We continue in The Money System That Never Fails with the Essential Accounts required.

If you missed the first few of parts you can view them here:

- Introduction

- Money Offense and Money Defense

- Most Important Part of the Money System

- Mental Accounting and Different Perceptions of Money

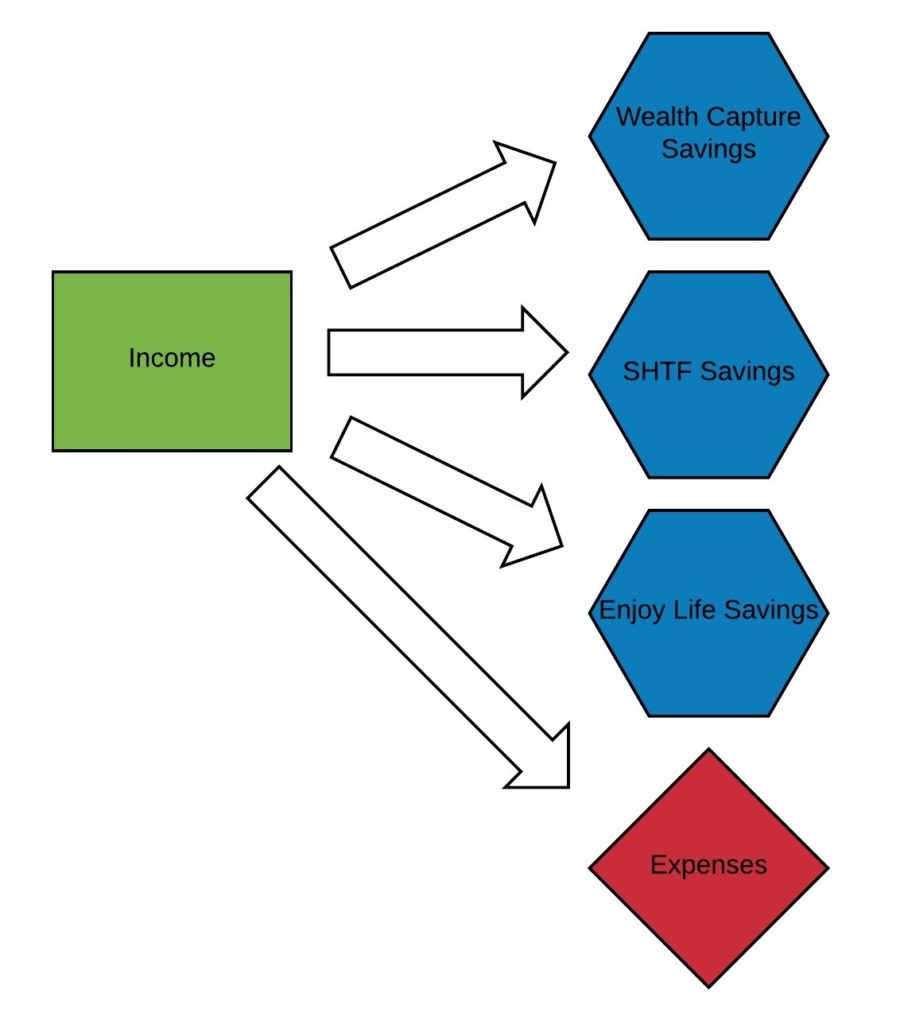

Income/Expense Account

You probably already have this. Most checking accounts would fit this definition. This is where your income comes into in the first place. It is where expenses go out of. If you’re like most people, you probably put most expenses on a credit card, which is fine as long as you use them responsibly. But this is the account from which you pay that credit card bill.

You only need one expense account personally. However, you may have more than one. For instance, a Paypal account, could be an additional expense account to your checking account.

Wealth Capture Account

If you have one and only one savings account this would be it. I got the name “Wealth Capture” from Garrett Gunderson. I’ll talk more about what I learned from him and his team in a bit. I like the name because this is where you literally are capturing your wealth.

Wealth is defined as “an abundance of valuable possessions or money”. Here you capture some of all that money that passes through your hands. You capture it for good.

Another quote from The Richest Man in Babylon: “Wealth, like a tree, grows from a tiny seed. The first copper you save is the seed from which your tree of wealth shall grow. The sooner you plant that seed the sooner shall the tree grow. And the more faithfully you nourish and water that tree with consistent savings, the sooner may you bask in contentment beneath its shade.”

Another name I’ve heard used is “Freedom Fund”. This is because, ultimately, this account helps buy your freedom from having to work.

You pay yourself first into this account. In the beginning, you just keep it here. Eventually, you begin to invest it…but only in safe ways. The point is that you’ve captured it, and you don’t want to lose any of it. You do things that keep the money, but put it to work to grow it further. Over time it will grow via interest and your continual adding to it.

I would advise, that even if you have a retirement account, such as a 401K, you want to have this account in addition. Why? Because chances are you aren’t in control of the 401K, the market is. (Not to mention many of them are riddled with hidden fees that will kill your growth.) I saw my mom’s 401K turn to half of what is was in 2008, right at the time when she was getting ready to retire. Your wealth capture account can be used for retirement, in addition to a 401K or other retirement savings if you have them.

But in your earning years, this is the savings that you DO NOT TOUCH. Not for something you want to buy. Not for some shit that hits the fan. Not for a vacation. Nothing. (That’s what the other accounts are for!)

The only place you may shift this money is into guaranteed investments. Those are few and far between. This is money you keep. It is not to be risked at all.

This can be the tough part, especially if you are in debt. So, we will cover what to do in those cases later. To reiterate the importance of this account please copy by hand the following:

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I Will Not Touch the Money Inside My Wealth Capture Account.

I WILL NOT TOUCH THE MONEY INSIDER MY WEALTH CAPTURE ACCOUNT!!!

Do you get the point? While I learned the principle of saving early on and did that, I got this part wrong. I kept touching my wealth, depleting it to zero then having to build it back up. I did this times beyond count. Please learn from my mistake.

Part of what made it so that I no longer did this wrong was by having the other accounts. Part of it was in getting out of debt and learning to manage my expenses properly. All in all, it was in having the Wealth Generation Plan in place that guided me in all of these things.

If you find that you end up touching this money there are a few things you can do. Here is a time when you may want to use an account that is hard to access. If you have to go to the bank in person this will be an added hurdle that will at least slow you down from getting access.

I’ve heard a story before of a financial planner making his client who kept touching this account, setting up a new one at a bank that wasn’t even in the state they lived in. While they could transfer money in easily, they had to show up in person in order to make a withdrawal. If you need to do something like this, then do it. It is that important.

SHTF Account

SHTF stands for “Shit Hits the Fan.” Problems arise in life (car breaks down, medical bill, etc.) This fund is aimed at keeping 3-6 months’ worth of living expenses. Some people like to have even one-year worth of expenses. This provides a financial safety cushion. Another name for it is the “Rainy Day Fund.”

When this is kept, and you have a decent balance in it, you won’t feel the need to ever tap into your Wealth Account either. That is part of why this account is essential.

It is not just for the financial effects. By having the account, your psyche benefits too. While it will suck when an unforeseen big expense comes up, with this account funded, you’ll be able to handle it without missing a stride. If you lose your job, or your business goes under, you will be able to get by. You’ll have the money needed to live while you get back on your feet.

Fun/Vacation/Enjoy Life Account

It is important to realize that money is to be enjoyed. This fund is expressly for that purpose, to use money in bigger and more enjoyable ways than your average everyday spending.

My friend Garrett Gunderson calls this the “Living Wealthy Fund”. I personally use this specifically for vacations, though you can use it elsewhere.

The point of this account is for you to get pure enjoyment out of money. Recently, I took my wife on a European vacation. This was more money than I had ever spent on a vacation, but we were able to live fully and enjoy it, not trying to get by on a budget, because it had been saved specifically for this.

Having this account is essential because I wouldn’t say you’re wealthy or successful if you act miserly with your money. If you only ever exist on a budget, and can’t enjoy life, then what is the point? By having this as an essential account, you get to enjoy your money.

The Money System That Never Fails is now available in paperback and Kindle at Amazon.