Cast your mind back to the earlier days of the internet. Do you remember when online banks became a thing?

And many people were scared to use them. “How could you trust a bank that didn’t have a building?” they asked.

Your money would disappear into the electronic ethers and you’d have to trust it would be there. I remember when I first signed up for one such bank, ING Direct. My parents thought I was crazy to do so!

That fear seems pretty naïve at this point of the pervasive internet, right?

While I’m sure that some still swear off these things, they’ve become quite common. People routinely do banking, make payments, buy and sell stocks off their smarts phones these days.

For years I’ve recommended using such online savings accounts because they offered an actual yield as compared to many banks (Local credit unions sometimes also being better).

But that yield has gone down, closer to what the big banks were giving. One of the places I used, has gone from 1.5% down to a measly 0.5%.

This does not even keep up with the inflation we have going on. The Fed expects 2.4% this year…when we know better than to trust official numbers. (That means it is most definitely higher.)

In other words, holding money in a bank account is a good way to lose.

No thanks, I need a better option.

Enter DeFi

DeFi stands for Decentralized Finance. Basically, this is the ecosystem that has sprung up around cryptocurrencies, most notably the Ethereum network.

By being decentralized it relies on smart contracts and a network of people. There are no centralized hubs like the banks. Instead, there are decentralized applications that build a financial platform available to everyone that operates peer to peer.

Let me check in…have I already lost you?

Do you understand what I’m talking about, or did your eyes glaze over earlier?

In the past months I’ve been having quite a few conversations with different people on these topics. And most simply cannot wrap their heads around it. It is too different from what they know.

New is challenging. Like conspiracy topics they don’t seek to understand because they want to stay safe within their worldview.

I understand it’s not easy to grasp. Yet, that is part of the reason it is important to do so now. Get ahead of the curve not behind, as I talked about in my last post.

Let me take you back in time…

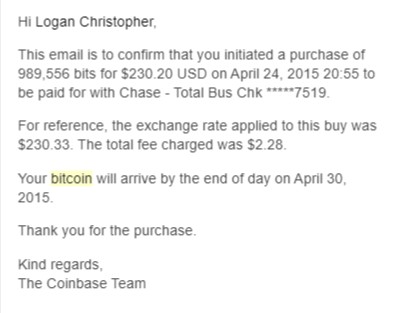

It was 2015 and I had heard about Bitcoin from several different sources. So I dug in. I decided I had to get what this was. It took me some time to do so, looking at multiple sources. It was challenging. But the reward was then I felt like I understood enough that I could begin investing.

On April 24th, 2015 I bought my first ever Bitcoin for $230.20.

Was that a good choice? While I have made many mistakes along the way, the fact that I saw the future coming at least to some degree, and did the hard work of trying to understand it, paid off.

The question is will you do the same if you haven’t already?

The Easiest Way I’ve Found into the Benefits of DeFi…without the Complications!

Why did I bring up online bank accounts? Because it is much the same here.

I’m going to cover more of the complex stuff in the future. But first I want to simplify it for you. Can you get the power (and benefits of DeFi) without actually understanding any of it?

Yes, you can.

What follows is the simplest route in that I’ve found. This doesn’t involve exchanges, setting up wallets or anything like that.

So let me tell you about Donut.

Unfortunately, at this time it is only available for iOS. But they are working on Android.

And that leads me to start with what I do not like. This financial app is exclusively for your smart phone, or iPad. They have a website, but you can’t even login there! You can only interface through the app right now.

Let me be clear, I do not like this trend. Since most of my work is at a computer, I use a desktop. I really don’t even use my cell phone much. But this is where things are going. (And that’s not to mention the whole being controlled by the smart device thing which will grow and grow.)

The good news is that if you can and do use any financial apps, you can do this too.

How Would You Like to Earn 4-13% on Your Cash?

Basically, because in DeFi there are ways to earn much larger yields, 5-12% is quite easy, and possibilities of making a ridiculous 1000%+, this company can use the money you save to do so.

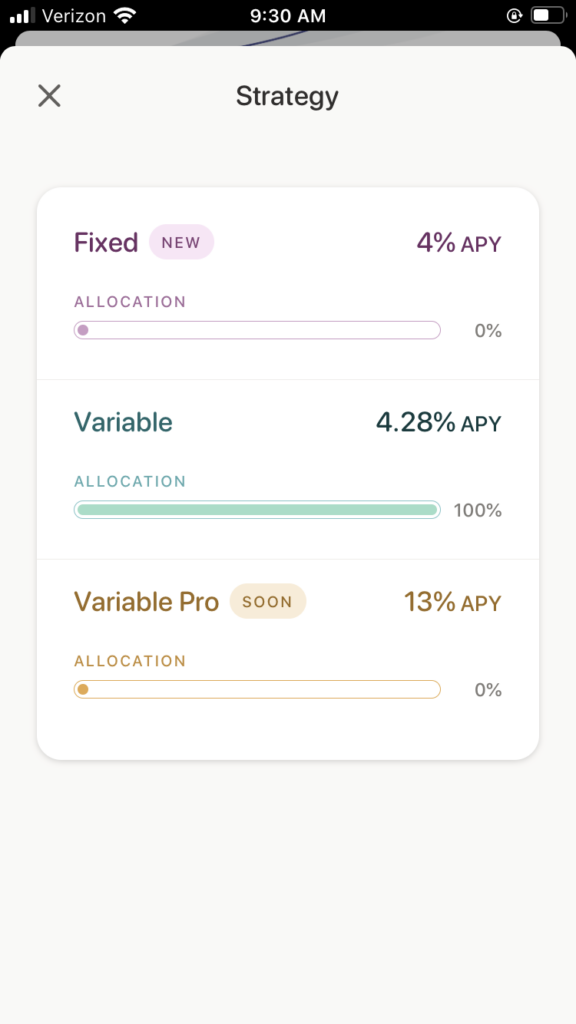

And they can give you your cut of 4% for use of your funds.

Here is an actual screenshot from my account. I have only been using this for a couple of months and have already earned more interest than a full year of my online savings accounts with a much smaller balance.

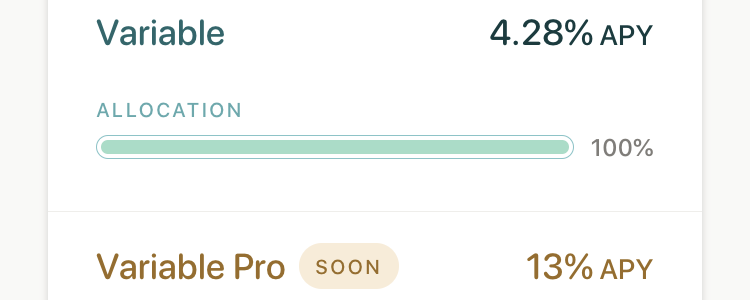

In fact, you can get more than 4%. You can select the variable amount. At the time of this screen shot it was 6.96%. I have seen it move below 4% as well. (The thing is you can click a button and then move back to the standard 4% when that happens too.)

And soon they’re planning on offering even more. This morning I took another screen shot. You can see the variable rate is just above the fixed rate at 4.3%. And they have a Variable Pro rate of 13% coming soon.

So at the very least you’re earning 8x times more than most banks offer. And there are possibilities for much more than that.

This is the power of DeFi…made really simple to get started with.

If you’ve got an iPhone, you can click this link to get started. Special offer through this link. You get $10 free once you’ve made a deposit. I also get $10 for making the recommendation. Win-win.

How Does It Work?

To understand this, you have to understand more about digital currencies. One thing (of several) that have stopped their widespread adoption is the volatility. The space does go through some wild swings.

And this is why stablecoins were created. They are cryptocurrencies that are pegged to a (comparatively) stable asset, such as the US Dollar.

These are basically a cryptocurrency versions of the US dollar. Like a digital dollar but typically backed by real cash and audited (PAXOS), backed up by code and a basket of other cryptocurrencies (DAI), or seemingly backed by cash but actually a scam (USDT aka Tether). More on stablecoins including the scam details another time.

In short, these stablecoins are stable in price compared to other cryptocurrencies. Importantly for this topic, they can be lent out in a variety of ways to make money in the space.

With Donut, your cash is converted into stablecoins (DAI specifically) and then lent out for you. You can withdraw your cash at any time.

Is this Risky? Is this Safe?

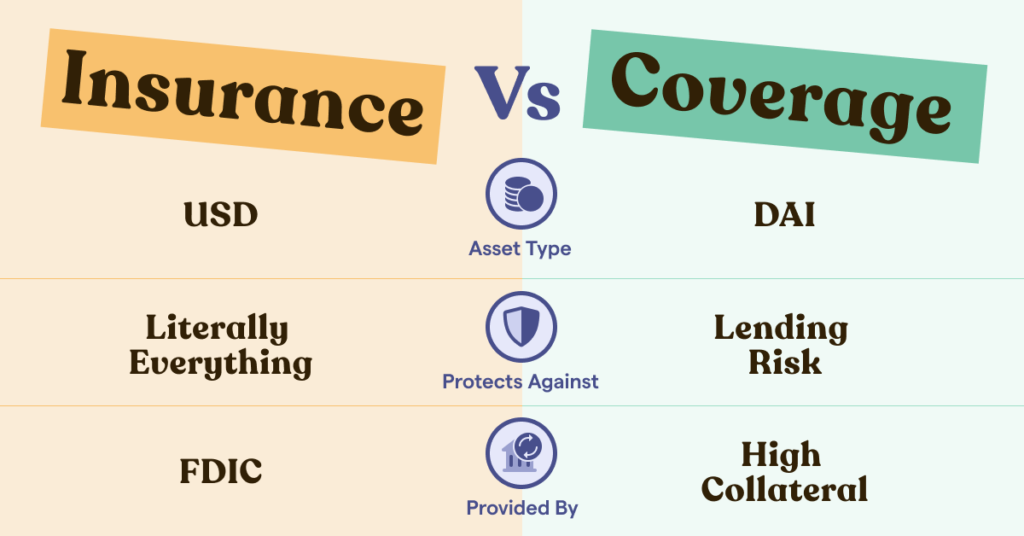

First of all, this is not FDIC insured. There is no Federal guarantee that your money is protected. (As you might imagine, there are financial problems with this federal agency, I plan to explore in the near future.)

FDIC insurance backs every bank account. But not this.

But the fact that this lending is backed by collateral ultimately acts as coverage, at least to a degree. While there are ways of leveraging such assets, within DeFi lending things tend to be collateralized over 100%. Often 150%. So it is safer in that way.

Donut has been around since 2019. I know that doesn’t sound like much but that is a decent timeframe for a stable company in this space!

Ultimately, time will tell. There is a big crypto crash at some point in the future. Nothing ever just goes up. When that crash occurs does the collateral cover everything so that Donut and their users have zero problems? I hope so. For my sake and theirs.

Ideally, I would like to see even more information on their website including audited reports.

My Use of Donut

I would NOT recommend you ditch any and all other investments and use only this. Far from it. Instead try it out as one place to make use of.

Diversification of platforms is one of my strategies especially in this newer field.

I am actively using Donut as one of my savings accounts. Sure, I can use those funds within the crypto space and make even more doing the lending myself.

One thing I like about this is the extremely quick liquidity of it. You can withdraw your cash at any time and it’ll arrive back to your bank within 1-5 business days.

This is far from the end-all, be-all of DeFi, but I choose to share it as it’s an incredibly easy intro point where you can get some of the benefits of crypto without the hassles of it.

- Download the app. (Again, iOS only right now.)

- Create a profile (login and pin).

- Connect your bank account.

- Deposit

- Start earning

It can be that simple.

Regardless of whether or not you choose to (or can) use this app, I hope that this served as an intro into the space. Much more to come in the future.

Let me know if you have any questions below.

Disclaimer: This is not to be used as financial advice. Logan Christopher and Legendary Strength LLC are not registered investment, legal or tax advisors nor a broker/dealer. All investment opinions expressed are from personal research and experience. Email and website content is to be used for informational purposes only. Logan Christopher is personally invested (long) in a number of cryptocurrencies.

Hi Logan,

finding it hard to get my head around it but will keep reading future posts.