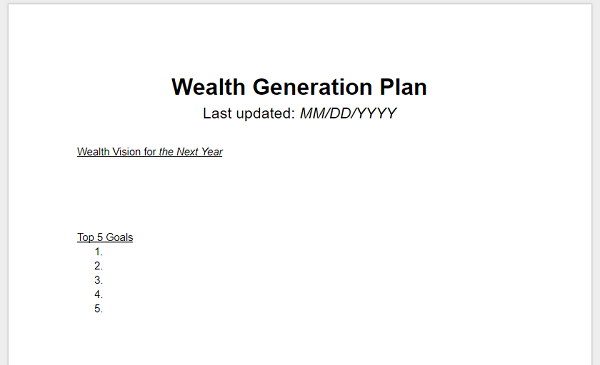

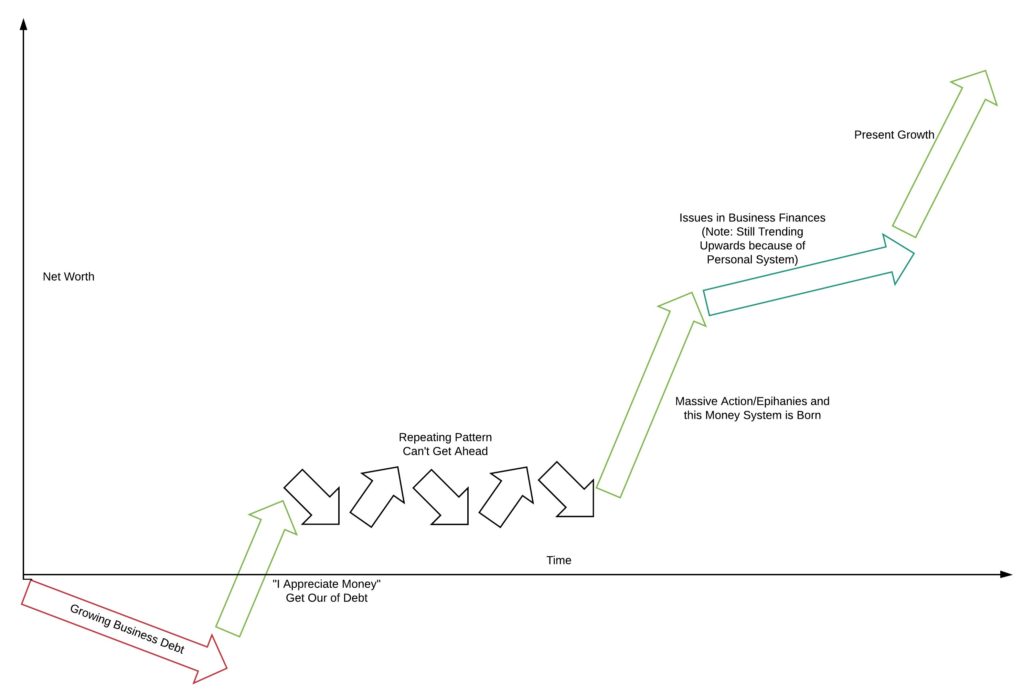

This is another chapter in The Money System That Never Fails and starts up one of the most important parts of the book, your wealth generation plan. This “living” document was what turned around my finances for good.

I don’t remember who I got this from specifically, or if it even was from anyone in particular. It may have been from reading the 30+ books, and I came up with this idea myself. If you’re making a road trip, you better have a plan on how to get there. Sure, GPS is prevalent these days, but you still need a destination. Similarly, a good business will have a solid business plan, whether or not it is in the standard business plan.

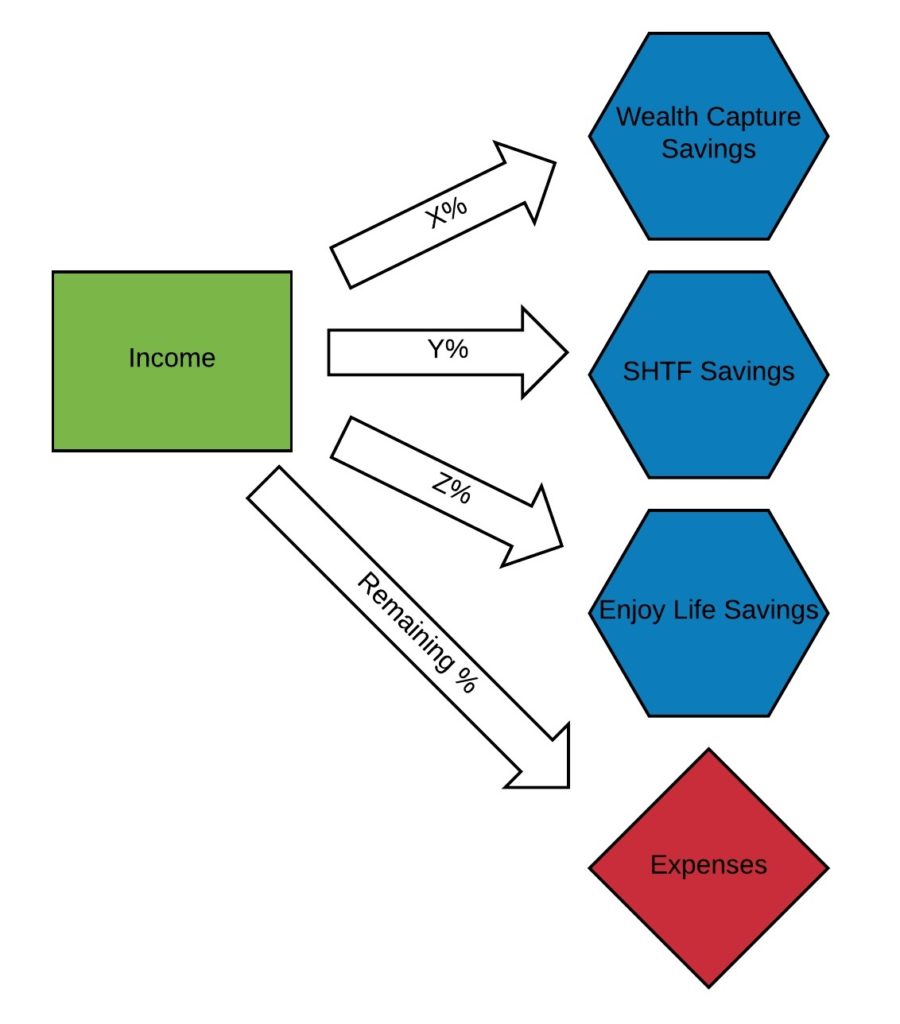

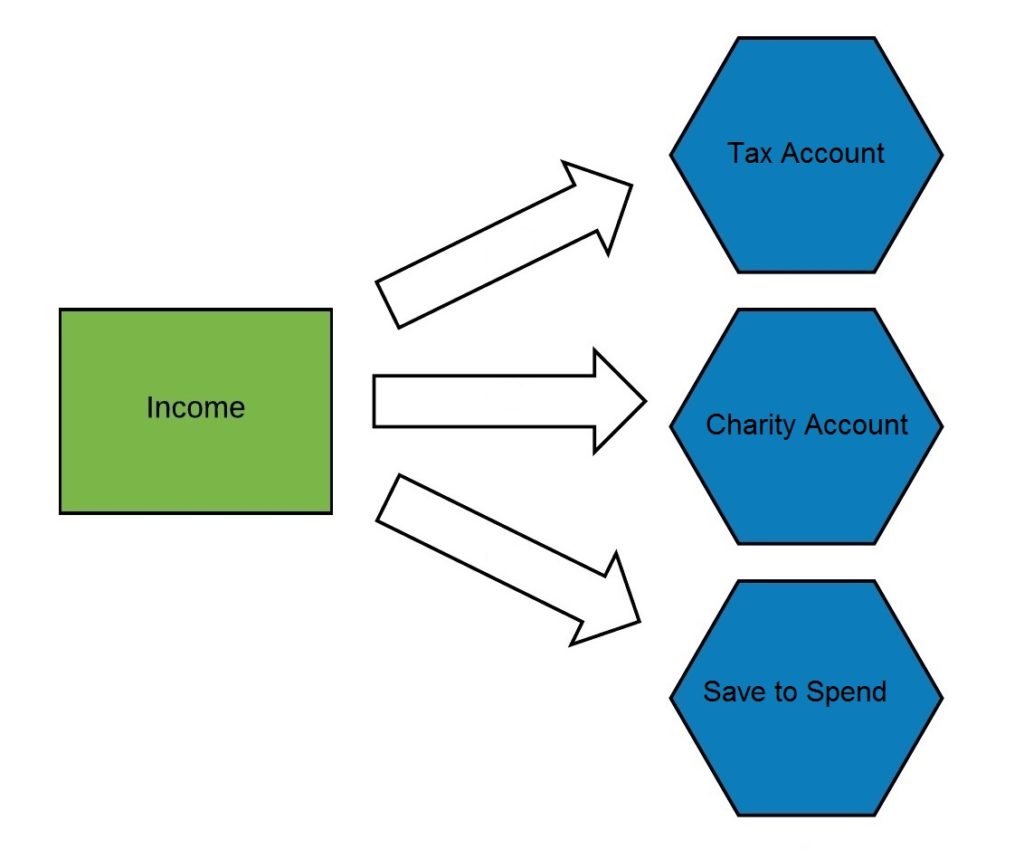

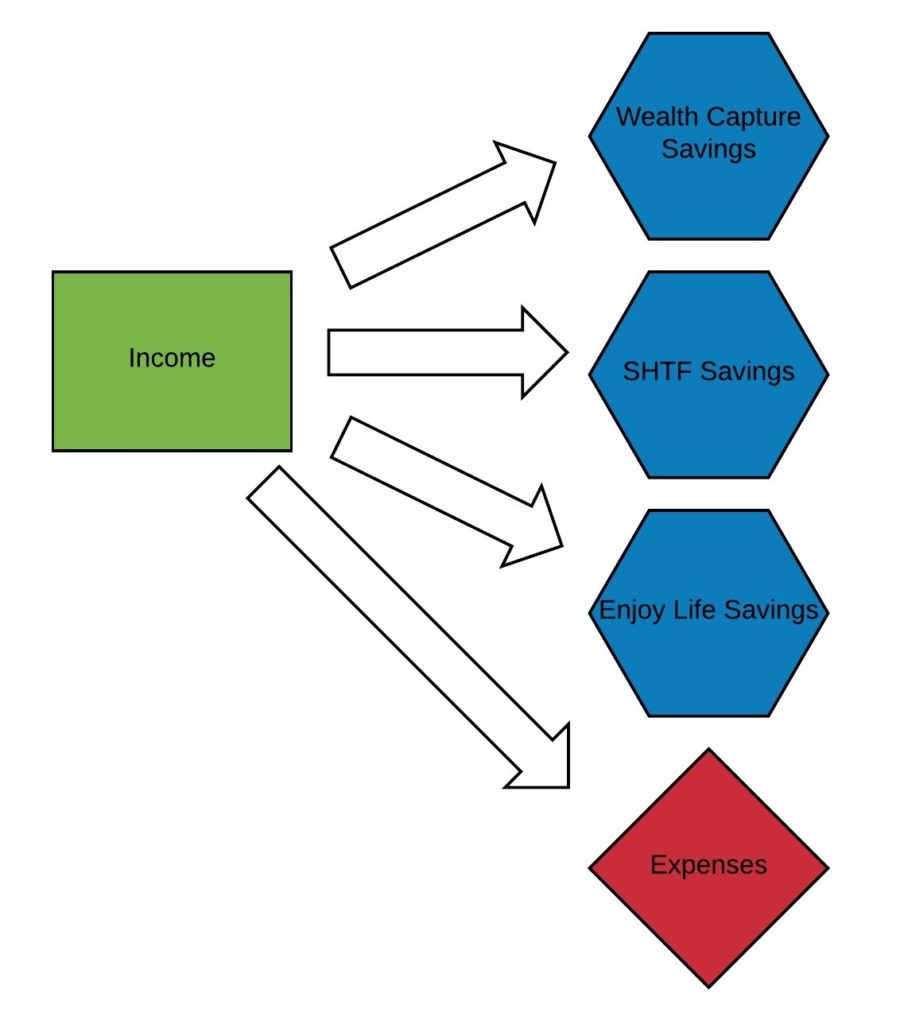

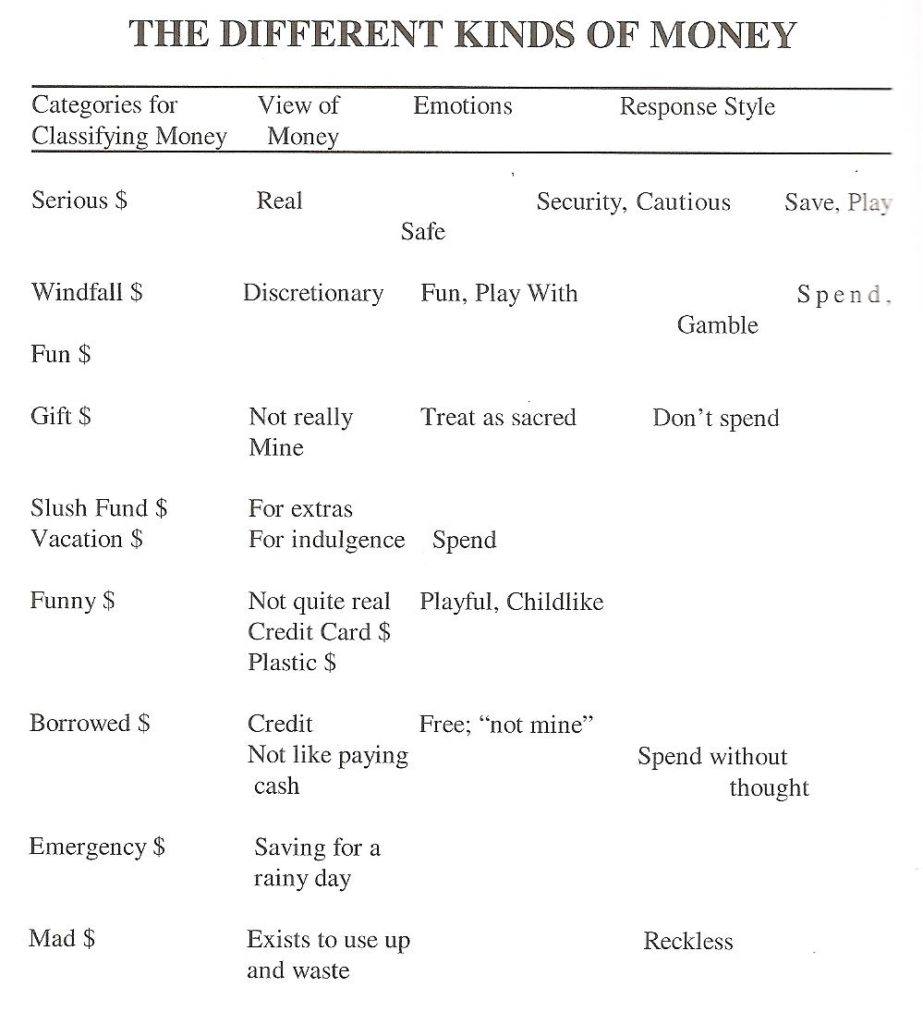

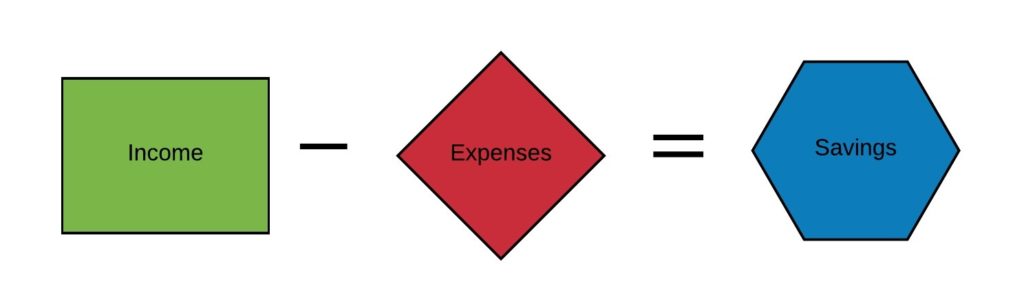

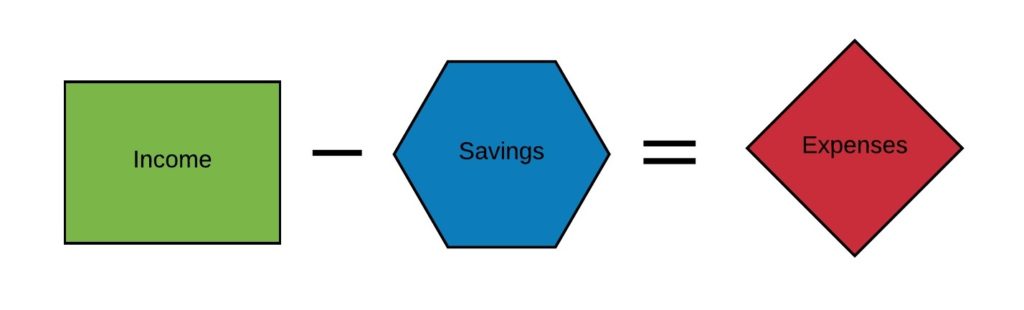

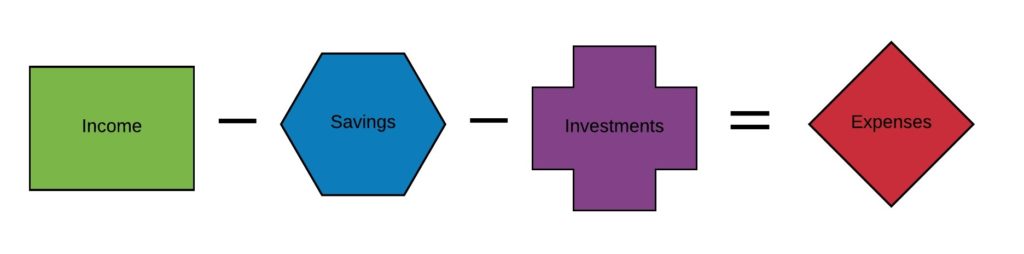

And so it is to be with your money. The Wealth Generation Plan is your plan of action to cover each of the four areas of money: income, savings, expenses, and investments. It covers goals, action items, savings percentages, guidelines and more.

You can find a template for this here.

If you don’t want to use the template, then open up a word processor document and title it Wealth

Generation Plan. Under that write Last Updated: Today’s Date.

Creating a vision of your wealth is an important step. This topic will be covered in detail in an upcoming course, using what I call The Fractal Time Binding System (working title). For now, as you are writing your wealth plan, envision where you’ll be one year from now regarding wealth and money. Write out a paragraph or so that describes what you do with your money and how you feel about it.

For example, here was my vision for 2017:

My wealth has accelerated with ease. I continue to work and tweak my plan and with it in action. I generate more money and expend about the same (though more to charity). Mostly, I save lots and grow my investments, and so the cycle repeats. My skills in each of these areas has grown as the figures grow bigger too. I run my businesses with better accounting and both the business and personal books show it. Funds shifted in order to put a down payment on a house, yet the numbers caught up and exceeded those.

I do this exercise around the end of the year, in December, to get ready for the upcoming year. It’s far from a New Year Resolution, but instead a lengthy and far more effective process. Still, you can do it at any time. If you do engage in something like that around the New Year and right now it’s June, go ahead and create your vision and goals for the rest of the year.

Now that we have a vision, what are your goals? Would you like to have a certain net worth? Get out of debt? Save a certain percentage of your income? Make a certain amount passively off of investments? While these and similar questions may be covered in the vision, I see a goal as something more specific that you can say is achieved or not achieved. (There is also a net worth calculating spreadsheet inside the templates.)

You’ll notice that my vision is more feeling based. Although there is talk of bigger numbers, it is devoid of any real specifics. When it comes to goals they must be specific. Without giving you specific numbers, here were my main financial goals in 2017:

- Buy a House

- $XXXXXX Net Worth

- Personal Income baseline of $YYYYY/month

- Regularly save 50% of income

- Make $ZZZZ off of passive investments

(Note: I tend to be aggressive in my goal setting. I realize I do this, and often fall short, but it keeps me moving in the right direction. At the time of writing this (in December of 2017) I have hit two of these goals.)

While it can be fun to imagine having a million dollars cash a year from now, if you’re under a pile of debt now, making minimum wage, please be a bit more realistic with your expectations. You want your vision and your goals to be motivating and drive action, not demotivating, fanciful dreams.

Write down three to six goals having to do with money. You might think about each of the four categories. What is your goal for your income? What is your goal for your expenses? What is your goal for your savings? What is your goal for your investing?

The vision and the main goals is the first page of your Wealth Generation Plan. At a quick glance, you can see everything. Then, on the following pages, we go into more detail about each of the four areas of money. Each one of these is then contained on one page.

For more The Money System That Never Fails is now available in paperback and Kindle at Amazon.

If you missed the first chapters you can view them here: