We continue in The Money System That Never Fails with the Optional Accounts that can be used in addition to the Essential Accounts.

If you missed the first chapters you can view them here:

- Introduction

- Money Offense and Money Defense

- Most Important Part of the Money System

- Mental Accounting and Different Perceptions of Money

- Essential Accounts

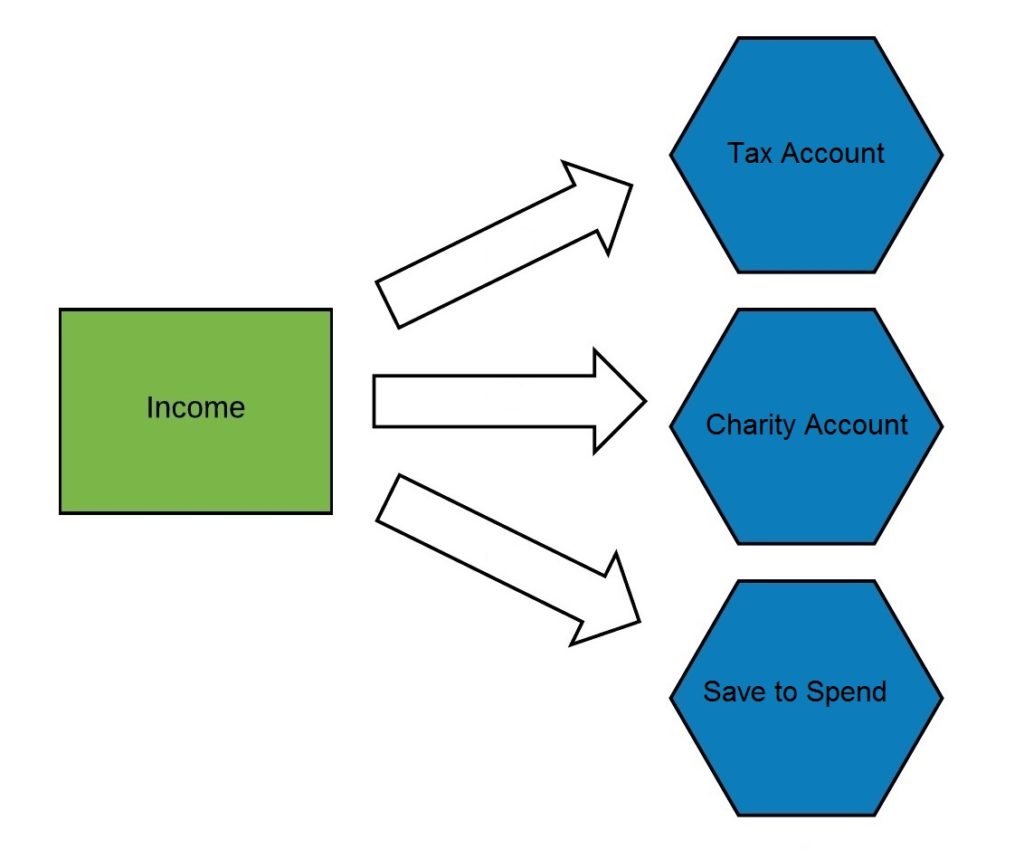

The preceding four accounts are the basics. If you do nothing else, get these accounts up and running. However, there are some additional accounts that you may want to use for a variety of reasons. Here are just a few ideas, though this list is by no means exhaustive.

Once again, if you have these accounts, it is important to make them physically different accounts at your bank (or banks).

Save to Spend

Got something specific you want? Make a savings account just for that purpose. This can be for anything, like for educational expenses, a car, a wedding, starting a business, that big dream you’ve always wanted or anything else you desire. Instead of taking a loan, why not save enough to buy in cash? You can have as many different accounts for different purposes as you’d like.

[Advanced tip: This can be combined with the SHTF account. When you get past 6 months of savings, or whatever goal number you set, then you will continue to save in this account. That extra money can then be used as a savings place for bigger purchases you’d like to buy, but require saving up for. It becomes the Save to Spend account, in addition to the SHTF fund, as long as you don’t go below that baseline number you require, as outlined in your Wealth Generation Plan.]

Cash Account

In addition to the SHTF fund, it is good to have a supply of cash at your house for emergencies. One months’ worth of expenses is recommended. This can be a good thing to build up and have on hand. Of course, keep it somewhere safe, like in a safe!

Charity

Often recommended is to save 10% of your income and give away 10%. This can be tithing, or giving to any charity you see fit. How does giving away make you wealthier? Someone put it best, “The hole you give through is the same hole you receive from.” A lot of people say they’ll give when they have money. Well if you can’t give $1 today, it’s much harder to give away $100,000 then. While this giving can be done right off your income, it can also be saved then given away in chunks.

Personally, I have a recurring monthly charge to my charity of choice, so it is an expense, and I am not saving. But the choice of how you do it is up to you.

Health Savings

Health expenses come up from time to time. Even with insurance we often need to cover some of the costs. But now some insurance plans come with health savings accounts (HSA) or flexible spending account (FSA) that also provide some tax benefits. If you have one of these, it is highly recommended you fully fund it each year. At the time of writing this is $6750 for a family per year that can be contributed to an HSA.

Gambling

Do you like to gamble? Not necessarily at a casino, but with riskier investments? Why not set aside some money that you are not afraid to lose specifically for this purpose. For the person that needs some more excitement than safer, solid investments, this can be crucial. Instead, of trying to fight your nature, just make it a bit more controlled. For instance, I put some money into Bitcoin, realizing this was speculative, but wanting to do it. In my case I made about 10X, but I would have been okay if it had gone down to zero, because it was money earmarked for this sort of speculative gambling.

Taxes

If you’re being paid by paycheck, the government is already taking money off the top. Why do they do this? Because they know, with many people, it would be the only way they’d receive it rather than collecting it after the year is up, since most people don’t save. If you need to save for taxes, I’ll address the topic more in the business section (because having a business, or at least investments, is where you’d need to do this on top of your paycheck).

The Money System That Never Fails is now available in paperback and Kindle at Amazon.