The transfer to digital currency appears to be a huge part of the agenda here.

For those brand new to bitcoin, blockchains and cryptocurrencies I present a short history.

It was in the aftermath of the last financial crisis that bitcoin was created. There had been some previous attempts at cryptocurrencies (B-Money and Bit Gold) but those were never fully developed.

In 2008, an unknown person (or group) going by the name of Satoshi Nakamoto, posted a paper called Bitcoin – A Peer to Peer Electronic Cash System.

(This is me conspiracy theorizing. Satoshi Nakamoto to this day is unknown. What if it was bankers and/or intelligence agencies and/or who knows whom else that started the project in the first place? We saw that JPMorgan Chase had the foresight to hoard physical silver while shorting the paper market What if big plans were put in operation even earlier.)

In 2009 Bitcoin became publicly available. Originally it was just mined. But in 2010, someone swapped 10,000 bitcoins for two pizzas, the first financial transaction that proved it held value.

In 2011, more cryptocurrencies, also known as altcoins, were created including Namecoin and Litecoin.

Bitcoin ran into some troubles including theft as occurred at Mt. Gox, then the biggest Bitcoin exchange. But despite these problems it continued on.

In 2016, the Ethereum platform came out. This used a cryptocurrency named Ether to facilitate blockchain-based smart contracts. Here was the first ICO or initial coin offering, which then took Silicon Valley by storm. People in fintech, even banks, started to get much more interested.

A big stumbling block in people understanding all this is the difference between cryptocurrencies and blockchains. Think of cryptocurrencies as an asset such as silver, gold, oil or the US dollar. Meanwhile, a blockchain is just a distributed high-tech version of a ledger, as in how you would do bookkeeping. Blocks are the data that is verified and chained together. So blockchains are needed to keep track of cryptocurrency transactions. In addition, there are many uses for blockchain beyond just cryptocurrencies.

Starting in 2017 up until the beginning of 2018 the biggest Bitcoin bubble occurred. This actually beat out the crazy Dutch tulip bubble as Bitcoin shot up to almost $20,000 per coin (making those earlier pizzas worth $100 million each!). It crashed since then but has been worth mostly around $5000 to $10000 for the past two years.

I first started paying attention to Bitcoin in 2015 because I heard lots of different people talking about it and found it intriguing. I bought some around $300 per bitcoin. It was money I could afford to lose but something I was willing to place a small bet on. I did find it was funny when I told people about it to which some would say in disbelief but it’s not worth anything. I would counter how is that different from our current fiat monetary system?

Unfortunately, I had to sell all of my Bitcoin at around $3000 for a down payment on a house. I really can’t complain about a 10X gain, but I wish I could have held on to it longer!

Since then I have bought some Bitcoin (BTC) again, as well as Ether (ETH), Ripple (XRP), and recently, Digibyte (DGB). I am currently long in these positions. Please note that this is not investment advice and I would not consider myself an expert in any of this stuff. I’m simply personally sharing what I’m doing and why. Do your own research.

There still is some potential for these things to become worthless. However, Bitcoin and some of the other cryptocurrencies have now survived several crashes without disappearing. That means they’re likely to stay valuable.

Personally, I don’t think that Bitcoin will be the crypto that is used for everyday transactions. There’s some hurdles in how it is built and transaction costs that prevent that from ever happening. But, like a digital version of gold, it will likely stand as a store of value. (At least, as long as power and the internet still work. It also shouldn’t be going down to zero because if that happened people wouldn’t trust digital money at all.)

In an earlier post, I shared how I invested in silver based on information showing that the banks were doing the same (while simultaneously manipulating the price). That’s a clue. Banks have also been getting interested in cryptocurrencies. This is another clue.

Besides my businesses, these “old money” and “new money” plays are where I’ve invested. So let’s dive in to why this is important now.

Remember that two days ago, I mentioned that China was working on a digital yuan. Based on that there was discussion at the World Economic Forum in Davos in January of this year of the digital dollar.

“China’s progress with its digital yuan has sparked similar conversations in different countries. People are quite concerned that China will pioneer national currencies. Some have even suggested that if the U.S. does not begin to act and ultimately catch up, China could displace the U.S…According to former Commodity Futures Trading Commission (CFTC) chairman Christopher Giancarlo, digital currencies present more utility than traditional fiats…Giancarlo is however not suggesting that the traditional methods available now should be disregarded. He believes what the U.S. needs is “a digital form that would be minted by the central bank.” The digital dollar would also use the current traditional banking system…Using a central bank digital currency (CBDC) will offer a lot more efficiency and speed than is currently available with traditional methods. Cross-border transactions will also enjoy better efficiency.” https://www.coinspeaker.com/davos-wef-digital-dollar-yuan/

The digital dollar almost made it into the $2 Trillion CARES Act. Important to note that while this was in an earlier draft it didn’t make it into the final passed form. (Maybe in the next bailout they’re already working on?)

“The bill establishes a digital dollar, which it defines as ‘a balance expressed as a dollar value consisting of digital ledger entries that are recorded as liabilities in the accounts of any Federal Reserve Bank or … an electronic unit of value, redeemable by an eligible financial institution (as determined by the Board of Governors of the Federal Reserve System).’ Additionally, a digital dollar wallet is identified as ‘a digital wallet or account, maintained by a Federal reserve bank on behalf of any person, that represents holdings in an electronic device or service that is used to store digital dollars that may be tied to a digital or physical identity.’ A mandate also requires all ‘member banks’ establish a ‘pass-through digital dollar wallet’ to all customers eligible for the stimulus. Member banks include those banks that are ‘members’ of the Federal Reserve and regulated by the Fed.” https://www.forbes.com/sites/jasonbrett/2020/03/23/new-coronavirus-stimulus-bill-introduces-digital-dollar-and-digital-dollar-wallets/#30c001204bea

The promise of blockchain and cryptocurrencies for many was that they were destined to replace government-controlled and centralized money with a distributed and decentralized alternative.

That is one possibility. But do you think the governments and bankers want that? Not in the least. Central Bank Digital Currency (CBDC) is the key phrase to look at.

It’s not just the Fed that is looking at this. Here’s the Bank of England’s take. “CBDC could present a number of opportunities for the way that the Bank of England achieves its objectives of maintaining monetary and financial stability.” https://www.bankofengland.co.uk/paper/2020/central-bank-digital-currency-opportunities-challenges-and-design-discussion-paper

(Did you catch the April Fool’s joke…because Central Banks are so great at maintaining financial stability. Ha!)

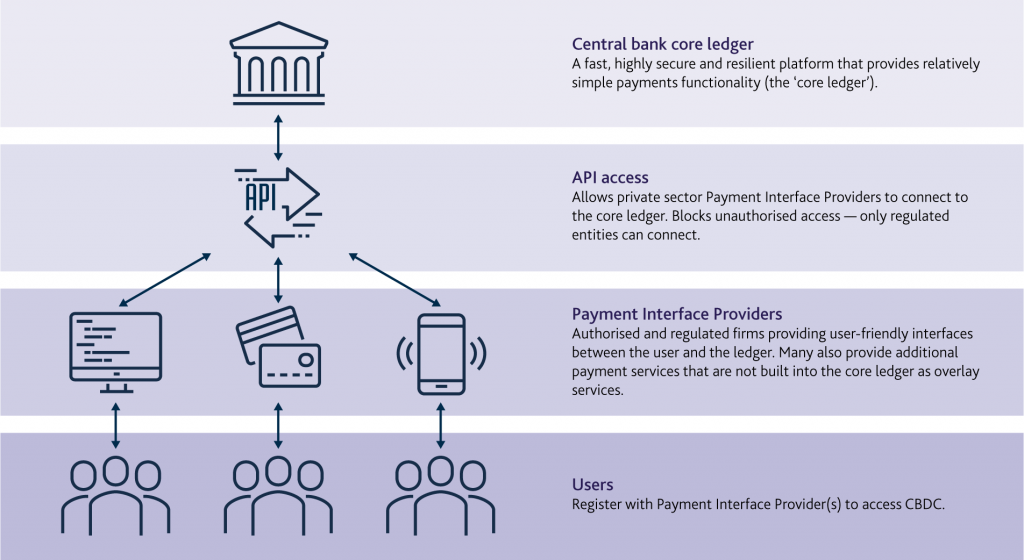

Notice with this graphic how the bankers control the core ledger. It’s a key difference between decentralized cryptocurrencies such as Bitcoin, and the CBDC’s.

“Any CBDC would be introduced alongside – rather than replacing – cash and bank deposits…A CBDC would not be a cryptoasset or cryptocurrency, nor necessarily based on the technology that powers them (Distributed Ledger Technology).”

“We do not presume any CBDC must be built using Distributed Ledger Technology (DLT), and there is no inherent reason it could not be built using more conventional centralised technology…Distribution and decentralisation may enhance resilience and availability, but could have a negative impact on aspects such as performance, privacy and security.”

Privacy of how their money works is necessary to keep control. CBDC’s may be the transition step to 100% digital currencies. I’m not sure how it will play out but movement in this direction is moving forward. The majority of monetary transactions are already digital. How would a digital dollar then play out with a hyperinflating dollar? It’s an interesting question, that I do not know the answer to.

Here’s a few more points that show this is coming…

Understand that businesses and people are already ceasing to accept cash because of fear of the coronavirus. “A growing number of businesses and individuals worldwide have stopped using banknotes in fear that physical currency, handled by tens of thousands of people over their useful life, could be a vector for the spreading coronavirus. Public officials and health experts have said that the risk of transferring the virus person-to-person through the use of banknotes is small. But that has not stopped businesses from refusing to accept currency and some countries from urging their citizens to stop using banknotes altogether.” https://apnews.com/167186097f44116220b757abebb49be3

This article, titled, ‘After Coronavirus ‘War,’ Bretton Woods-Style Shakeup Could Dethrone the Dollar’ is quite interesting. If you’re not familiar with it, Bretton Woods in 1944 as WWII was ending, “set the template for the current system and entrenched the dollar’s near-century-long reign as the world’s dominant currency.” https://finance.yahoo.com/news/coronavirus-war-bretton-woods-style-130000284.html

“So with officials starting to envision what it might take to rebuild damaged economies and restore society to a semblance of normal, speculation is mounting that seismic shifts might be in the offing for the global monetary system — a phenomenon that historically has occurred in the wake of world wars… Even before the coronavirus hit, questions were percolating among some economists and monetary officials over whether the dollar-based system could last through the 2020s…One concern is that monetary policy in the U.S. – actions by the Fed to maximize domestic employment and keep prices stable – reverberates through countries all over the globe…Bank of England President Mark Carney floated the idea of a “synthetic hegemonic currency,” possibly based on new digital-asset technologies, to reduce the dollar’s “domineering influence” on global trade.”

US Treasury Secretary Steven Mnuchin Appoints Coinbase Chief Legal Officer to Oversee Banking System. “Brooks’ appointment to oversee the country’s banking system may signal a changing tide at the US Treasury given Mnuchin’s anti-crypto rhetoric and remarks made last year that he sees no need for the US to launch a digital currency. Brooks is an outspoken proponent of making the United States a leader in digital currencies specifically by launching a US digital dollar.” https://dailyhodl.com/2020/03/16/us-treasury-secretary-steven-mnuchin-appoints-coinbase-chief-legal-officer-to-oversee-banking-system/

In Italy, you can buy Bitcoin from a bank. The country’s mobile bank Hype has announced a partnership with fintech startup Conio, enabling customers to buy, sell, and securely store BTC from within their banking app.” https://news.bitcoin.com/1-2-million-italians-can-now-buy-bitcoin-from-their-bank/

Seeing the writing on the wall, people are getting more interested in cryptos. “Exchange data and statistics from Google Trends, Twitter, and Baidu show that despite the recent price drop people are looking to buy bitcoin. During the week of the crypto market massacre that started on March 12, Coinbase broke traffic records and witnessed considerable trade volumes. Similarly, the trading platform Kraken saw an 83% increase in account signups during the market calamity as well.” https://news.bitcoin.com/searches-buy-bitcoin-skyrocket-signups-increase/

While silver and gold price, in their physical form, have gone up high, cryptocurrencies are still knocked down from their highs. Again, this is not investment advice. But the writing is on the wall here. Do with it as you will.

I’ll be talking more about this subject in the future, especially as more steps are made, but wanted to give a broad overview.