Remember that people dismissed the internet as a fad. How are they feeling right now?

Sure, there was spectacular flashes and crashes along the way. The dotcom bubble being an early such example. But did that kill the internet?

Look at where we are at today. Everyone holds the internet in their hand or pocket with them wherever they go. To not be connected at an instant is the anomaly.

This is where cryptocurrencies, blockchains and smart contracts are going.

If you’re looking to stretch this analogy further, we are likely in the post dotcom bubble era with crypto.

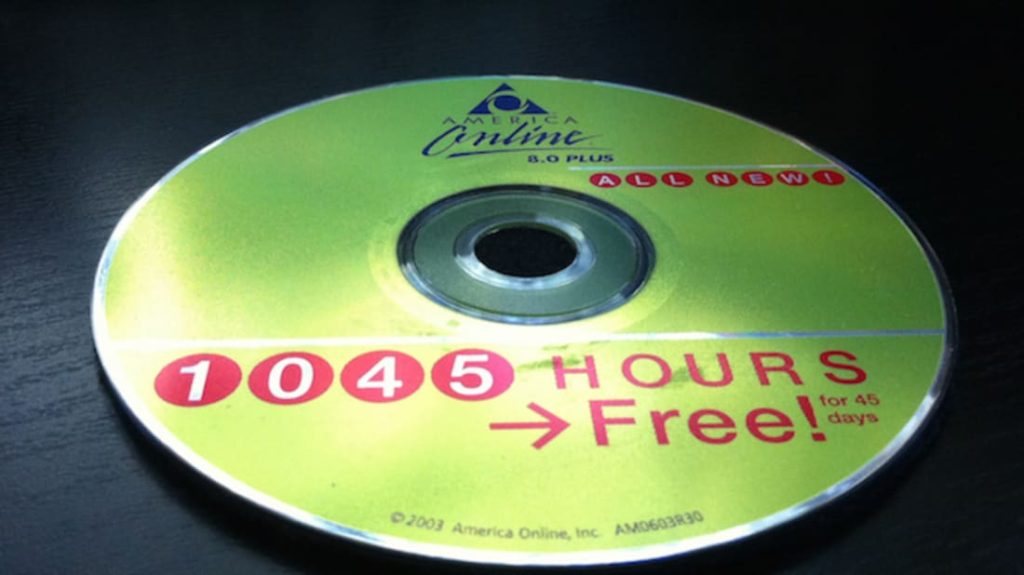

The internet is established but most people still aren’t using it. This is the time of the mass mailing of AOL discs!

We’re in the spot where many people were still hesitant to buy things or bank online.

We’re in the spot where entrepreneurs were flocking to the zone. (I launched my first ecommerce website selling goods a whopping 14 years ago now back in 2007.)

We’re in the spot before social media became pervasive.

We’re in the spot before smart phones made the internet ubiquitous.

NOW is the time to get in. Because this may well be even bigger than the internet. That might be hard to believe, but it is the entire global economy in transition.

Just because it might be hard to wrap your head around how such things work, doesn’t mean that its not worth paying attention to.

You may not know the engineering details of how electricity gets generated and everything involved in delivering it to your house but that doesn’t stop you from flipping the light switch, does it?

There are other factors at play that make this even more pressing.

Our Economy is Crumbling

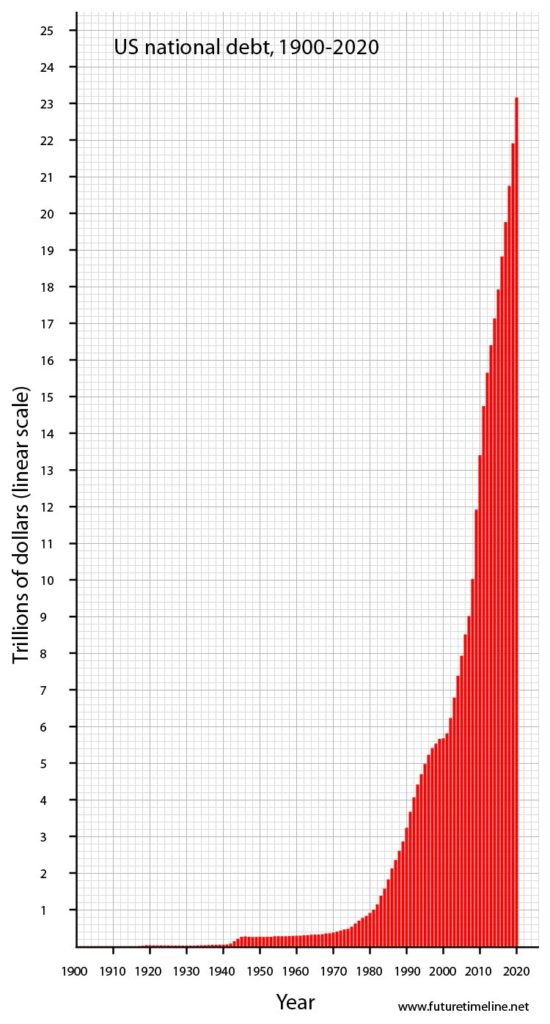

Here’s the US National debt over 120 years…

Exponential growth and hockey sticks are not sustainable.

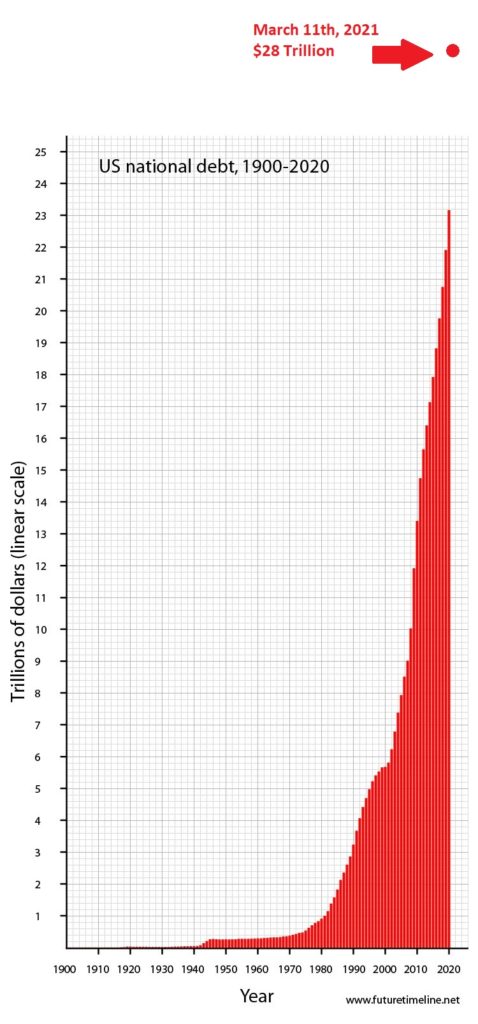

This image, made at the end of 2020, is already outdated and inaccurate. The chart must be extended to shift into less than 2 ½ months of 2021.

Oh yeah, and this doesn’t even include the $1.9 Trillion stimulus bill just passed.

They project $40 trillion by 2031…which means we’ll probably be there by about 2026 or 2025 if not sooner.

Do you understand what this means yet?

They will continue printing money in ever bigger amounts. Eventually people will lose confidence in the US dollar. Modern Monetary Theory says there is no consequence for printing all the money you want. (How did that work out for every other country that has done that?)

Russia and China are already divesting USD. They have been slowly doing so for years.

I don’t know when the proverbial SHTF.

As of right now the USD is still the global reserve currency. Being tied to oil (they don’t call it the petrodollar for nothing), backed by the US army, it still has legs.

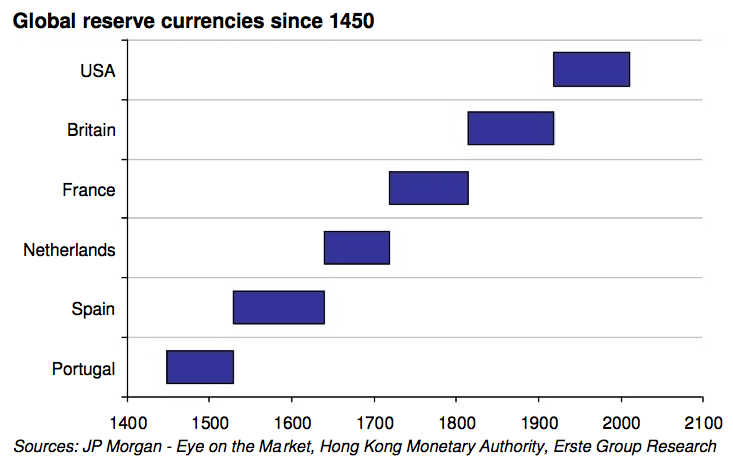

Reserve currencies don’t last forever. In fact, they tend to last about 70 years. The US dollar is getting long in the tooth.

This won’t happen tomorrow. But the transition will happen in time.

And when it happens, it may happen FAST.

When that does happen, everything will be disrupted even bigger than what happened with the pandemic.

First bit of advice, do not get caught with your pants down!

Be prepared and ready for this. Even better, be in a position where this works for you.

Are You Winning or Losing from Inflation?

Crazy inflation is already happening…but most people don’t see it, because they don’t understand the bigger picture.

(So many still think the virus is about this virus! The economic magicians wonderful use of misdirection hides their schemes.)

At some point, very likely in the near future, the prices at the store, at the gas pump, and elsewhere will start to rise. In some places they already have.

This will snowball…

Perception is fact in this day and age, sadly. That’s why the news can print or say something the is literally the opposite of the truth and besides a few people screaming about the insanity, nothing happens.

We’re dealing with fake money after all. That is what fiat means.

(I laugh at people who balked at crypto saying it’s just made up. Yes it is…and that comment shows how little they understand our economy and current fiat currency. If you haven’t got that memo, it’s all made up. It is all based on perceived value.)

Most of what is happening right now is known as asset inflation.

Have you noticed real estate prices lately? The stock market? Physical precious metals? And certainly cryptocurrencies?

In other words, right now, people perceive certain cryptographic code on a computer called a Bitcoin as worthy of lots and lots of dollars.

90% of the attention goes on Bitcoin. But honestly, I’m more excited about several other tokens.

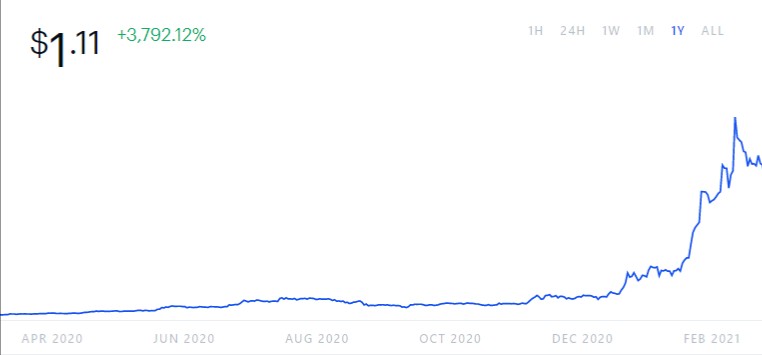

Here is one of many I got invested in. Some hockey stick charts suck (US debt). Some hockey stick charts rule (anything I’m invested in).

What is the Dollar’s Replacement?

If the dollar is going away, something must come to replace it. What is coming?

The answer should be obvious by now. Cryptocurrencies, in one shape or another. This much is certain.

Based on limitations, it won’t be Bitcoin. Who knows? It might be the Digital Yuan.

There are still hurdles to overcome and details to get ironed out, but we know the shift is here because the technology involved make certain things possible that are not in any other way.

Besides most of our money is already digital.

The “signal” that cash was to be phased out because of the virus, and the supposed coin shortage, should be loud and clear.

Money is flooding into things of value. Some certainly more tangible and more productive than others.

Yet, many think these bits are not productive. That’s not quite correct. There is technology backing them. Productive technology and ideas. Therefore, money will continue to move from the “old system” into the “new system.”

Being faddish, absolutely this will outstrip what is rationally moving in.

But if you haven’t figured it out there is little rationality in the 20’s.

Bitcoin has popped as a bubble three times now. And it’s still around. It is bubbling again and will pop again. But it is not going away.

We had the real estate bubble in 2008. Did real estate go away after that? Not at all.

So my question to you is this…

Would you rather own some of that asset inflation, or have it in areas that are deflating?

Paypal is in. Tesla’s in. Hedgefunds are moving in. The banks are using the technology and starting to allow customers to hold Bitcoin.

It…is…happening…before…our…eyes.

Why wait for them to be forced on you (likely in the form of CBDC’s, central bank digital currencies explained here) when the trap is fully laid?

I’ll get back to that but let’s talk more financial matters…

Social Security is Bankrupt Guaranteed

Social security will be bankrupt somewhere between 2023 and 2035. The 2035 projection was before the pandemic, but this rapidly accelerated that time line.

This is just one example of many.

The only way the US government can afford to pay it’s many, many liabilities, is to print more money. This means that if you’re relying on those government services, you’re becoming poorer and poorer.

Bitcoin at $100,000 is not because bitcoin is worth necessarily worth $100,000. A large chunk of that is because US dollars are losing value.

So many of us, especially within the USA, are soft. Life has been easy. Comfortable. We don’t know what true hardship is.

…And that makes so many blind to the trajectories we’re on leading us there.

It is tough to learn lessons you don’t have first hand experience with.

You’ve been reading my conspiratorial blog posts here, so you understand some of what is going on. And on that note, the thing I get asked more and more is what do we do about all the craziness?

What Can We Do?

To be honest, these forces are far more powerful and with far deeper pockets than you and I.

Sure, collectively together we are more powerful. But we are NOT acting collectively together. Not by a long shot!

Divide and conquer has worked so well. Why change the playbook when the same play works over and over?

Yes, the sheep could turn on their owners. But it’s not in the nature of sheep to do so.

How many people that swore off of politics, knowing it’s a shitshow, have gotten wrapped up into the right vs. left fight once again because the soap opera theatrics have been cranked up to 11?

I’ll admit it. It drew me in as I tried to make sense of the craziness.

Sure, one side is fighting for more freedom, but in most cases only just enough to make a good show of it. You gotta have your faces and heels. (That’s pro wrestling terms for the good guys and bad guys.)

So what can we do?

You can take care of yourself and yours. I don’t mean this in a selfish manner.

Instead, I mean that the only chance we have to do anything is to accumulate resources which can then be aimed towards greater collective action.

You can increase your optionality. You can figure out your Plan B, C, D and E.

Money is one part of that. Community and other usable skills is another.

Some of the best people I see trying to support collective action…have FU money.

FU money is defined as “any amount of money allowing infinite perpetuation of wealth necessary to maintain a desired lifestyle without needing employment or assistance from anyone.”

Do you?

It certainly makes it easier if you don’t have the regular 9-5, much less two or three jobs.

I don’t see any way around this.

As the saying goes… “The best thing you can do for the poor is not be one of them.”

Granted, that’s just a starting point. Money by no means makes you a good person.

But if we wanted to fight Bill Gates‘ plans…it sure would be much easier if we had Bill Gates’ resources without his techno-morality!

The Opportunity Before the Fall

Crushing you and your free thinking is necessary for the agendas at play.

We are economic men and women, and therefore control of the money is paramount. Always has been. Always will be, as long as money exists in one form or another.

While the totalitarian control grid will seek to wrap money into your digital ID, vaccination passports and more, that is still far off. Years down the road.

Understand that that cannot happen until widespread digital money is used. And we’re still a far cry from that.

(Although the vaccine pass apps are starting up already, Israel taking the lead. There are many steps that are happening quite quickly.)

So there is great opportunity now…even if crypto makes up part of our ultimate prison. You can get in and get out if that becomes necessary.

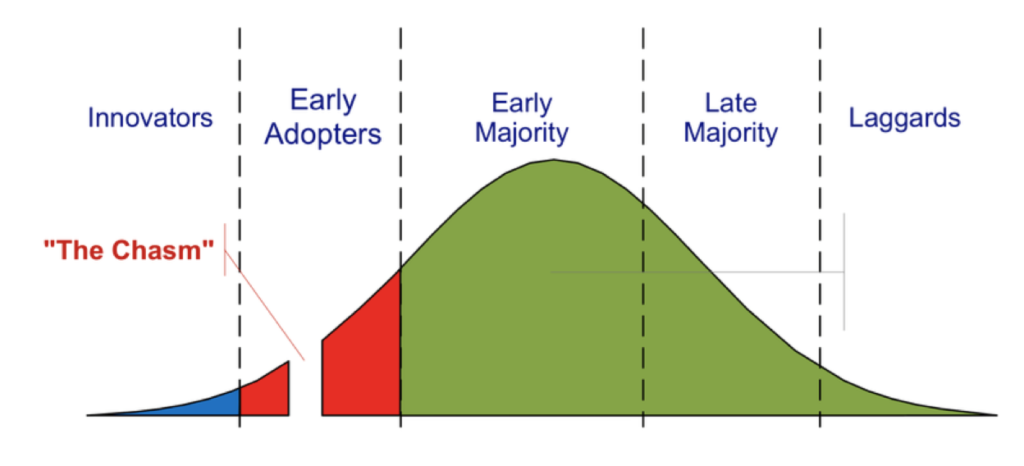

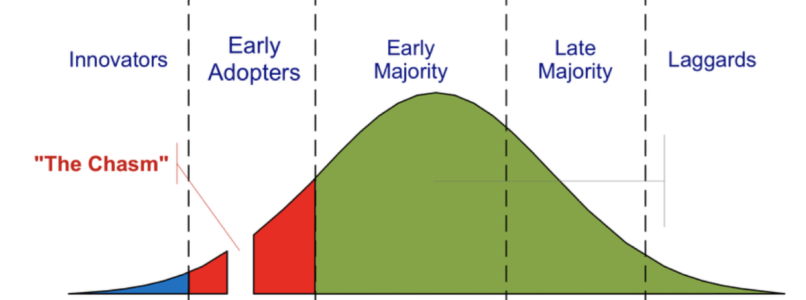

You may be reading this thinking you’re missing out, sitting on the sidelines, but the truth is we haven’t even crossed the chasm of the early adopters yet. We’re a far cry from the early majority.

In other words, there is still time to get in early and profit from doing so. But I don’t think that chasm is very far off now.

The good news is that cryptocurrencies could also be used to free us from the central banks and their government, media, etc. cronies. That’s what decentralized, as in decentralized finance or DeFi, is all about.

Some cryptos are by their very design aimed at getting around such totalitarian systems too.

Thinking of optionality wouldn’t that be great to be setup and proficient in ahead of time?

The elites won’t go down so easily. In fact, I would argue they’re behind many of the most popular cryptocurrencies, a topic I plan to explore in future articles too.

And scams and schemes certainly abound in the area. It is the new wild west. I’m not saying to throw caution to the wind. But I’m also not saying to be complacent.

Crypto is happening. The dollar hegemony is falling. These forces will not be stopped.

A One World Currency?

There will not be a global currency. Not for quite some time at least. There are tons and tons of currencies and will be for some time.

Eventually there will be a few winners and lots of losers. But we’re still far from any sort of consolidation. We’re in expansion mode. (This too, means there are tons of failures, but also plenty of winners.)

You have two choices in front of you:

Accept what is coming. For good or ill, digital currency is the future.

Or bury your head in the sand.

Look, you don’t need to be super technical. I can’t write nor read a line of code to save my life. If you use online banking services and apps on your phone, you have the skills necessary to get involved in investing in crypto.

Sure, it can get complicated fast, but it doesn’t have to be super difficult.

All the luddites didn’t stop the internet. And now my almost 70 year old dad who never used a computer in his life…uses his smart phone regularly. The naysayers won’t stop it.

My argument is that it is worthwhile to hop aboard this train we’re all on. It is worth doing so.

I’m going to be doing more articles in the coming weeks…

Crash Course Beta Program!

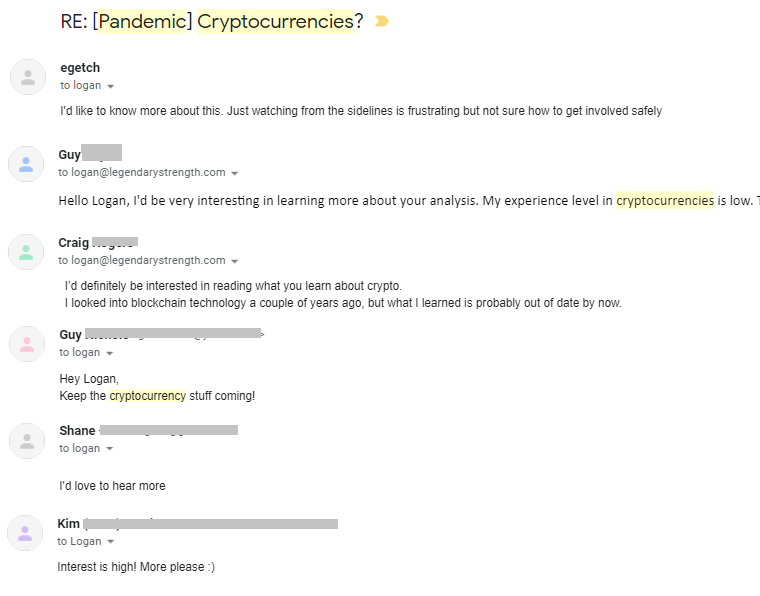

But after I sent out an email the other week asking people’s interest in the topic I was flooded with response. I expected a positive response, but it was huge. Here’s just a small sampling:

The vast majority of people knew nothing and held nothing. That got me thinking.

After careful reflection I’m trying out something new, a beta program to walk a few select people by the hand into this world giving everything I know.

I won’t be doing this for free. And it assumes you have some funds to invest as well. As the plan is to work one-on-one with a few select people, it is limited. (After all I’ve still got my two businesses and family to attend to.)

If that interests you reply in the comments below or shoot me an email at logan@legendarystrength.com with your interest.

I will be putting up free articles soon on the topic as well, but this program is for people that want to get up and running, with a solid strategy in place, as quickly as possible.

Disclaimer: This is not to be used as financial advice. Logan Christopher and Legendary Strength LLC are not registered investment, legal or tax advisors nor a broker/dealer. All investment opinions expressed are from personal research and experience. Email and website content is to be used for informational purposes only. Logan Christopher is personally invested (long) in a number of cryptocurrencies.

Just a note: There is no customer service with bitcoin. a cut and paste gone bad or denial the funds were received and the money is lost. If you complain Bitcoin will lock the account. They will then request a checklist of verifications of your identity which seemed a little bit too much to access the account. Try to figure out the reason before you complain because the account will be locked and there is not a second chance look. That was a couple of years ago with the stock at $5000 so what little money I had remaining in the account could be worth 12X the amount. Of course this could be a gold thing where you just buy the stock and let it sit there hoping the price goes up instead of down.

Absolutely true. This is one of the reasons you gotta be careful in working this area.

I’m interestd.

Thank you. I’ve just sent an email.

Hi Logan,

Thanks for the great info. We see eye to eye on many subjects and crypto is one of them. I am already invested in crypto, have done my studying and research. Having said that, I respect your view and research ability too much to casually pass by your offer. Please give more details.

Thanks in advance.

Nick

Thank you. I’ve just sent an email.

Thanks much Logan for the opportunity, if this requires for the participants to give private information over the internet or by mail, then I think it’s best someone else take my slot 🙂

Most of it does, yes. I am digging deeper on how to keep it completely private though and will likely have updates on that topic later.

Logan I am definitely interested!!

Thank you. I’ve just sent an email.

Interested. Please send additional details.

Thank you. I’ve just sent an email.

Yes, Id like to get in.

Think of me as your almost 70 father’s classmate with a MacBook.

Thank you. I’ve just sent an email.

Hi Logan

Thanks for this interesting article, i would definitely be interezted…best wishes, Mark

Thank you. I’ve just sent an email.

Dear Logan:

That was quite an insightful, informative and timely article on cryptocurrencies and their application for the future.

I feel that blockchain technologies are definitely the future of money going forward, however, not privately. Central Banks of Sovereign Nations do not want nor will they stand for privatized crypto currencies because they do not want any competition to their fiat paper currencies. In fact, they, meaning primarily the US Government, have suppressed the price of Real Money, i.e. Gold and Silver for nearly 8 decades as these criminal politicians and government A$$holes have managed to dissuade the populace from owning Gold and Silver as it subjugates their fiat currencies. In fact, the manipulation of Gold and Silver over the previous decades has created quite the monstrous 900-pound gorilla in the room masquerading as suppressed valuations of Gold and Silver.

The world is just now on the verge of witnessing exploding prices to the upside and causing the current valuation of Gold and Silver to reach many multiples in fiat valuation.

Yes, we’ll have cryptocurrencies but they will be government-owned or be some sort of Black Market situation.

BOTTOM LINE……….BUY SILVER AND GOLD. TAKE PHYSICAL POSSESSION TO PROTECT YOUR WEALTH. THE US DOLLAR IS LOSING VALUE DAILY. ANYONE WITHOUT SILVER AND GOLD WILL BE EMPTY BAGHOLDERS.

Agreed for the most part. As I’ve talked about in previous articles, I’m bullish on precious metals, especially on silver (because of it’s industrial uses). I’m still waiting for the explosion. While the silver 100% price increase last year was good, it did pale in comparison to the 1000%+ that much of the crypto space has gotten in the same timeframe.

Privacy concerns etc, can you send more info pls