The inspiration for this article was ignited by a video from Clif High. I’ve been following Clif’s work for maybe a year and a half or two years now. He is definitely off the deep end…and I think there is some genius there otherwise I wouldn’t continue to follow him. If nothing else, it is a fascinating perspective.

Anyway, in one of his videos he talked about a “Civilization Collapse Stack.”

This immediately caught my attention, helping weave together what were disparate threads in my mind.

Now there’s a lot in that video that he talks about if you watch it that you might not agree with. Here’s the thing. Regardless of the specific scenarios, I think this is a useful model.

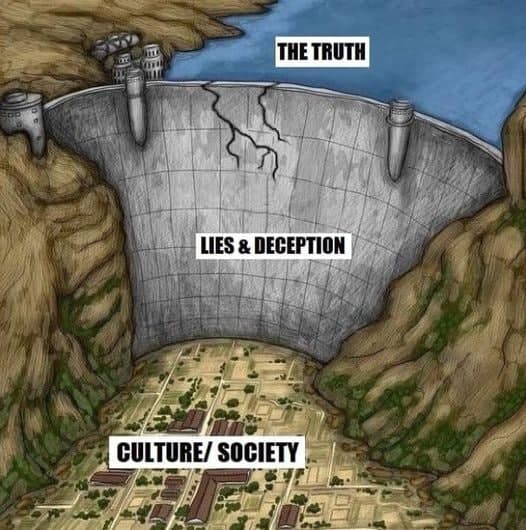

First of all, we are without a doubt going through civilization collapse. Now, this does not necessarily mean the “apocalypse” is upon us, 90% of humanity is going to die, we’re going back to living in caves, etc. It COULD mean that…in time especially with cascading effects. That is absolutely a possibility.

Just because there is an emotional or unthinkability bias against these possibilities that stop most people from seeing them, doesn’t mean it’s not actually there.

Secondly, there is a strong chance of much of the ‘collapsing’ of the collapse being mitigated, thus the collapse is short-lived, or localized, humanity bouncing back. In this sense the collapse might have more to do with institutions and cultural norms, then much of the technological underpinnings of our society. The magnitude of this happening is still HUGE.

If you doubt this…observe the world flip flop from conspiracy theory to leading theory about the origins of the virus…and people begin to see the financial ties of individuals involved.

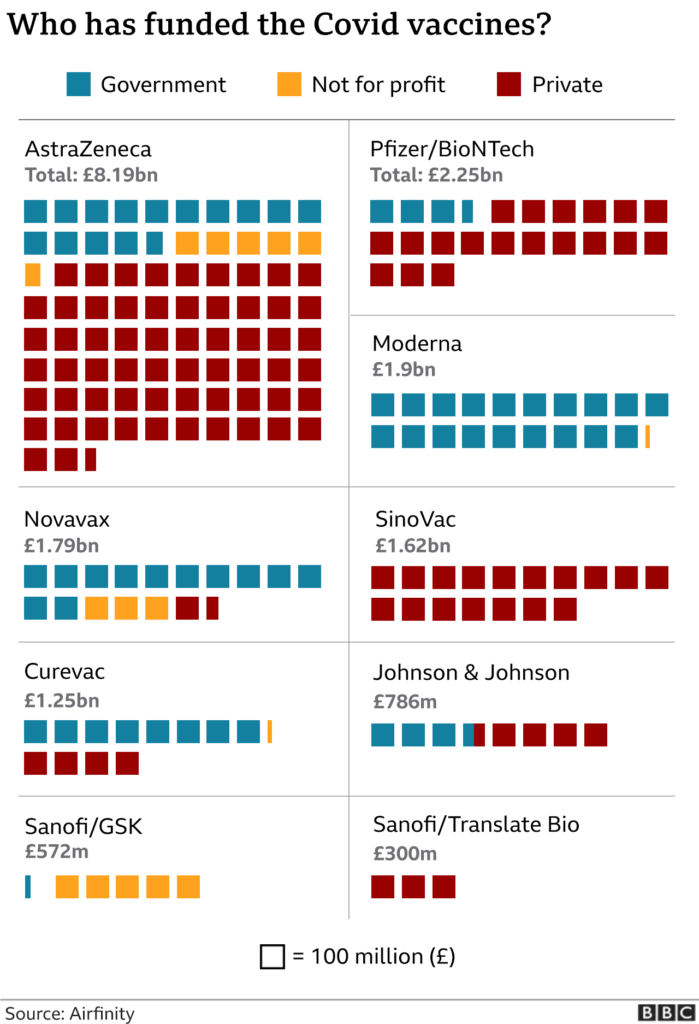

Witness the inventor of mRNA vaccines basically saying whoops, we messed up and “normie” pro-vax scientists having to wrestle with how our institutions are allowing this to happen.

Of course the damage control spinners are working overtime! Interesting times nonetheless…

Still, since we’re talking civilization collapse, for some background it can be worth studying the collapse of the Roman Empire, the Mayans, and many others that have come before. There are strong parallels available.

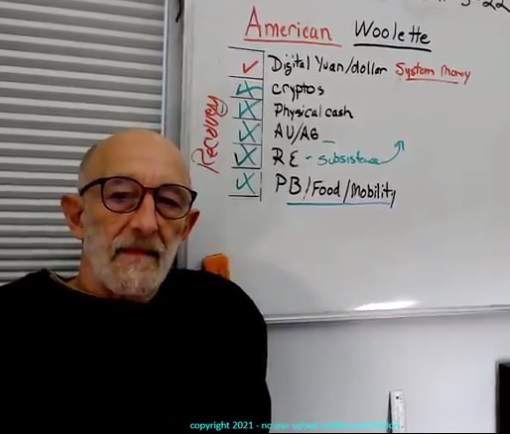

So what is this Civilization Collapse Stack?

This is a way of thinking through the possibilities of how this can play out.

If it gets really, really, really bad (aka Mad Max world as Clif High mentions) then we’re all the way down to the bottom of the stack.

If it’s not that bad, we’re at the top of the stack, not even collapsing just stepping into the future from here.

How far we go down the stack remains to be seen, but by being aware you can be better prepared.

And this doesn’t just have to do with survival but thriving which basically leads us into investments, along with adaptability.

So let’s dive into his stack and I’ll riff on it.

PB/Food/Mobility

Have you seen Mad Max? That’s a description of the worst things could go in. The Walking Dead minus the zombies is a likely more accurate description that gets rid of the flamboyancy of Mad Max.

PB stands for lead, aka ammo and guns. Food is a descriptor of not just food, but water and everything else you need to survive. Mobility is being able to move as that could be the difference between life and death.

An important aspect of these assets are not just that you need them to survive but they are good for barter. That you can trade any of these goods for other things you need is important in this world where any and all currency might not be worth anything. (I’m reminded of the image of people burning cash in the Weimar republic in order to stay warm.)

RE – Subsistence

RE stands for real estate. Perhaps more importantly here, can you live off your land? Grow your own food? (Can you defend it…to go back a level?) Depending on how difficult things are and for how long the ability to meet your survival based on where you’re at could be especially useful.

Note that this contrasts with mobility. Best bet would be to have a self-sustaining place as well as mobility.

Real estate also acts as a worthy investment. Right now, with asset inflation real estate is going up, up, up. There is not likely to be a change in that anytime soon unless civilization collapses down the stack. In that sense with a good home you can be set either way.

AU/AG

Those are the chemical symbols for gold and silver. Precious metals have always held value throughout almost all human civilization. This trend could stop at some point but is not likely. I like to call this the “old money” play.

If the US dollar goes into hyperinflation and becomes worthless this would be a rock-solid hedge against that.

The interesting thing going on with these is that even though ALL other assets are seeing inflation, it has not happened in precious metals. Why? There is significant evidence of the manipulation of these markets. They likely will have their time to shine in the sun again but can’t say for sure when that will happen.

Having some of these on hand in small denominations allows for trading in any world that isn’t solely about short-term survival.

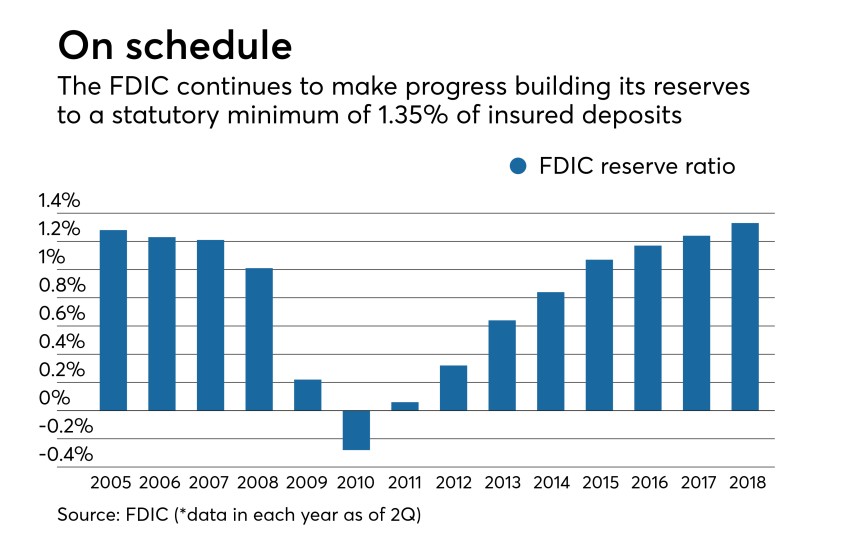

Physical Cash

The interesting thing about the US dollar is that most of it is already digital. Nothing more than bits on computers. There is a case to be made that actual physical cash could be more valuable than the digital version. The fact that cash is not tracked like everything soon will be makes a case for this.

At the very least it is useful to have cash on hand for any variety of short-term emergency situations.

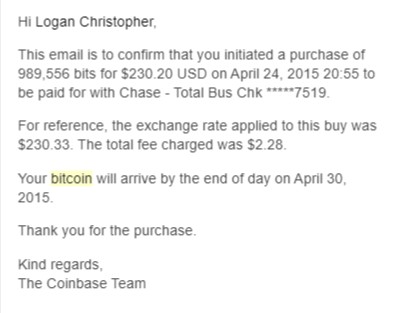

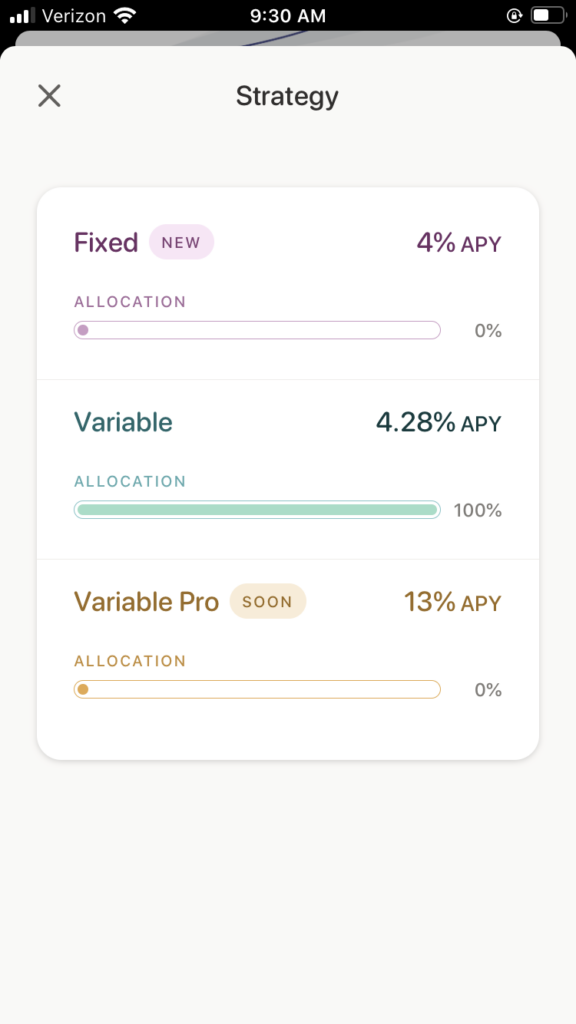

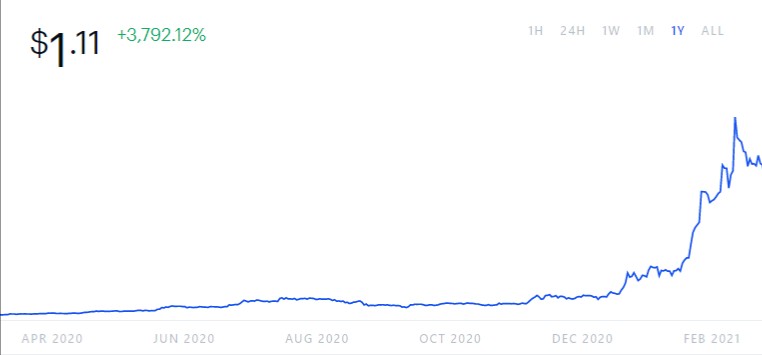

Cryptos

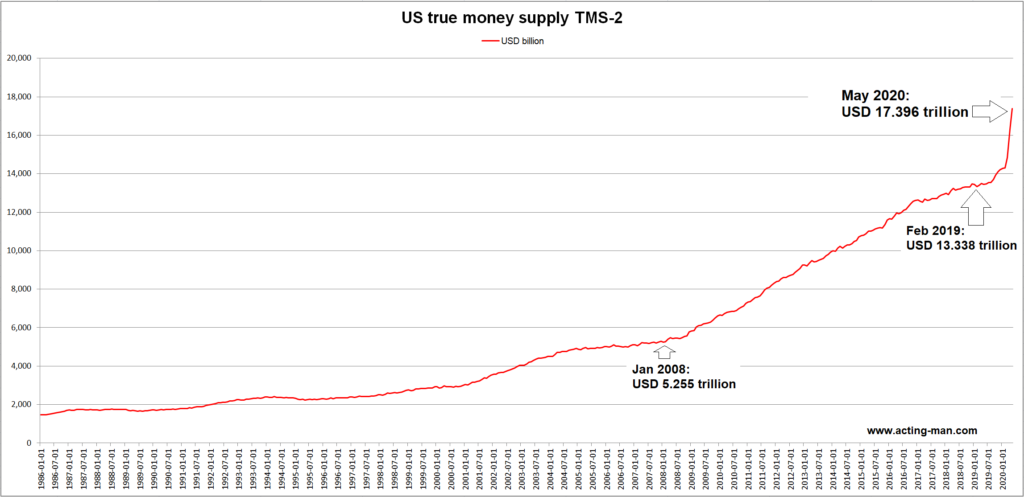

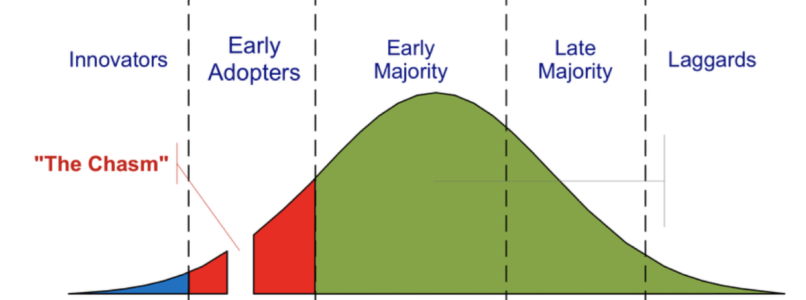

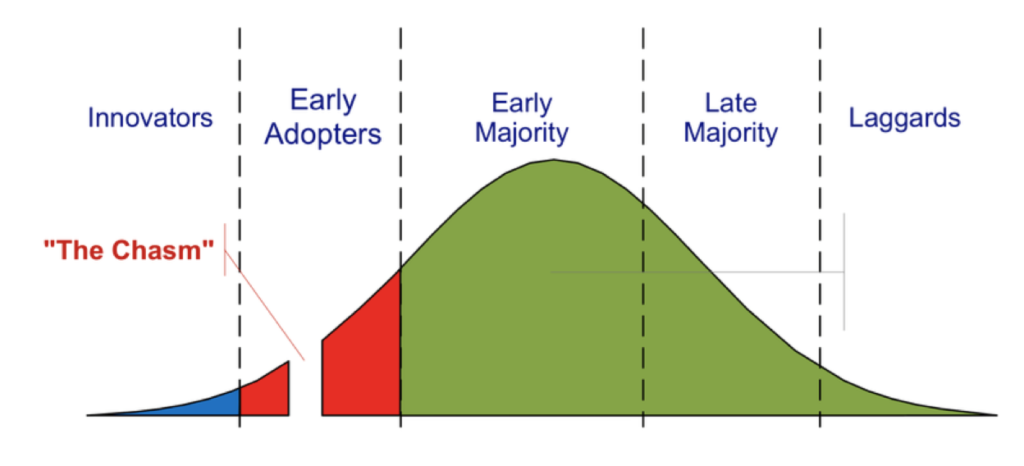

We’re going through the Great Reset, an economic transition. As I’ve talked about before that appears to be coming one way or another. Now we may go down the civilization collapse stack before that fully happens. Or it could be a more seamless transition depending.

Cryptos obviously have no use in a Mad Max world. But they are a worthy investment in many versions of “Future World.”

(I’m currently accepting a handful of new clients for my Crypto Crash Course Coaching.)

Digital Yuan/Dollar (System Money)

These are the central bankers rolling out their versions of centralized, more highly controlled, technocratic cryptocurrencies. The technical name is CBDC’s, central banker digital currencies. China is already experimenting with their version. The Fed is soon to release prototypes of its Digital Dollar.

The goal is to not go through civilization collapse but steer us into this system in the making. And it’s not just these but there’s reason to believe the powers-that-be are behind some of the popular crypto technologies today.

What most of the powers-that-be seem to want is a near seamless step into this control grid world.

Though an argument can be made that much needs to collapse before the world (like the freer parts of the USA) are ready to go there. If that’s the case then collapsing is desired and may receive “assistance.”

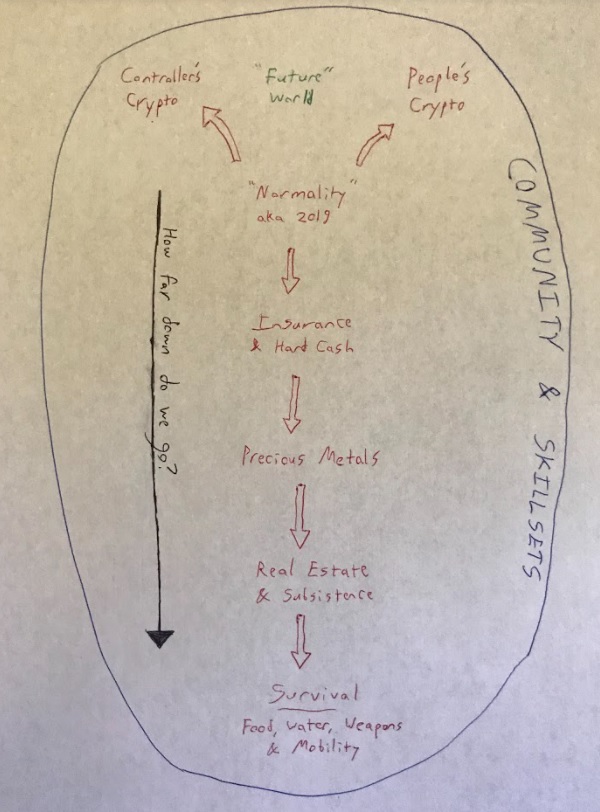

My Version of the Civilization Collapse Stack

I see this a bit differently than Clif. I see these two top parts of the stack more or less as split pathways. (Not that it’s all or nothing as these could fight it out for some time.)

Here’s my drawing.

A key point is that there is what we may call “normality” the pre-pandemic world. So here you see a splitting of the possible futures.

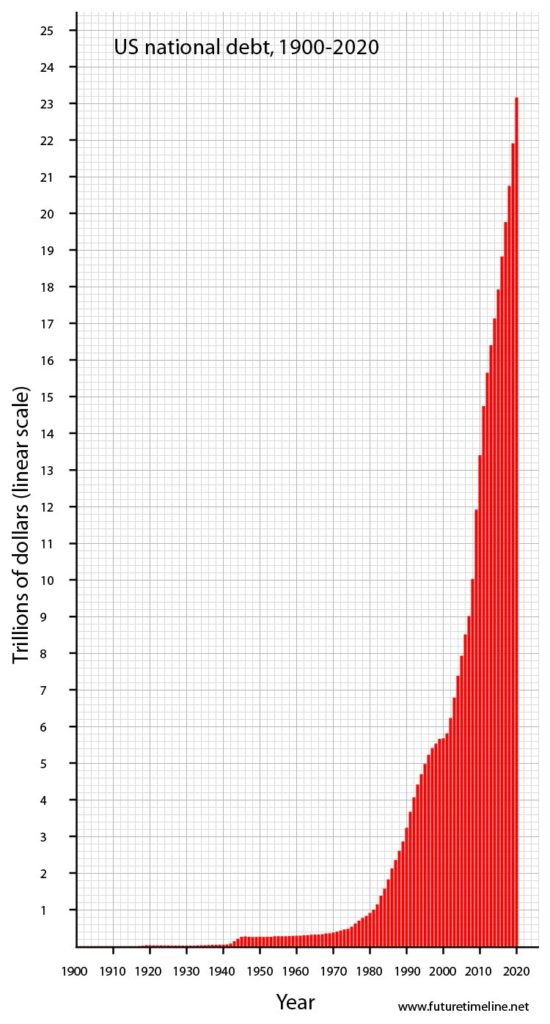

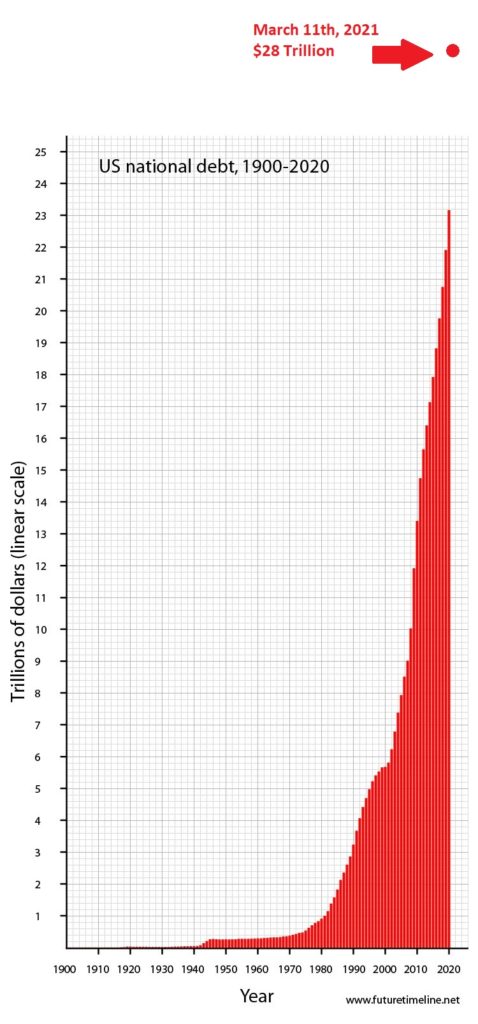

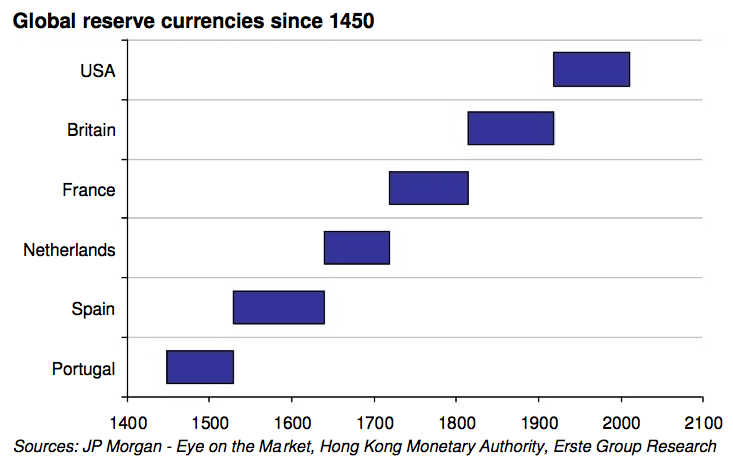

Look, I think the US dollar is doomed as the national reserve currency. It may be re-born as the digital dollar. Something else could take it’s place. But it’s chances of remaining long term the world’s reserve currency are doubtful, based off of very solid historical trends and the facts that show up today.

I highly doubt we step seamlessly in the future from this point. Instead, it’s a matter of how far down the collapse stack we end up going. If we collapse hard down the stack, then currency isn’t so much a concern.

If we don’t collapse as hard, or we do but go through a “Great Rebuild,” it is a cryptocurrency future in one form or another. That’s the way I see it.

Collapse – A Phenomenon Spanning Time and Location

Yes, we’re a globalized world right now. That is the main thing, with all it entails, that makes our current position different than the Roman Empire collapsing.

That adds so much complexity that predicting things is tough to do. That’s why this principle-based look at civilization collapse is useful. It simplifies the complexity.

And one of the most useful things to know about civilization collapse is that that doesn’t happen all at once.

Civilization collapse is not an overnight thing. In fact, it could take more than my lifetime! But a fair guess is that the rest of the 2020’s are rocky.

There’s one other key point…

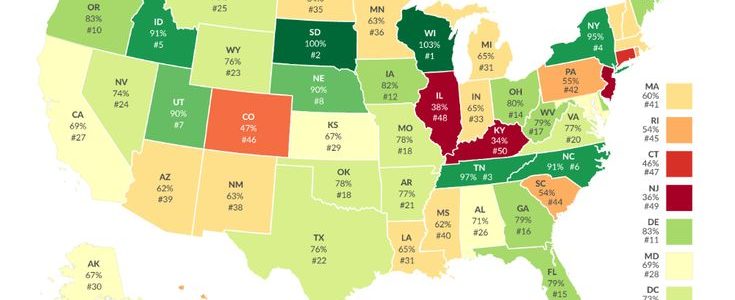

Collapse doesn’t affect every area across the globe the same either.

Take for instance forest fires. As most people know, I lost my home in California to one of these last year. Note these things:

- California burns every single year.

- Over the past five years or so, it has gotten worse every single year.

- Last year was a big step up from before. Not just California but the entire west coast up to Canada!

- This year the state is drier than last year.

- Fire season is just about to start once again…

What helped me out here? Surviving and thriving. Mobility and insurance came in handy here personally. And unfortunately, that makes many of the other things tougher to do. (I lost all my stockpile of survival goods for instance and had to start over.)

That’s the thing about this model. It’s not just civilization collapse but also useful for short-term emergencies too.

One thing I’m thankful for in the fire is that it stretched me out of my own unthinkability bias here. That it couldn’t happen to me. And thus, with this antifragile outlook, I feel more prepared to look at such scenarios as I’m laying out here.

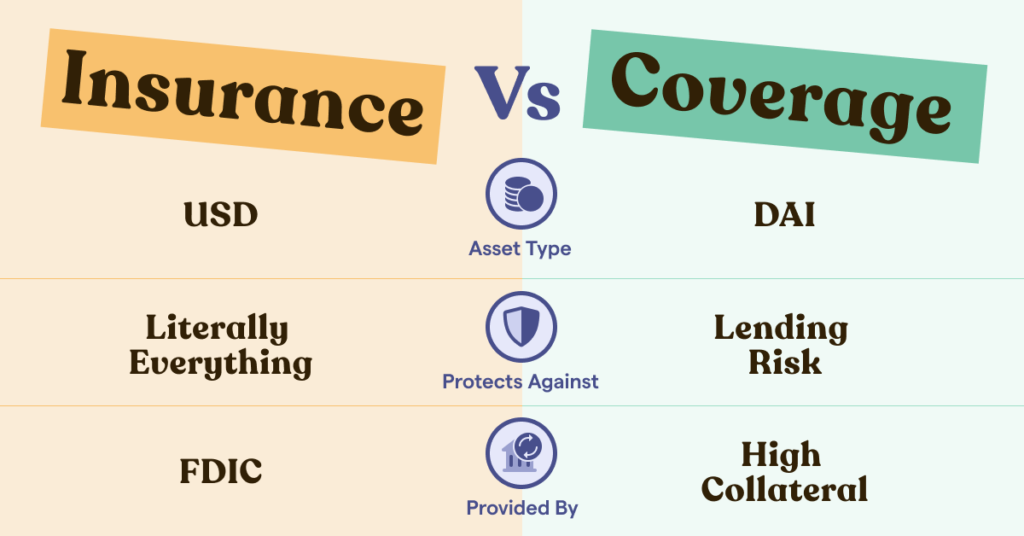

Insurance of various types can help through many possibilities, which is why I added it to my chart. The thing is you must also trust those institutions to be there as well.

And in any case, survival goods and weaponry are a type of insurance. Being in cryptos has gotten me thinking a lot more about risk mitigation in many different ways.

There are more natural disasters happening. Remember how Texas froze this last winter?

Whether there is a grand solar minimum coming causing a mini ice age, it’s man-made changes causing cascading environmental effects, weather modification weaponry, or some combination of these factors I can’t say for sure. Probably all of them. What will effect where you live? Are you ready for that?

Another example. We just had the Colonial Pipeline Hack. Even though it was the owners that shut it down, not the hackers, it caused people to not be able to get gas, disrupting their lives.

Those are just a few minor examples. As the collapse occurs across multiple issues, these things exacerbate each other. For example, the fires happening during the pandemic/government edicts made things tougher.

It is completely possible that certain places (whole countries?) may collapse completely, while others function virtually untouched.

Certain places become Mad Max while others step straight in the future. It’s not fair, but it may be how it goes.

Community and Skillsets

I’ve added two meta categories to my drawing that encompass the whole stack.

The community of people you surround yourself with is important no matter what level we descend too. In addition, it can be useful to know people that specialize in different levels of this such as survival vs. investing.

Not to mention that investing in your community (which may mean your family, your friends, worthy charities, those fighting the good fight, etc.) is always worthwhile.

Then there are skillsets involved in the whole stack. At the bottom of the stack, the many branches of survival skills and subsistence living. Towards the top end more so on investing skills. And so much besides that.

Investing in your personal skillsets is always worthwhile. But not just the same old skillsets. With this model is a call to expand your proficiency into likely new skillsets.

What to Do with This?

Ask yourself: How prepared are you for these different levels of collapse?

I really don’t want to be promoting fear. Some describe me as cynical. But these are plenty of realistic scenarios worth thinking through. That’s why I put together this article, largely to sharpen my own thinking through them.

The best bet is to be ready for anything!

Unfortunately, that is not easy to do. So what do you do? Start at some bare basics at the bottom of the stack and work your way up. The specifics of preparations are beyond the scope of this article. There are places that cover that far better than I could at this time anyway.

Return to this model overtime to modify your positions, insurances, plans and assets as necessary.

What do you see as most likely? Least likely?

What is most harmful if you get it wrong? (If you miss out on a financial investment you can live with that, if you miss out on being able to feed yourself, not so much.)

It can easily be overwhelming. So what is one thing you can do, even today that is a step in the right direction?

I’ll be doing another article that looks at some of the existential threats on the horizon.