This is another chapter in The Money System That Never Fails and continues one of the most important parts of the book, your wealth generation plan. This section covers the “offensive side” of the financial equation, with income and investments.

Income

In this section, and the ones to follow you’ll want to briefly write out your strategy in regarding that area. So, we start with your Income Strategy. How is it you’ll work on growing your income? For instance, for this year mine was:

Work on growing income daily through my main and side sources. A specific focus on building my salaries and distributions through businesses.

Write down all your sources of income. There may be only one, a paycheck, and that is fine.

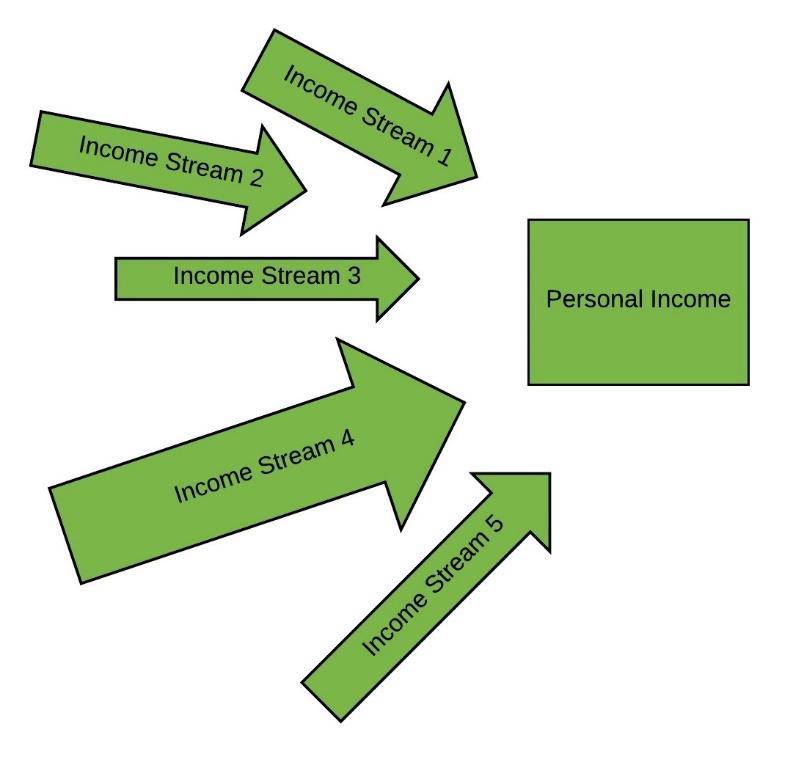

There are a couple of ways you can look at this. One of the early books about money I read was Robert Allen’s Multiple Streams of Income. This idea is that you should have lots of money coming in from different sources.

On the flip side, there can be a drawback to scattering your focus. If you have just one much larger income stream, an income river if you will, it can be better than lots of trickling streams.

Adapt the template as you see fit. Include your main personal income stream(s). Write down any side streams you may have available to you. This can include selling stuff at garage sales, on eBay, or a moonlighting job you do. (Years back whenever I needed extra cash, I would unload various info-products and other goods on eBay.)

If you’re in business for yourself, include those income streams too. The distinction between this is what puts income into the business’s pocket, versus your own. If you’re not familiar with this distinction (and I wasn’t for many years), that will be covered more later.

Next, you have the To-Do section. Are there certain next action steps you should do to increase your income? This could include asking for a raise, or setting up a side hustle. What new streams of income might you be able to add? Lots of options abound.

Lastly, here you can go into more detailed goals, specifically about your income. More me, this involved increasing my salary from each business, as well as to setup a new business income stream (as an entrepreneur, I like to set up new things).

Investments

Remember, start off with your strategy. Here is an example of mine with investments:

I invest primarily for cash flow. My primary investments are my businesses, as that is where I can see awesome returns. But what is covered below is those hands free investments and storehouses of value. Buy a house before I start focusing more on investing. For each thing, figure out my Entrance and Exit Strategies, as well as any Risk Tolerance that must be figured in.

Remember earlier where I mentioned the difference between passive and active investments? Once again, passive investments don’t generate income. They may appreciate in value (or depreciate), and can then be sold, but they’re not actually building your income.

Meanwhile, an active investment does generate income. This could be a business that pays returns,

dividend stocks, bonds, even a savings account (however small that return is). It is really the active

investing part, or as I mention investing for cash flow, that gets investments put on the offense side of the money game.

Here, you will list out both active and passive investments you have. With the active investments, you can write the rate of return they generate. Write in how much of your income is transferred into these accounts, or whether they come from specific savings accounts.

And as before, write out any action steps and goals you have in this area.

For more The Money System That Never Fails is now available in paperback and Kindle at Amazon.

If you missed the first chapters you can view them here: