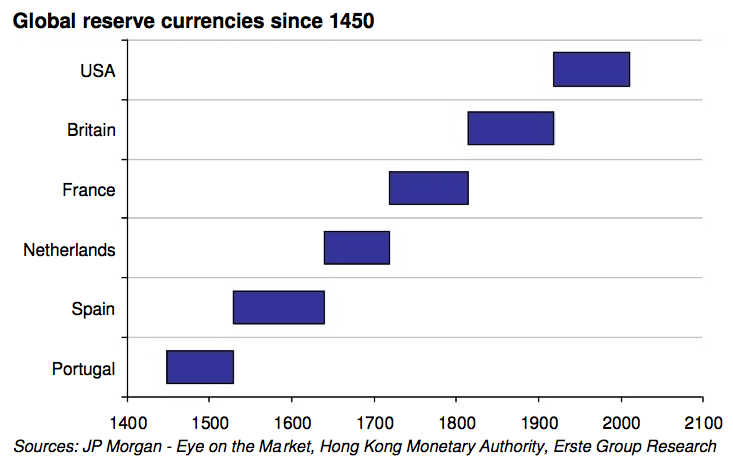

I came across the following image which stated, “Reserve currency status usually lasts about 100 years. The petrodollar certainly had a good ride last 100 years. At some point people just stop accepting them for goods (like oil, gold, food, houses etc).” https://twitter.com/100trillionUSD/status/1243115218043047938

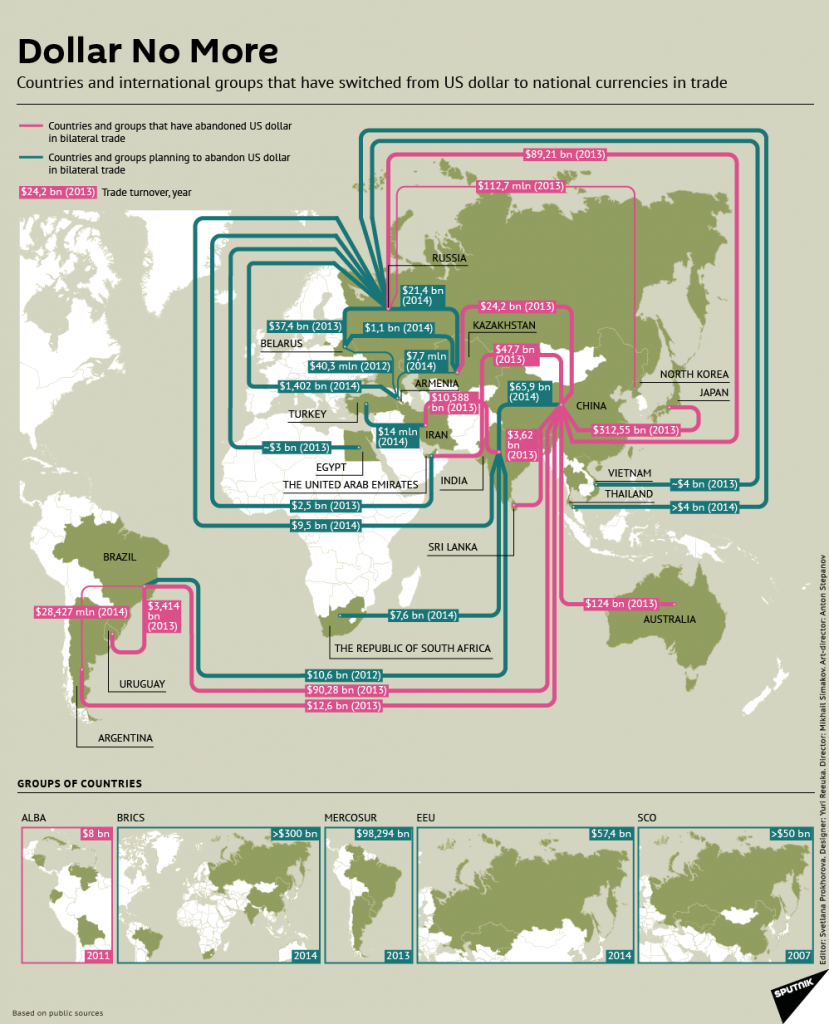

No it’s not just the pandemic. The first hints of this were here the past few years as other countries made moves away from the dollar. “It is not only the Chinese that are starting to question the viability of the dollar. A report in 2010 by the United Nations called for the abandonment of the U.S. dollar as the single reserve currency…With more bilateral trade transactions bypassing the dollar, and the increasing internationalization of the Chinese financial system, the yuan is eventually going to give the dollar a run for its money.” https://www.visualcapitalist.com/the-dollar-is-slowly-losing-its-status-as-the-primary-reserve-currency/

That’s one possibility. But my bet is that what succeeds the dollar will be some type of digital currency. (Actually the Chinese have a digital yuan which will likely be a strong play.) https://www.coindesk.com/prof-michael-sung-talks-about-the-rise-of-the-digital-yuan

As of right now, there are lots of cryptocurrencies out there. One or a few will come to ascendency. That’s a big topic we’ll be diving into soon, but first more about why the dollar is unsustainable.

Our entire money supply is based on debt. And in that way, it is a Ponzi scheme. The only way for the system to keep going is by adding more and more in. You need continual growth, or it collapses.

The Federal Reserve is the creator of this system. The common belief is that they’re there to make sure the system keeps running. But the fact is they are largely the problem themselves. They create bubbles and bursting by their manipulations of the markets.

What we have in 2020 is the biggest bubble ever created, now bursting.

And the Fed is making unprecedented moves in order to soften the landing. The thing is all these interventions, even if they work in the short term, simply cause bigger problems later on. To put it another way, part of the reason we’re in this mess is everything they did back in 2008! Hence the stimulus three times as big as the start of the prior bailout.

For example, companies learned that they could be too big to fail. Therefore it is in their interest to seek higher, riskier returns, knowing the that government would bail them out next time too. If our economic system does bounce back, it simply means a bigger bubble bursting later.

Unprecedented moves. That means never done before. (Once again, expect more unprecedented things to occur because this event is part of a massive transition. Unprecedented moves are the new normal for a while now. Get used to it.)

The national debt stands at $23.6 trillion right now, the highest it’s ever been. https://usdebtclock.org/world-debt-clock.html

The US is essentially bankrupt. We’re getting to the point that has occurred in many other countries where we won’t be able to pay even the interest on that debt. Not to mention other underfunded liabilities we have such as social security, Medicare, etc.

Do you know what makes up over 50% of the assets held by the US government?

Student loans. https://www.advisorperspectives.com/dshort/commentaries/2020/03/16/the-fed-s-financial-accounts-what-is-uncle-sam-s-largest-asset

What happens when these stop getting paid? I’m not sure…but payments are suspended through September now. (These certainly made up their own bubble, and what happens to bubbles? They burst.) https://www.buzzfeednews.com/article/sarahmimms/coronavirus-bill-ends-student-loan-payments-interest-6

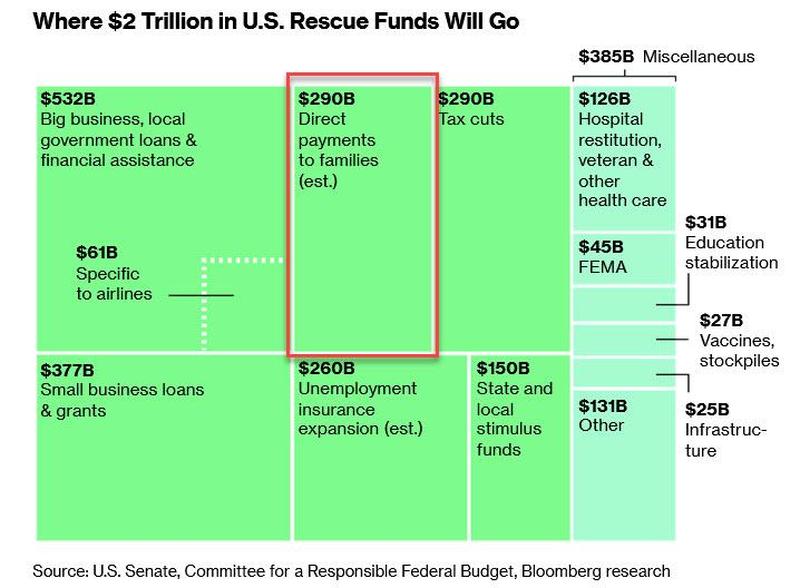

Right now we’re printing money out of thin air. Many are calling it helicopter money. The $2 trillion bill, Coronavirus Aid, Relief, and Economic Security Act (CARES Act), is just the start.

And of course, that is stuffed full of money to all kinds of businesses and pet projects, far more so than directly to people or necessary relief. Direct payments to people account for $290 billion or just about 14%.

It seems to me just a token gesture to try to satisfy people that the government is here to take care of us.

Meanwhile, there are provisions in the act to make the Federal Reserve LESS transparent about what it does. https://www.zerohedge.com/economics/if-getting-us-6-trillion-more-debt-doesnt-matter-then-why-not-350-trillion

They’re making daily $1 trillion loans to banks. https://www.pbs.org/newshour/economy/federal-reserve-to-lend-additional-1-trillion-a-day-to-large-banks

The Federal Reserve now has a $5 Trillion balance sheet, the highest it’s ever been. https://finance.yahoo.com/news/federal-balance-sheet-tops-5-210123506.html

This balance sheet is swelling because the Fed is buying up all kinds of things it’s never done before. As of today, the Fed is even buying up exchange traded funds (ETFs). What the Fed is spending dwarfs the CARE Act. https://www.marketwatch.com/story/the-fed-is-going-to-buy-etfs-what-does-it-mean-2020-03-23

Most people don’t really understand inflation. One way of thinking about it is as an extra tax you don’t directly pay. If the government prints so much money that the money supply is twice as big, then any money you have is worth half as much.

Understand that the government just took on some massive liabilities in the expansion of 3.3 millions of Americans on unemployment. And this is just the first wave of unemployment. https://www.zerohedge.com/personal-finance/record-xx-million-americans-just-filed-unemployment-benefits

Even if the virus disappears tomorrow (which will not happen), these people will not all immediately get their jobs back. These people then have less money, so they spend less, which means more layoffs will occur.

Virginia just issued a statewide stay-at-home order through June 10th. https://www.richmond.com/special-report/coronavirus/update-northam-issues-statewide-stay-at-home-order-effective-through/article_67dbe141-da92-504b-b74d-e7c9ed8a118c.html

Ripples of impact.

Meanwhile, the government is going to be paying these people month after month for quite some time. This money comes from new money added by the stroke of a few keys, because we’re certainly not sitting on any cash reserves.

At best, it looks like we’re moving into strong inflation long term. I don’t know how bad it will get. Hyperinflation is usually defined as over 50% per month. It hopefully will not reach this rate. And it hopefully won’t be far worse, such as the rates of 30000% per month in Weimar Germany, or the freaking-insane-to-comprehend example of Hungary where prices doubled every 15 hours. https://www.investopedia.com/ask/answers/061515/what-are-some-historic-examples-hyperinflation.asp

Many people just took a huge hit to their 401K with the stock market crash. The US Public Pension lost almost a trillion dollars, down 21% for the year. What was underfunded gets more underfunded. https://www.zerohedge.com/news/2020-03-27/us-public-pension-funds-have-lost-1-trillion-recent-weeks

Recognize that even after recovery, with inflation coming all the savings you’ve made will become worth less and less.

It is a transfer of wealth. But unlike what many people are asking for from the rich to the poor, it is going in the opposite direction. Meanwhile the people are meant to be placated by the handouts from the government. (I found the joke funny that who knew Trump would be implementing many of Bernie Sanders ideas like universal basic income!?!)

The good news is there’s likely some time to position yourself for the transition. Diving into that you’ll see more proof that this was planned ahead of time. Maybe not the virus itself, but the economic transition.