I’ve been talking a lot about cryptocurrencies lately and will continue to do so. One of the big topics that stops many people from getting involved is how safe are they?

Safety is an important question, but I want to change tracks a bit. How safe is your money in general? How safe is the ever-growing economic bubble we all live in? (Like a fish in water, most can’t see it.)

In this article we’ll be looking at several areas to dispel the myths of safety we are supposed to believe in, showing that such safety nets that we assume exist may not be there when we expect them to be, especially as this country continues to fall apart.

First, I’ll start with a quote from Catherine Austin Fitts, in her excellent Solari Report, The End of Currencies. Highly recommended reading!

“To understand the state of our currencies, it is essential to realize that we live and transact in a transition time between two systems—amid a global currency war. The first system is the U.S. dollar, which has served as the global reserve currency since World War II…The second system is ‘in the invention room’ as we speak. Numerous parties throughout the developed and developing worlds—including members of the dollar syndicate—are attempting to bring up new digital transaction, payment and settlement systems…these unfolding developments represent a complex, confusing landscape for even the most sophisticated financial observer…The important thing to understand in this transition period is that many members of the global leadership do not intend to bring up a new currency system for use by the general population. Instead, they intend to end the use of currency as we know it, as part of a radical reengineering of our existing laws, finances, and culture. Their goal is the end of individual sovereignty—managed with technocracy and transaction systems that can operate without markets or currency in the classic sense, integrated with other heretofore separate control systems.”

I’ve touched on many of these areas before but aim to give a bigger picture looking at the unsustainability of our current system here in a two-fold way:

- The system at large

- Your dollars within the system

How Safe is the FDIC?

FDIC, the Federal Deposit Insurance Corporation, is what backs every bank account to the tune of $250,000 nowadays. Your money is safe in banks because the government guarantees it.

As their website says, FDIC is “an independent agency created by the Congress to maintain stability and public confidence in the nation’s financial system. The FDIC insures deposits…”

But do you believe in a guarantee when you know that our government is run as a criminal organization?

(After all, the Constitution is supposedly a series of government guarantees, but we can see these guarantees are all being whittled away.)

Here’s a history lesson. Another US insurance organization, the Federal Savings and Loan Insurance Corporation, became insolvent in the 1980’s savings and loan crisis.

It was “recapitalized” with taxpayer money, $15 billion in 1986 and $10.75 billion in 1987. Despite these efforts, by 1989 it was still broke and was gotten rid of. Its responsibilities were replaced by the FDIC. That crisis ultimately cost taxpayers $150 billion dollars.

So let’s look at the FDIC.

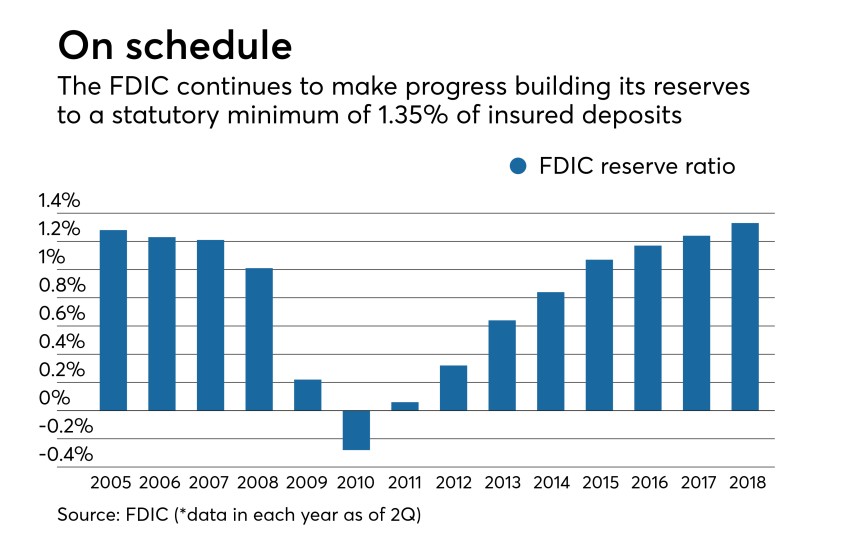

Did you know that the FDIC was $8 billion in the hole back in 2010 from the last big crisis and bank failures? They’ve since reversed that, but just how exactly are they insuring that your money stays in bank accounts when they themselves haven’t always had it?

Nothing fundamental was fixed after the 2008 crisis. The problems are all bigger now…just elsewhere besides mortgages.

The most up-to-date info I can find on their website discusses how they’ve lowered the reserve ratio from the “Restoration Plan” after the 2008 crisis. As of September 30th, 2018 they held $100.2 billion.

That covers 400,800 accounts at the $250,000 limit. Of course, most people don’t have that much money. But of those that do, many have several different insured accounts at different institutions.

If a crisis bankrupted a federal insurance institution before, what are the chances of it happening again? I’d be willing to bet on it.

Bank Runs?

Investopedia defines a bank run as the following: “A bank run occurs when a large number of customers of a bank or other financial institution withdraw their deposits simultaneously over concerns of the bank’s solvency. As more people withdraw their funds, the probability of default increases, prompting more people to withdraw their deposits. In extreme cases, the bank’s reserves may not be sufficient to cover the withdrawals.”

If there is a demolition of the current system (whether controlled or uncontrolled) this is a potential consequence.

Oh, and regarding those reserves? I reported on this back in March of 2020. The Fed stated: “As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.”

Banks aren’t required to hold any reserves anymore. Suspicious timing…What does a pandemic have to do with bank reserves? There’s no answer on the surface level which is why such a policy change got no mainstream coverage. But below the surface…everything.

I guess if we go fully digital there can’t really be a bank run?

…at least no one will SEE the bank run since all they need to do is transmit some bits over there and say we’re not allowing cash transactions anymore (because of the virus of course).

The FDIC is there to ensure that bank runs don’t happen. But what if the system is pushed to the point of collapse where FDIC goes with it.

The “good news” is there is a solution…

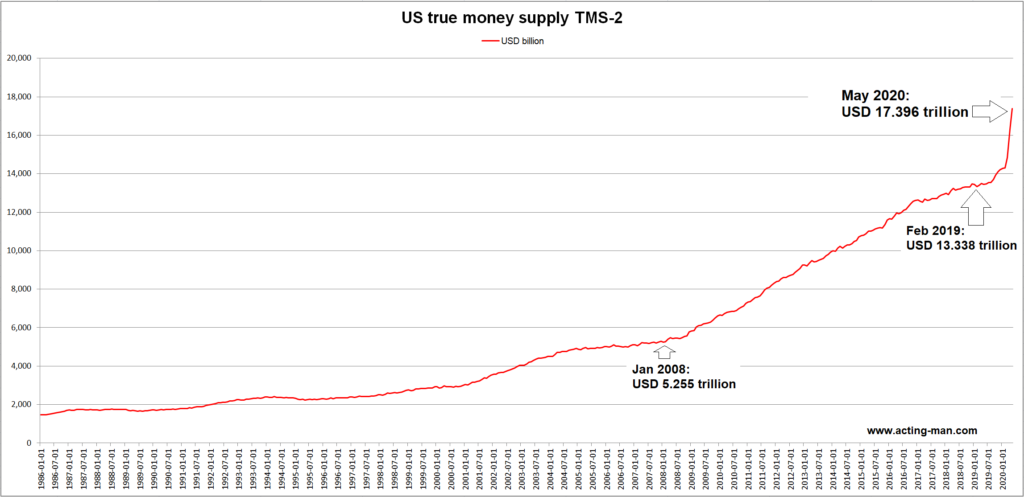

The Solution to Every Problem – Print More Money

The answer to any and all of these questions is to print more money. That seems to be our economic plan. That is what Modern Monetary Policy says to do.

Yes, the FDIC could be rescued from ANY failure by printing more money. But understand that comes at a cost, the dollars we all have get debased further.

Printing money acts as a hidden tax on the people. Congress doesn’t have to approve it. (Technically in the Constitution they approve budgets but that’s hardly how it actually works now.)

They don’t take it from you like they do with taxes, instead they just make any dollars you hold worth less.

In fact, with almost everything listed here the answer may be the same. Got a pandemic? Print more money. Going to war with China? Print more money. Climate change? Print more money. Alien invasion? Print more money.

It’s the magical solution to any threat, real or spun.

Why would they debase a currency like this?

Understand that by printing more, the bankers and their political, intelligence, non-profit, and corporate friends can gobble up assets better than anyone else. They get the benefits of new money created out of thin air, while it negatively impacts all the other existing money in value.

This creates bubbles. Bubbles always pop. Whether engineered or not, growing bubbles contribute to economic inequality. The rich get richer. The poor get poorer.

…And the bubble popping is another crisis which gives license to print more money.

It’s a hell of a system. Kicking the can down the road like this, without any fundamental reform, only delays and grows the problems that will have to be dealt with at some time.

Many in the financial space liken this money printing to be hooked on crack, heroin and meth!

The Debt Death Spiral

A zombie company is defined as a company that either needs bailouts in order to operate or has debt that it can pay interest on but not principal. While some can get turned-around most ultimately go bankrupt.

It must be great to be too big to fail, right?

Bloomberg reported that since the pandemic started over 200 large corporations, with over $2 trillion in debt, were added to the list of zombies list. This included Boeing, Delta, Exxon Mobil, Carnival, Macy’s and more.

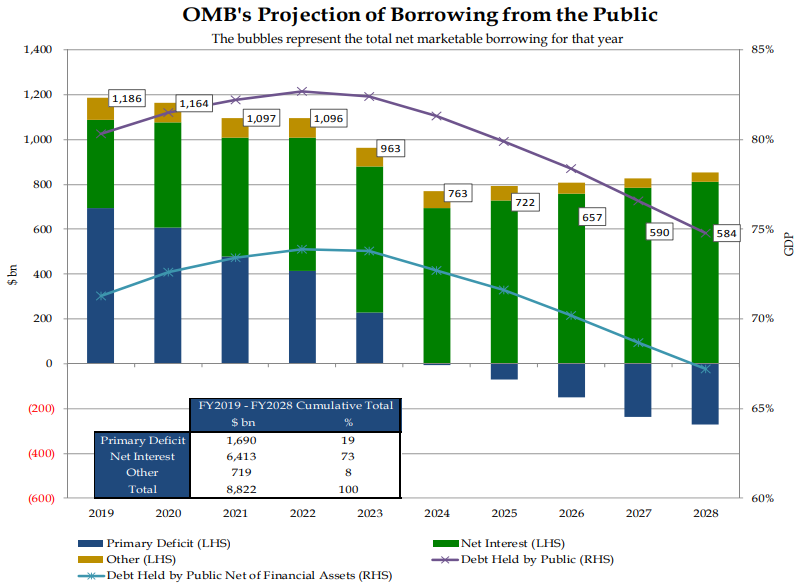

Even more important than companies…what happens when the US goes full on zombie government?

This report comes from Q1 of 2019 from the Office Of Debt Management. It forecasted that in 2024 the US would only be able to pay interest and no principal on it’s debt.

This was BEFORE all the pandemic bailouts. Are we already a zombie or will it be in 2022 or 2023?

I suppose they can just print more money to handle the debt, right?

How Safe are 401K’s?

Most IRA’s are only taxed when you withdraw from them. (Roth IRA’s being the exception, where you pay taxes before contributing and then can withdraw tax free.)

Here’s a question to ask yourself. By the time you’re taking money out, do you think taxes are going to:

A) stay the same?

B) go lower?

C) go higher?

Really take some time to ponder that question. They might just print money, but I’d also be willing to bet taxes will be going up.

I just saw this article the other day. “Payback time: Biden to repeal Trump tax cuts and propose first major federal hike since 1993 to help fund $1.9 trillion COVID package: President is expected to raise corporate tax and personal rates for high earners”

With government spending ramping up, likely to ramp up even more, where do you think that money is going to come from?

And if you think only the richest people are going to be taxed, I’m sorry but you’re not paying attention. Yes, there are things like the proposed California wealth tax, but the brunt will always fall on the middle class, while the elites have their ways of avoiding the worst of such policies. (After all, they’re paying the politicians to write the rules.)

I know some of my readers are already retired. Others won’t for decades to come. But you really need to project out where you think the USA is going for this.

Do you even own Your 401K?

Can the government just take your 401K? Not with current laws. But laws can change. Apparently, this would take going through Congress, the President and the Supreme Court. Again, if you think this is impossible, I ask you how many impossible things happened in 2020?

My friend Garrett Gunderson first clued me into this. In a Forbes article he wrote, “Did you know that your 401(k) does not even technically belong to you? Read the fine print and you will find that it is what’s called an “FBO” (For Benefit Of). In other words, it’s held in trust by a custodian on your behalf and is subject to a slew of government regulation and change. It’s essentially a tax code. If history proves to be a reliable guide, 401(k) funds are therefore in great jeopardy! In the same way that the government raises and lowers taxes at their whim, it can change the rules and take the money that you so diligently saved.”

But realize that is just one means of transferring wealth.

Even if 401K’s aren’t touched, we know that the markets are largely rigged. I don’t know if it is completely so, or just partially, but insider’s do have ways of creating, inflating and popping bubbles to their benefit. They can ride the bubbles on the way up and get out before they pop.

In 2008, my mom’s retirement in her 401K was cut in half by the stock market crash. She passed away before she retired (because of the poisoning of our environment and ineffective medical care) but I know she was worried that she wouldn’t be able to retire when she planned to. She’d have to work longer because of the market of which she had no control. She just trusted that her 401K was a wise choice.

Is the Stock Market Safe?

We saw stocks drop significantly in March of last year, only for it to resume going to new highs. The stock market is thriving only because of the money being pumped into the system. But that won’t inflate it forever.

But what goes up must come down.

There will be another bigger and prolonged crash at some point. Guaranteed.

Most people have ZERO control over their 401K’s, all of which is in the stock market. It’s managed by some mutual fund, typically paying a hefty but hidden fee for the privilege.

A better option in my mind is a self-directed 401K. This way you can do much more than index funds in the stock market. With the right setup you can invest in businesses, real estate, precious metals, foreign assets, and even cryptocurrencies.

Personally, I don’t have a 401K. And I don’t ever plan to. Truthfully, I don’t even buy to the idea of retirement for myself. That doesn’t mean I’m not working for my future; I’m just using different vehicles to do so.

The fact that you don’t actually own it makes it highly suspect in my mind.

What if the government decides that all white people need to pay reparations for their whiteness and the 401K is a good way to do that? Because obviously, if you have a 401K you’re privileged and engaging in white supremacy.

I only say this in partial jest with the direction things are going…After all, if math can be racist, all things are on the table!

“White supremacy culture shows up in math classrooms when… The focus is on getting the ‘right’ answer.” (This quote comes from The Education Trust Inc., which happens to be funded by the Gates Foundation of course.)

It’s not a far leap from the right answers in math being racist, to any financial literacy and therefore retirement funds being racist.

How Safe are Pensions?

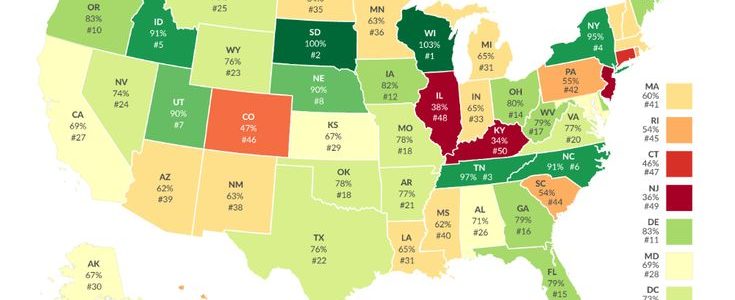

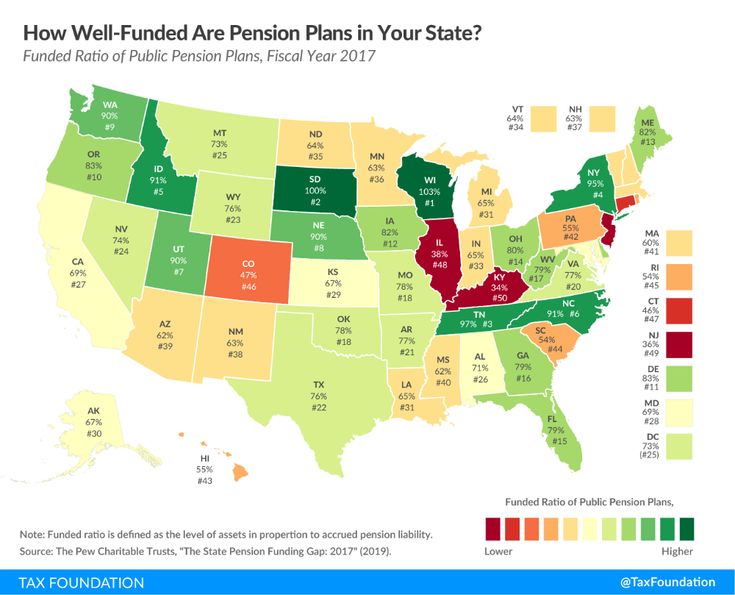

Virtually all the state pensions are underfunded.

Here’s a graphic from 2017 showing the average state is short about 30%. Some like New Jersey are deeply in the red. Only two states, South Dakota and Wisconsin were fully funded.

That’s government workers. What about private pensions?

In 2012, the Irish government passed a 0.6% tax on private pension funds due to the financial crisis and a need to increase revenues.

Argentina nationalized $30 billion in private pensions in the last global crisis.

There are many more examples of such actions the world over. Do you think this kind of thing is impossible within the USA?

Is it American exceptionalism alone that protect us?

A good question is why are these pensions underfunded? The government is full of crooks that are already robbing us every chance they get. For the sociopaths involved, they’ll continue to rob us of anything and everything with whatever they can get away with. Of course, there are ways of getting at pension money, just like social security which will be bankrupt within a couple years.

Have no fear the federal government is here. The recent COVID relief bill included $86 billion in pension bailouts.

Too big to fail, right? The states must fall in line with the Federal government to get their handouts too.

A good question to ask is, do you live in a more or less controlled state because of such liabilities?

Government Waste and Corporate Profiteering

Did you know that in 2020, New York spent $447,337 per inmate? This was up 33% from the previous year.

Yes, there is tons of government waste. But so much more of this money is going into the pockets of corporate partners. (Like all those private prisons and contractors. It’s a very profitable system and has been for decades to throw victimless criminals in jail.)

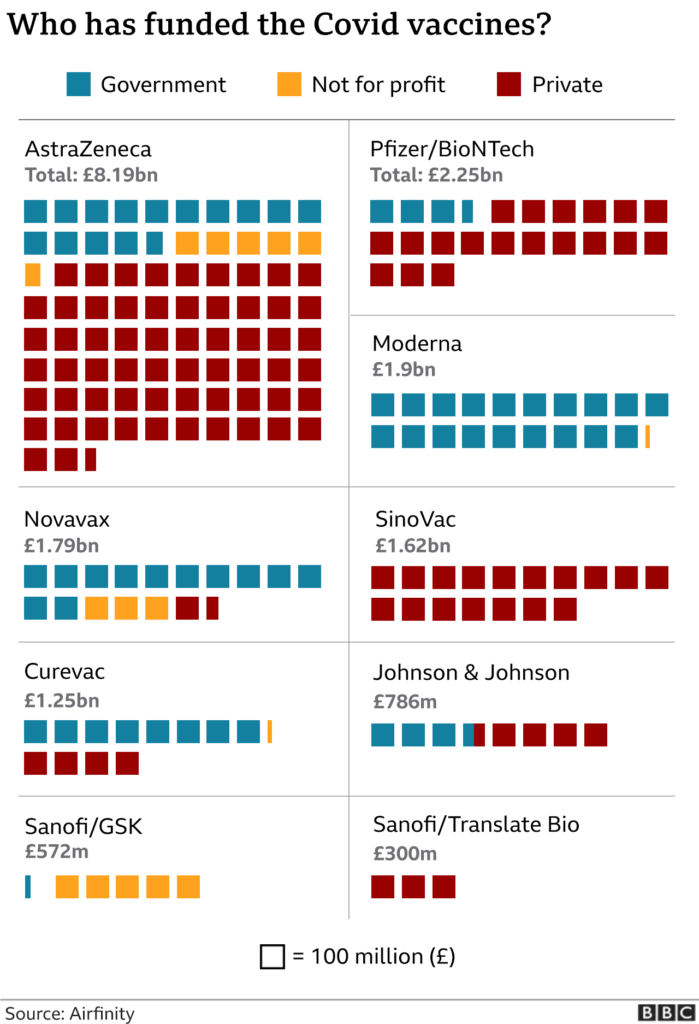

The vaccine manufacturers received more than $9 billion from the federal government.

Our government actually pays them to make profitable products. Just Pfizer and Moderna are estimated to make $32 billion off covid vaccine sales just in 2021.

Moderna was almost 100% government funded, the last little bit kicked in from…you guessed it, the Gates Foundation.

Public funding, yet Moderna gets to keep the profits private. Furthermore, the private companies have zero product liability, that falls on the government too. That’s one a hell of a deal!

This is how the organized criminal syndicate runs. This is why the system is so overburdened with debt. the criminals loot money from taxpayers to pass back and forth between each other.

The Student Debt Bubble

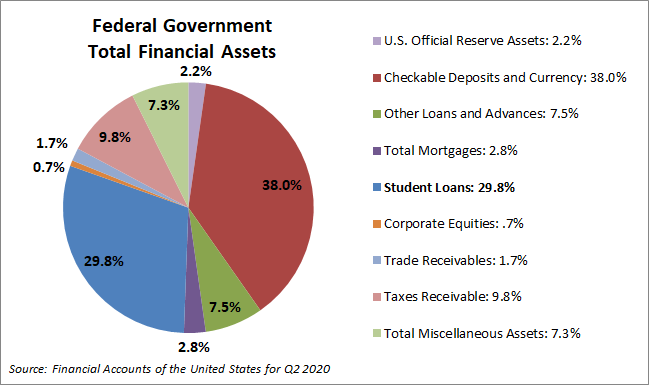

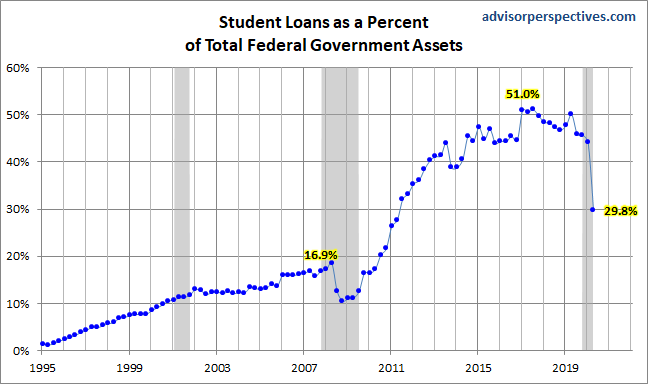

Student loan debt makes up almost a third of the assets of our government.

And previously it was even a larger chunk, over 50% of governement assets!

So what happens when this is forgiven as many politicians are pushing for?

In the last round of bailouts (aka Covid relief measures) the bill made it so debt relief was non-taxable which it previously had been. In other words, this is paving the path for debt cancellation.

And Biden is going around canceling debt, bit by bit now.

Student loans are certainly a racket that screws over people big time. I’m not trying to debate that here.

But just looking at it from the other side…what happens when you get rid of the biggest asset held by a government quickly going bankrupt?

I suppose you can just raise taxes or print more money to make it up.

The Dollar Continues to be Downplayed Across the World

The discussions between Russia, China and other countries about moving away from the dollar continue to occur. This has been going on for years now.

Recently, Nikkei Asia reported, “Russian Foreign Minister Sergei Lavrov began a visit to China on Monday with a call for Moscow and Beijing to reduce their dependence on the U.S. dollar and Western payment systems to push back against what he called the West’s ideological agenda.”

“Washington has been abusing SWIFT to arbitrarily sanction any country at will, which sparked global dissatisfaction. If China and Russia could work together to challenge the dollar hegemony, a laundry list of countries would echo the call and join the new system,” Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times.

But it’s not just our “enemies” saying this…

Mark Carney, governor of the Bank of England said in 2019, “The world’s reliance on the U.S. dollar won’t hold and needs to be replaced by a new international monetary and financial system based on many more global currencies.”

The Coming Shocks

Understand that all this IS the desired outcome by many at the top of the financial pyramid. It allows the cover-up of crimes over the decades and for the global ponzi scheme to continue. And of course, even more power and control.

How? Read The Shock Doctrine. At the very least watch the documentary. It’s a great overview of how things have worked and will continue to do so.

An analogy that I think fits is that we’ll be going through a fall-of-the-USSR type of change, covered about halfway through the video here.

(Though they went “communist” to “capitalist”, while our case seems more in reverse. Those labels aren’t what is most important, but instead to see the commonalities of the economic impacts! In either case powerful oligarchs manipulating the systems are profiting while people suffer.)

By continuing to manipulate markets, loot pensions and taxpayers, this allows for benefits to them today and bigger shocks for the common people later.

Then greater austerity measures will be introduced.

Your acceptance of the totalitarians aims in order to get your handouts are the carrot. Their threats and violence, the stick.

With a heavy heart I say that unfortunately more violence is coming to the US’ “domestic terrorists.” They’re discussing drone striking Americans on the news.

Furthermore, while tested out with Ebola, the bird and swine flus, and even earlier, we can say that “Pandemic Capitalism” is definitely on the rise.

Let me ask a few questions…

Did drugs go away after we declared war on them? (Not when intelligence agencies were funding their black ops by running drugs.)

Did cancer go away after we declared war on it? (Not when the pharmaceutical-industrial-government complex is profiting from both causing and curing cancer.)

Did terrorism go away after we declared war on it? (Not when the military-industrial complex profited trillions.)

We declared war on the coronavirus. Does that mean the coronavirus be gone soon?

It is frustrating to me that people think we’re getting back to normal now.

A temporary reprieve at best. Something that serves to drive us deeper into trance come the next shock.

No, the endless wars (not just physical) have been running for a long time now.

Looking at and understanding the economics of it (instead of getting wrapped up in left/right politics, royal scandals with Markle and Oprah, even scientific debates about health) will give you the most clarity moving forward.

That’s why I’m going to be talking about this even more.

Economics is probably the most useful lens to use to see how the world really works.

My Conclusion: US Dollars are Not Safe

Wrap your mind around that. To keep assets in USD is risky. Once again, I don’t think the dollar is going away anytime soon. It’s a step-by-step process that will unfold over the next several years.

But we are on that road.

The value trend is going down while other assets inflate. (Despite a spike up in USD value recently. That likely has to do with it’s not just the US printing money either.)

Not today, but soon. Perhaps somewhere in 2023-2025 when the US debt stands at $40 trillion, we’re a zombie government, social security is bankrupt, and more has all occurred?

That’s the old system. What about the new?

I found this interesting. Soros Fund Management chief information officer Dawn Fitzpatrick said, “We think the whole infrastructure around crypto is really interesting, and we’ve been making some investments into that infrastructure — and we think that is at an inflection point…I think when it comes to crypto generally, we’re at a really important moment in time, in that, something like Bitcoin might have stayed a fringe asset, but for the fact that, over the last 12 months, we’ve increased money supply in the U.S. by 25%.”

The hedge funds are seeing it. Are you?

An inflection point.

You can literally follow the money right now as we go from the dollar system to the new system.

By that I mean follow the money with your money.

Of course, this doesn’t make cryptocurrencies completely safe either. Far from it. A big crash will come there too. A huge shock which allows the “Fedcoin” to come in is almost assured at some point.

But right now, as it is in the “invention room” we’re FAR from the totalitarian control of the system. We are going through the massive change right now.

So many in the crypto space are against the totalitarian control. But just like everything else, you need to seek to see what is going on behind the scenes.

Most of my assets besides my businesses are invested in cryptocurrency right now.

(With a good portion in silver to act as a hedge…but I’ve been waiting for years for the silver manipulation to end there and am still waiting).

The writing is on the wall. I’m reading it. I could be wrong about this trend , but I don’t think I am. I certainly benefited by seeing this trend last year.

This gives me time to profit from the asset inflation, the bubble, take profits along the way and get out when the time is right.

To reinvest those profits in my family, my community, supplies and Plan B scenarios. Also to fund those that are fighting the good fight.

You might think me risky to do so…but as I’ve shown, money, the US dollar, is risky right now.

There is risk either way…

But I am trusting in my understanding of the global system! I’m almost all in.

More Spots Opened Up

Reading over this article multiple times, I feel like it may be stoking lots of fear. I sincerely apologize for that, but I think it is best to be realistic even if it looks incredibly pessimistic.

There still is hope that the system implodes on itself allowing people to get free. But even if that happens that too will be rough.

Neither should this be construed to mean that cryptocurrency is some utopian thing that will save us all. I hope I’ve clearly explained how it very well could be the exact opposite.

Still, I do believe their is a window of opportunity here. So much so that I’m not just doing it myself but sharing this message with others.

On that note, my crypto crash course coaching is going great. Several have made their first investments already. (One even got in right before one token shot up in value about 20%. Good timing there.)

As I’m halfway through with several clients, I’ve decided to open up a few more spots. If you’re interested email me at logan@legendarystrength.com and I’ll send you more details.

You can also signup with your email on this page and I’ll reach out shortly.

Even if you don’t work with me I hope you’ve taken this message to heart and are a little better prepared, psychologically…and perhaps financially… for what is coming.